Table of Contents

Banks’ digital capabilities are starting to have a bigger and more noticeable effect on the competition for corporate banking clients. The largest U.S. companies are allocating additional business to banks that have invested in digital platforms that streamline processes and make it easier for their clients to do business.

Going forward, banks servicing clients through traditional manual and bureaucratic processes will find themselves at real risk of losing both existing and new business to competitors who are faster and more innovative, flexible and responsive. Simply put: Why wouldn’t a corporate treasury office choose to do business with the bank whose digital platform makes opening a new account a snap, eliminates KYC headaches, generally makes day-to-day banking functions less of a hassle, and provides tailored insights into workflows to help make better decisions?

As companies start to gravitate toward the most innovative banking partners, banks are also beginning to show a preference for digitally advanced clients. Of course, in today’s highly competitive marketplace, banks are fighting hard for every big corporate client they can get. With loan demand other than acquisition finance stuck at modest levels, most large corporates are overbanked, not underbanked. However, when the biggest U.S. banks plot strategies for growth, they are specifically targeting the technology sector and other next-gen-type industries embracing digital technology.

At least some of these banks have groups dedicated to reimagining the client relationship with next-generation e-commerce companies. In many of these relationships, clients themselves are driving the innovation and pushing the banks to keep up. Banks like this arrangement, because it accelerates their own R&D process, enabling them to speed the rollout of new processes, services and products. These new offerings don’t just do a better job meeting the needs of sophisticated clients, they also lower banks’ cost-to-service. The enhanced efficiencies created by these new platforms and approaches are critical to bank business strategies at a time of low interest rates and compressing margins.

The digital solutions now sought by the most cutting-edge clients will eventually become standard to all corporate banking relationships. Today, companies in manufacturing and other “old-world” industries are just starting to modernize their IT infrastructure and integrate digital banking services. In the next 5–10 years, even these “analog” clients will be internally digitized and ready to transform their banking relationships. The banking IT race is in full swing, but many are just getting serious about what it takes to effectively compete.

Corporate Banking: A Widening Technology Gap

The biggest U.S. banks are off to an early lead in this critical race, thanks to an important head start. Over the past 24 months, investment banking has disproportionately driven banking-industry revenues and profitability. Even in lending, a sizable share of volume has been related to M&A. Strong investment-banking performance has given universal banks the wherewithal to fund robust R&D and technology budgets, even during a global pandemic. These resources have not been available to regional competitors and banks with more limited investment-banking capabilities, many of which have been forced to reduce or even postpone IT initiatives. At a time when technology investment is perhaps the most important strategic imperative, many banks simply lack the profitability to fund IT innovations at requisite levels. In addition, the largest banks have commited resources to sourcing, vetting and onboarding fintech partners to fill important digital-capabilities gaps. As a result, the technology gap between the country’s largest banks and virtually all other competitors is widening.

