Table of Contents

As COVID-19 cases continue to rise, our first thoughts are for the victims, their families and the healthcare professionals fighting the disease. This pandemic is likely to lead to significant changes in the way we live our daily lives and to many aspects of our global economy.

While it is too early to pinpoint what might change in financial services, we have come up with some broad themes as to how current dislocations in the market might impact fixed-income dealers, investors and other market participants.

Focus on Resilience

The COVID-19 crisis has compelled market participants to initiate their disaster recovery plans globally and across business lines. Undoubtedly, firms will review these plans post-crisis to better understand what worked and what did not.

Consider, for example, single disaster-recovery sites that extend individuals’ commutes. Are single sites close to major financial hubs the answer or will experiments in working from home (WFH) be proven more effective (e.g., have firms been able to provide adequate VPN capacity)? Is the most resilient solution a mixture of different solutions? Will the WFH requirement spur further investment in direct fiber connections to individual homes and in soft turrets? Many traders, for instance, have had their workstations—so-called ‘Rona-Rigs—installed at home. Might these become more permanent and fall under the aegis of bank IT departments?

This crisis may well lead to reprioritizing IT spending. Spending on cloud capabilities and strengthening networks is likely to increase. As market volatility has led to increasing trading volumes, there are some reports of trading systems hitting capacity constraints. Some dealers likely will want to invest in bolstering their systems’ ability to cope with extreme market stress. Given the tight cost environment at banks, it may be difficult for them to increase their tech spend to meet these reprioritized needs without reducing spend on other projects.

Buy-siders also may want to review how well their backup facilities have worked. Though a number of them seem to have been well prepared, anecdotal evidence shows that even some large asset managers have less than robust systems and may need to invest in them, in addition to potentially upgrading their EMS/OMS tools.

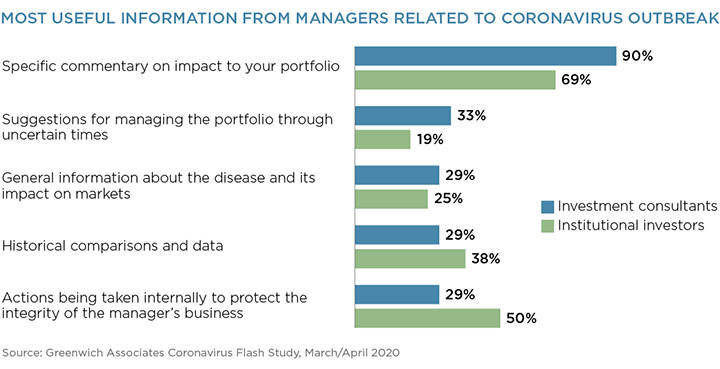

A recent Greenwich blog (Pandemic Perspectives – Part 3) shows that institutional investors prioritize information from managers on the actions being taken internally to protect the integrity of their business second only to commentary on how market turbulence is impacting their portfolio.

Digital Capabilities and Voice Trading

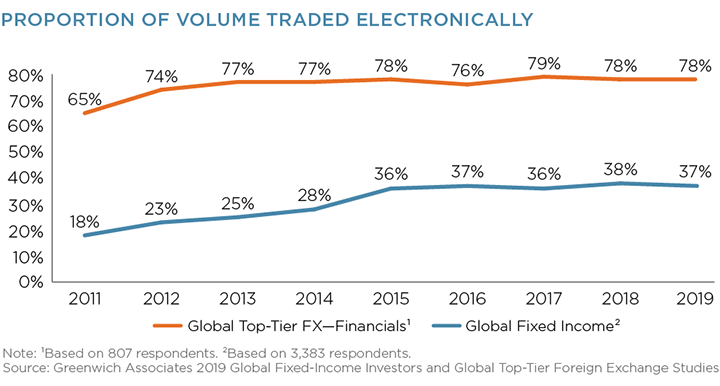

Over the last few years, our data shows an inexorable rise in electronic trading, spanning pre-trade discovery, execution and post-trade processing. Historically during periods of market volatility, sell-side traders and clients have reverted to voice for at least some of the trades they used to execute online. It is not unusual for e-trading screens to go dark in times of distress, even in more liquid products.

The story for the current crisis is similar, but it is important to look at how trading protocols have changed by asset class to cope with the almost unheard of surge in trading volumes and market turbulence.

