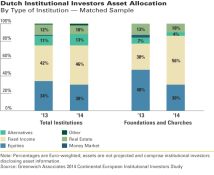

Results from the Continental European Institutional Investors Study revealed how Dutch investors increased their allocations to fixed income, while decreasing their equity allocations. As a result, fixed income in this region now makes up 46% of portfolios, versus 42% in year prior. During this time, total institutional investors maintained exposure amongst real estate, money market and alternatives.

Other Findings to Help Support Your Business Strategy:

- Corporate Pensions dramatically increase exposure to fixed income (13: 30%, 14: 56%), while slashing allocations to equities from 48% to 30%. Simultaneously investors reduced weighting to real estate, money market and alternatives as fixed income dominated corporate fund portfolios.

- Dutch institutional investors identify asset return expectations, market volatility and funding position as key decision-makers for allocation changes.

- Regarding portfolio risk, one Dutch fund mentions, “We shifted more to credits and away from government bonds. We now have 14% of our fixed income portfolio in worldwide credits.”