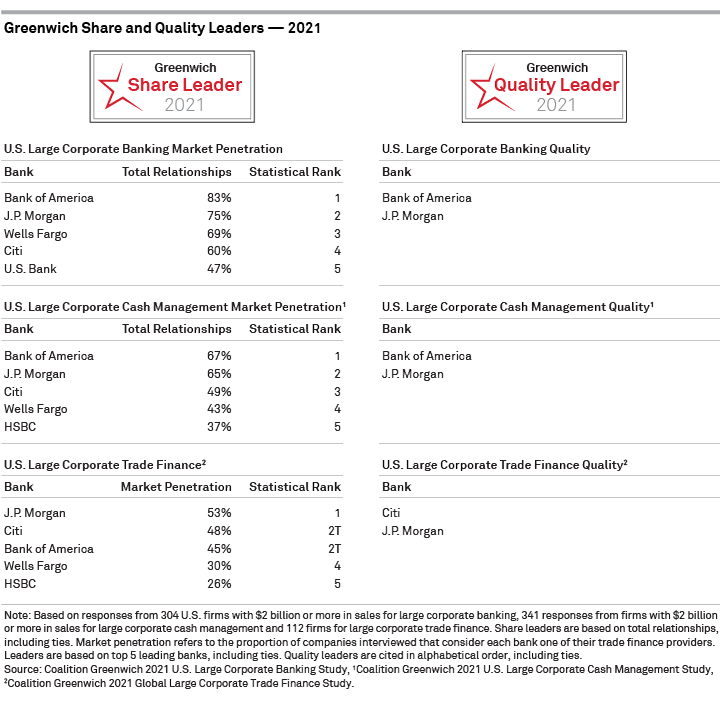

Almost all the banks on the list of 2021 Greenwich Share and Quality Leaders in U.S. Large Corporate Banking have leveraged strong investment banking results to finance rapid technology development. By extending their technology advantage over smaller and less well-resourced competitors, these large banks are setting the stage for additional future gains in market share. The IT gap between these market leaders and the rest of the industry is already causing smaller banks to reassess strategies. In announcing its $66 billion acquisition of Sun Trust in 2019, BB&T executives cited the need for scale to support technology investments as one of the deal’s drivers. The pressure on regional and smaller banks will only build from here, as the technology race unfolds and digital transformation leads to further consolidation in the U.S. banking industry.

Cash Management: It’s the Service, Stupid

During a period of unprecedented disruptions to normal business activities, the right level of support from a bank can have a huge impact on corporate business performance and results. So, too, can a lack of support at a time when much of the workforce is still at home, supply chains remain snarled, inflation is eating into profit margins, and skilled workers are hard to find.

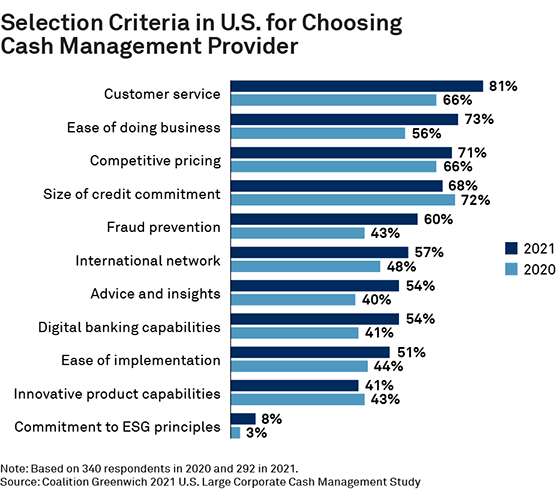

So it’s no surprise that client support became more important than ever during the COVID-19 crisis. Every year, Coalition Greenwich asks the large companies participating in its research program research to name the top criteria they use for selecting a provider for a range of banking services. Over the past 12 months, the share of companies citing “customer service” and “ease of doing business” as top criteria in their selection of a cash-management provider each increased by double digits.

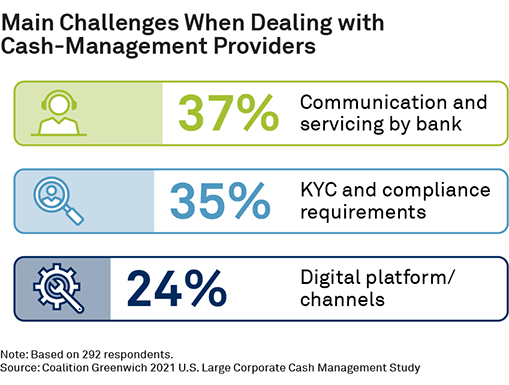

But the industry’s preoccupation with service didn’t start with the pandemic. Companies cite “communication and servicing by the bank” as the No. 1 challenge they encounter when dealing with cash-management providers, followed closely by the KYC and compliance requirements that consistently cause headaches for corporate treasury professionals.

When companies consider reducing the amount of business they do with a particular cash-management provider, poor service is usually the reason. The top reasons that companies give for reducing the role of a cash-management provider are heavy process/bureaucracy, lack of flexibility, timely response, and a lack of innovation or digitization. At the other end of the spectrum, companies planning to increase the business they do with a particular provider most often cite the bank’s flexibility, proactive solutions and overall support as a partner—in addition to the ready availability of bank specialists. In international cash management, growing numbers of companies are allocating additional business to providers ranked highly in terms of “ease of doing business.”

Almost all solutions to industry service issues involve technology. Digital systems and virtual communications allowed companies to continue finance, cash management and trade functions during pandemic disruptions. About 40% of cash-management clients say their banks have streamlined and digitalized account opening and KYC processes. About 1 in 3 companies say they are experiencing new benefits from their banks’ investments in predictive analytics and artificial intelligence. Study participants cite accounts receivable and cash-flow forecasting as their primary areas of impact.