FX

In FX, the most liquid asset class, much of trading has continued to be electronic, though anecdotal evidence suggests that there was more voice trading, due in part to the increasing size of trade tickets. In addition, dealers reported a shift in the use of the different e-channels, with more growth in volumes going to SDPs (single-dealer platforms) and dealer APIs than to MDPs (multi-dealer platforms).

But volumes on FX MDPs did, in fact, go up. For example, 360T’s ADV increased from $21.6 billion in March 2019 to $35.2 billion in March of this year. However, feedback from the Street suggests that some dealers were concerned about managing their counterparty risk to individual clients across multiple MDPs and about the market impact of executing trades on these “public” venues. Even within FX, it is sensible to differentiate by product with, on one side of the spectrum, highly electronic G10 spot trading and, on the other end, FX options which went much more voice.

Rates

The picture for rates, the next most liquid FICC asset class, is slightly different. During the height of the market dislocation, when investors were looking for safe USD assets, there was a more meaningful shift to voice trading than in FX, according to industry sources. Greenwich MarketView showed that voice trading in U.S. Treasuries increased from 25.5% of market volume in February to 42% in March this year.

Banks are understandably more comfortable negotiating large risk transfers on the phone than by electronic means. Due to the volatility in the markets and the resulting larger DVO1 associated with a trade of the same size in more benign market conditions, there was much more risk transfer going than usual, necessitating the need for more voice trades.

This does not mean that e-trading in rates did not increase significantly. Trading platform Tradeweb reported a record ADV exceeding $1 trillion in March, with most of it in rates (accounting for two-thirds of their trading volume in 2019). And some of the non-traditional bank liquidity providers that have state-of-the-art trading technology were able to maintain if not improve their electronic execution for clients in these difficult times. Greenwich MarketView saw an almost 10% month-over-month increase in electronic trading of U.S. Treasuries across venues and trading protocols.

Credit

According to our sources, trading in cash credit greatly shifted to voice during the peak of the crisis, when liquidity was hard to find in many issues and when spreads were very wide. While trading in cash investment grade shifted to large new issue trades that are a natural fit for voice trading, e-trading in credit index products, portfolio trades and ETFs grew substantially.

MarketAxess, for example, saw record trading volumes in a number or products this March and a more than 50% increase in overall credit trading volume compared to March of 2019. Tradeweb also reported a surge in credit trading volume, including cash bond e-trading, but a good chunk of the increase in the latter seemed to be related to electronic processing of large blocks.

As large as these increases in electronic trading are, Greenwich MarketView reports that they grew less month-over-month (by 14%) than the month-over-month growth in U.S. corporate bond volume according to TRACE data (+25%).

Auto Hedging Tools

Auto hedging tools proved similarly resistant, withstanding the market test better in the most-liquid asset classes. Since the credit crisis, sell-side firms have been investing heavily in tools to automate their pricing and hedge their risks in OTC markets. Models that assume “normal market conditions” and are configured to adjust risk parameters in times of increased volatility frequently underpin these tools. Obviously, these systems have been operating in anything but a normal environment, necessitating the need to rely more on human traders.

In FX, dealers continued to depend on their auto pricing tools, though spreads reportedly widened out significantly and voice traders were closely monitoring the performance of their pricing engines. Given the sheer size of the FX markets and the number of tickets, it would be impossible to have humans manage the risk of every trade.

In addition, FX dealers with a large client franchise are able to cross trades in their internal dark pool, sitting on a trade for a shorter time than in less liquid asset classes. Unsurprisingly, banks did not rely on their algo risk management tools for credit fixed income, instead managing risk manually during the recent volatility.

What does this all mean? Once market and working conditions have "normalized", it makes sense for dealers to review whether additional investments in their auto-hedging tools are required and perhaps whether they should re-invest in voice traders (or least not cut back further on voice trading). Dealers’ choices will depend in part on their risk appetite and the individual asset classes where they focus. They also may need to make a trade-off between beefing up their backup and WFH facilities, strengthening their risk management and trading systems, and maintaining other IT spend.

Voice Communications

In the current WFH environment, speaking to someone may be the only way to get adequate market color. Some dealers report that 95% of their salespeople are working from remote locations, a stunning statistic that would have seemed impossible even a couple of months ago. The current geographic dispersion affects not only interactions between dealers and clients but also between sales reps and traders at the same firm. Rather than shouting across the trading room to get a price from their trader, salespeople now need to pick up the phone to reach them.

