Table of Contents

Although the flow of European fixed-income market share to U.S. competitors slowed considerably last year, the market’s post-crisis evolution is far from complete.

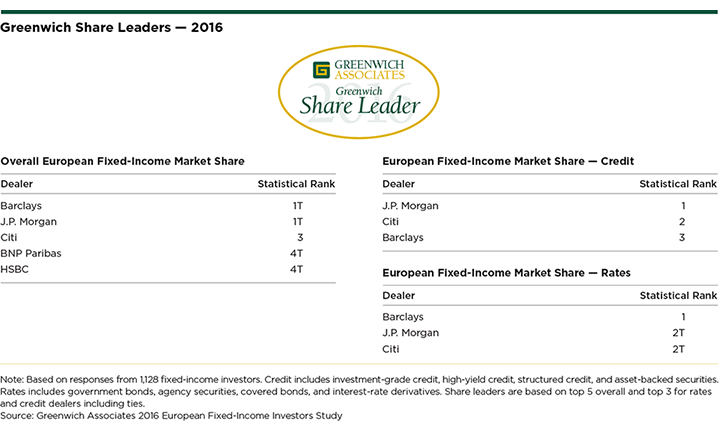

2016 Greenwich Share Leaders

Barclays and J.P. Morgan are tied for the top spot in the list of 2016 Greenwich Share Leaders in European Fixed Income. Citi is third, followed by a tie between BNP Paribas and HSBC. Barclays has built its position in part on its strength in Rates Products, in which the bank has a clear lead in share over J.P. Morgan and Citi. In Credit Products, it is J.P. Morgan that has built a commanding lead overCiti in second place and Barclays in third.

2016 Greenwich Quality Leaders

J.P. Morgan is the 2016 Greenwich Quality Leader in European Fixed-Income Credit Products. In Rates Products, that title is shared by Barclays, Citi and J.P. Morgan. Citi and J.P. Morgan are the 2016 Quality Leaders in European Fixed-Income Trading, and J.P. Morgan is the sole winner in both Fixed-Income Sales and Research Quality. Greenwich Associates interviewed 1,128 institutional investors for its 2016 European Fixed-Income Investors Study. Greenwich Quality Leaders are dealers who received quality ratings from clients that top those awarded to competitors by a statistically significant margin.

Dealers on Different Trajectories

Behind the top three market leaders of Barclays, J.P. Morgan and Citi, a tight group of seven banks round out the top 10, with these dealers separated by no more than 100 basis points in market share.

“While the market is not changing as rapidly as it has in recent years, individual banks are on different trajectories based on the strategies they have chosen or have been forced to adopt,” says Greenwich Associates Managing Director Andrew Awad.

For example, most European dealers—including some of the biggest—saw their market share in fixed-income trading stabilize last year, and a few even made gains. But there are exceptions, with some European banks continuing to rationalize their franchises. Meanwhile, most U.S. banks—but not all—have slowed their advance into the European market and shifted to a more measured approach to growth in the region.

As a result of these differences, the competitive landscape will continue to change and evolve in the months to come. “The big group of dealers now clustered together at the center of the market will begin to separate and differentiate, as some follow expansion strategies and some redirect resources away from prior areas of focus,” says Greenwich Associates Managing Director Frank Feenstra.

Bigger Changes Ahead?

Several looming issues and events could trigger even more radical change. For starters, the implementation of mandated swaps clearing has had a significant impact in the fixed-income business in the United States, driving up electronic trading and pushing the market toward more standard products. That event is now on the horizon for the market in Europe.

Also coming soon: MiFID II. The research provisions of MiFID II will have a revolutionary impact on European equities markets, and with the marketplace lacking any real mechanism to value research, the shake-up in fixed income could be even greater. Sixty percent of the institutional investors participating in the Greenwich Associates 2016 European Fixed-Income Investors Study say they have come to terms with the fact that they will have to pay for research with hard dollars.

Nevertheless, the shift represents a dramatic change to market structure. Greenwich Associates projects that MiFID II will increase concentration at the top of the European fixed-income research industry, while allowing opportunities for smaller providers within specific niches. Everyone in the middle could get squeezed. “It remains to be seen how investors will react and how the dealers will adapt,” says Greenwich Associates Managing Director Woody Canaday.

Finally, dealers and investors alike continue searching for new sources of liquidity that have been regulated out of the market. Institutions participating in this research say they are often forced to break trades into smaller transactions due to difficulties executing large trades.

The marketplace is experimenting with a range of possible solutions to the liquidity shortage, ranging from ETFs, index products and other macro-credit products to new crossing networks and emerging nonbank liquidity providers. “Although bond ETFs are growing fast and other options are starting to gain traction, all of these alternatives are in their early stages as sources of institutional liquidity,” says Greenwich Associates consultant Thomas Jacques.

“The only certainty is that the continued evolution of these products and platforms will ensure more change ahead for European fixed income,” observes Greenwich Associates consultant Satnam Sohal.

Consultants Andrew Awad, James Borger, Woody Canaday, Frank Feenstra, Thomas Jacques, Satnam Sohal, and David Stryker advise on fixed-income markets across Europe and around the world.

MethodologyBetween May and July 2016, Greenwich Associates conducted 1,128 interviews with senior fixed-income investment professionals at banks, fund managers/advisors, insurance companies, corporations, central banks, hedge funds, and other institutions across Europe.

Countries where interviews were conducted include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Malta, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom and selected

interviews conducted in Central & Eastern Europe and the Middle East. Interview topics included service provider assessments, trading practices, market trend analysis, and investor compensation.