A quarter of U.S. small businesses and mid-sized companies are obtaining credit from non-bank providers, and nearly all have found the experience so positive that they would borrow from a non-bank lender again.

Approximately one-quarter of the 218 small businesses and mid-sized companies taking part in the latest Greenwich Market Pulse obtained credit from a non-bank provider in the past 18 months. That finding is consistent with results from a Q2 2014 Greenwich Market Pulse.

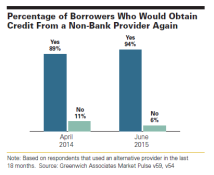

About 8 in 10 of these companies say the process of obtaining credit is easier with non-banks than with traditional banks. A full 51% contend it is “much easier” to get credit from non-bank lenders. Of even more concern to traditional banks is the fact that roughly 94% of non-bank borrowers say they would obtain credit from a non-bank provider again. That share is up from the approximately 89% of non-bank borrowers who said they would return to non-banks for credit last year.

“There is still a perception that companies borrowing from non-banks are doing so because other banks won’t provide them with credit,” says Greenwich Associates consultant Dana Schwaeber. “While some companies certainly do turn to alternative providers after being turned down by traditional banks, non-bank providers are widely viewed as being easier to work with than traditional banks, and our study results suggest they are becoming increasingly competitive in price.”

The Greenwich Market Pulse is an ongoing research series that addresses the most important and timely issues facing small ($1mm-$10mm) and mid-sized ($10mm-$500mm) company owners/ executives and their banking relationships. The current studies were conducted in Q2 2015 with participation from 218 companies interviewed in May and June 2015 representing 103 small businesses and 115 mid-sized companies.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.