Institutional investors in Europe and Asia are at the forefront of adopting environmental, social, and governance (ESG) investment strategies, while North America lags behind, according to the Coalition Greenwich Voice of Client – 2022 Global Institutional Investors Study—Delivering on ESG.

Globally, 75% of investors incorporate ESG strategies, with Europe leading at 92%, followed by Asia at 76%. However, North America trails at 53%, driven mainly by Canadian investors.

ESG Considerations Vary Across Regions

The top objective for using ESG is now to make a positive impact on society, particularly the environment. Investors' ESG considerations differ across regions, with Europeans focusing on climate change and carbon emissions, while North Americans emphasize diversity and inclusion, and Asians prioritize business ethics.

Net-zero targets have gained traction, with 15% of institutional investors globally setting such targets, and around a quarter of European investors adopting them. In contrast, only 5% of North American investors have implemented net-zero targets.

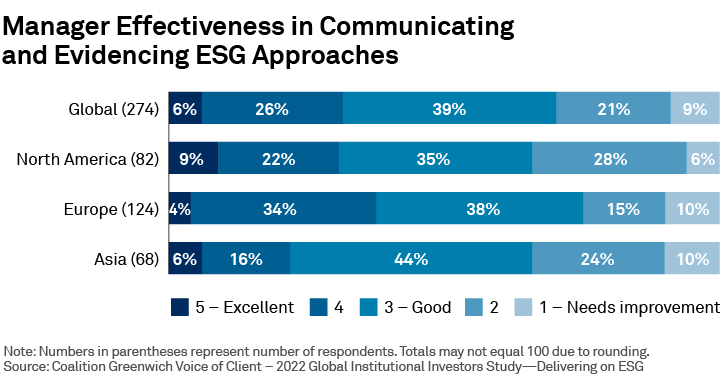

ESG knowledge is a crucial factor in selecting investment managers, with European and Asian investors considering it early on. However, only 6% of managers excel in communicating and providing evidence of ESG performance, while nearly 40% are considered "good."

ESG Integration Outlook

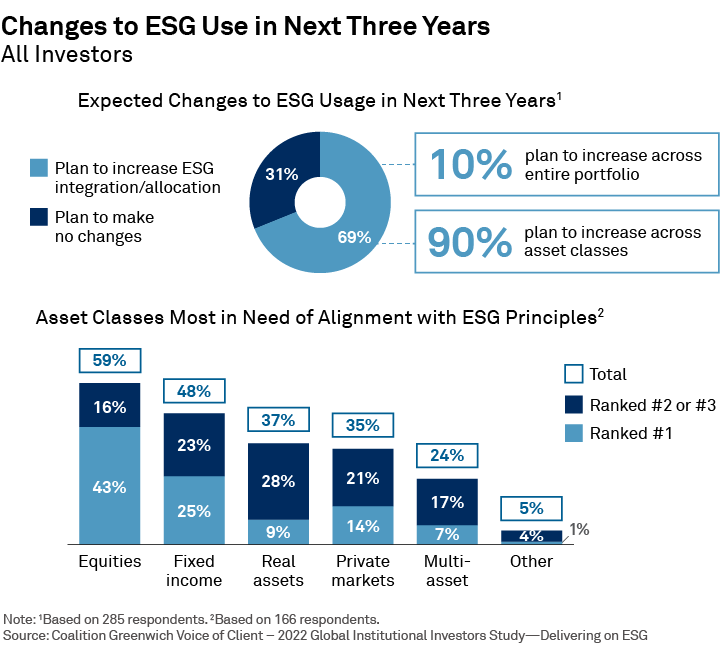

Looking ahead, approximately 70% of large institutional investors plan to increase ESG integration in their allocations, especially in equities and fixed income. Additionally, over half of current ESG investors expect to change investment managers on more than 10% of their portfolios in the next five years, with the trend led by the EU and Asia.

In conclusion, ESG-based investment strategies are gaining prominence globally, driven by the desire to make a positive societal impact. Europe and Asia lead in ESG adoption, while North America's uptake remains comparatively low. Net-zero targets are becoming more prevalent, but greater understanding and evidence of ESG performance are needed from investment managers.

Going forward, institutional investors plan to further increase ESG integration, particularly in equities and fixed income, and are likely to change investment managers in response to ESG considerations.

Sophie Emler is the author of this publication.