In our view, the phone is a vital tool in times like these. It enables sales reps to highlight their key points directly, which might be missed if they are put on a chat. Some clients are likely to appreciate the personal touch and, in fact, may be more accessible when at home than in the office, where they may be pulled in many different directions. Millennials, who may be more comfortable communicating with clients using chat, may need to get used to placing a phone call.

This is not to say that phone calls are the perfect answer. Dealers need to record all calls with clients, which may be difficult if desk staff are working from home unless they have a soft turret. We have heard from a few dealers that salespeople tend to have no more than two recorded lines (one for speaking with the trader and one for speaking with a client), which is a far cry from the turret that they use on the trading floor. And chats have the advantage that they are recorded and allow salespeople to keep a dialogue going with multiple clients at the same time.

The more important question for the long-term structure of the market is whether this crisis leads to a renewed appreciation of sales relationships and the ability to trade human to human. The buy side may well choose to invest in their voice relationships to ensure access to liquidity in times of market stress—at least for as long they remember this March’s trading conditions. This will need to be counterbalanced by best execution and trade reporting requirements.

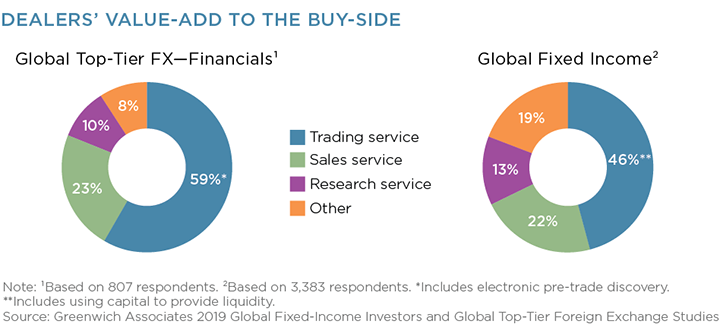

While MiFID II requirements around best execution and paying separately for research add a layer of complexity, successful sales forces will harness content to build their firm’s brand. Furthermore, in extremely uncertain market conditions like today, the value of advisory services, such as research and specialist sales, is much more compelling.

Just like voice trading can help getting trades done in unsettled markets, so can content by providing guidance and insights. After many years of pressure and eroding revenues, will the buy side re-evaluate their sell-side advisory relationships?

Scale Will Continue to Triumph

Even before the COVID-19 crisis, scale has increasingly become a competitive advantage in the trading businesses, as sell- and buy-side margins have been under pressure and the trading business has become increasingly digital.

As noted earlier, our view is that both the buy and the sell side will need to continue to invest heavily in technology in order to keep up in the arms race. This trend clearly favors large players with large revenue streams and deep pockets. Smaller banks just won’t be able to keep up. Most don’t have the ability to develop their own in-house tools, while outsourcing solutions also come at a price and are unlikely to offer a competitive differentiation in mission-critical systems.

As buy-side institutions become larger, so does their need for capital to access market makers’ liquidity. Banks that don’t have a large balance sheet may be able to operate as a niche provider but won’t be a top multi-asset-class counterparty for mega fund complexes. Smaller scale dealers do not just lack the capital but also the product and regional capabilities required to qualify as one.

Scale also matters to trading platforms. This has been most evident in rates and credit, where a few firms dominate. There has been more fragmentation in FX, but there are signs this also is changing. Consolidation of FX platforms has been under way and will likely continue as leading FX dealers, such as Citi, are cutting back on the number of FX platforms on which they provide liquidity. In our view, the current dislocation in the markets is likely to favor the largest platforms with the deepest liquidity tools, as investors flock to the trading sites that provide the best liquidity.

Conclusion

To summarize, it seems likely that the COVID-19 health crisis will continue to unfold over the next months, if not longer. Markets seem to have regained their footing for now, but uncertainty remains, as the long-term impact on the economy is hard to assess at this point. We have sought to identify secular trends in the FICC markets that may accelerate, pause or even reverse, given this crisis, and how they may affect the fortunes of different market participants.

Ultimately, however, the effectiveness and efficiency in which sales and trading businesses deliver content and liquidity to their clients that will best support the recovery of the real economy will likely determine the long-term winners and losers.