Of course, the flip side of those results shows that banks still have a lot of work to do. With more than half of large U.S. companies saying they haven’t seen any improvement—relative to their rising expectations—in terms of streamlining KYC and account-opening processes. Banks that are slow to implement digital tools will find themselves at risk of losing wallet and clients. In many cases, the banks most at risk of losing business will be regional or smaller banks lacking the resources to invest heavily in technology, where white-glove service can’t overcome an inability to meet what is becoming near real-time expectations.

Trade Finance: Supply-Chain Disruptions Fuel Demand

The COVID-19 crisis triggered a surge in demand for trade-finance services among large U.S. companies. Amid the logistical and geopolitical challenges caused by the pandemic, companies need expertise and assistance in reassessing, maintaining and remaking their global supply chains. While demand for trade services and working-capital financing increased modestly over the past 12 months, there was increased focus on supply-chain financing in 2021.

As companies step up their use of trade finance, they are allocating new business to banks that go beyond the basics of competitive pricing and capital provision. Companies are seeking trade-finance providers who have invested in simple and flexible platforms that make day-to-day business as easy as possible. “Good customer service, turnaround time, communications, flexibility on terms, and competitive pricing are key for us,” says one corporate treasury officer.

Companies are also seeking banks with trade specialists who are both knowledgeable and available when needed. “Their expertise in the area and their willingness to get involved are the key drivers of our rating,” says another treasury professional about her company’s trade finance provider. “Their knowledge and their breadth of services is the reason for our loyalty.”

Finally, large companies are looking for banks committed to supporting their clients in good times and bad. One treasury officer explained why his company is increasing the business allocated to one particular provider: “Great at providing not only advice but just being great partners for us during this difficult time.”

ESG: A Top Priority for Corporate Treasury

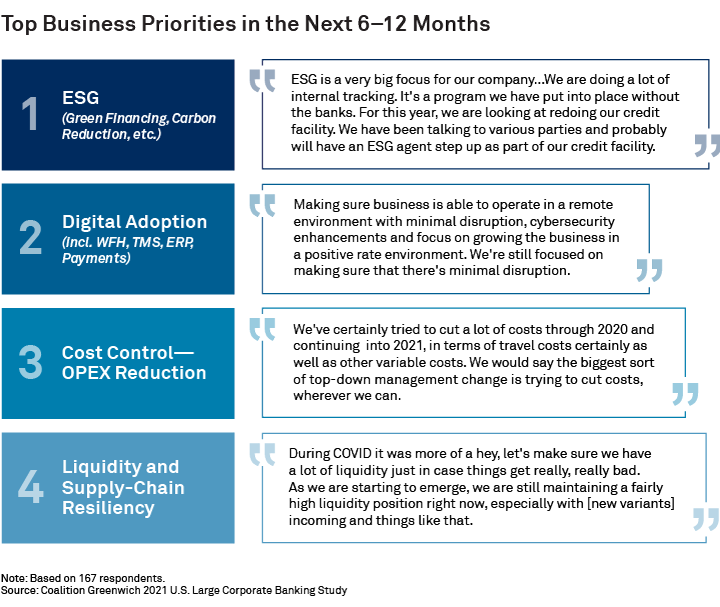

The tumultuous events of the past two years have caused a radical reordering of priorities among America’s largest companies. Eighty-five percent of the corporate treasury and finance executives participating in this year’s study reported a change in top business priorities in 2021. Eight in 10 large U.S. companies have established some internal ESG goals.

Spurred on by senior management, boards of directors, shareholders, and customers, corporate treasury officials are now working to expand ESG and more fully integrate ESG factors into finance and treasury operations. “As things have evolved on the financing front and on sustainability overall, we’re constantly trying to find ways to weave in ESG with what we are doing here,” says a treasury professional from a large U.S. corporate.

As they do so, companies are looking for banks and other advisors who can advise them on where and how to apply ESG standards, goals and products within these functions. On the corporate-banking front, companies in 2021 said they participated in ESG seminars and webinars hosted by their banks and spent time getting educated by their bankers about green bonds. In cash management, companies said they are relying on their banks for news, advice and education on ESG. In trade finance, companies are looking for specific advice on how to achieve ESG compliance up and down the supply chain.

Going forward, companies will partner with banks that can help them achieve their broad ESG goals. Corporate treasury officers say are looking for two main characteristics in a partner: 1) A demonstrated commitment to ESG in the bank’s own business, including a strong brand association with positive environmental and social practices, and 2) The expertise and capabilities to help the company understand and execute on ESG strategies. These traits will become increasingly important as more companies adopt ESG standards as baseline criteria for participation in their banking groups.

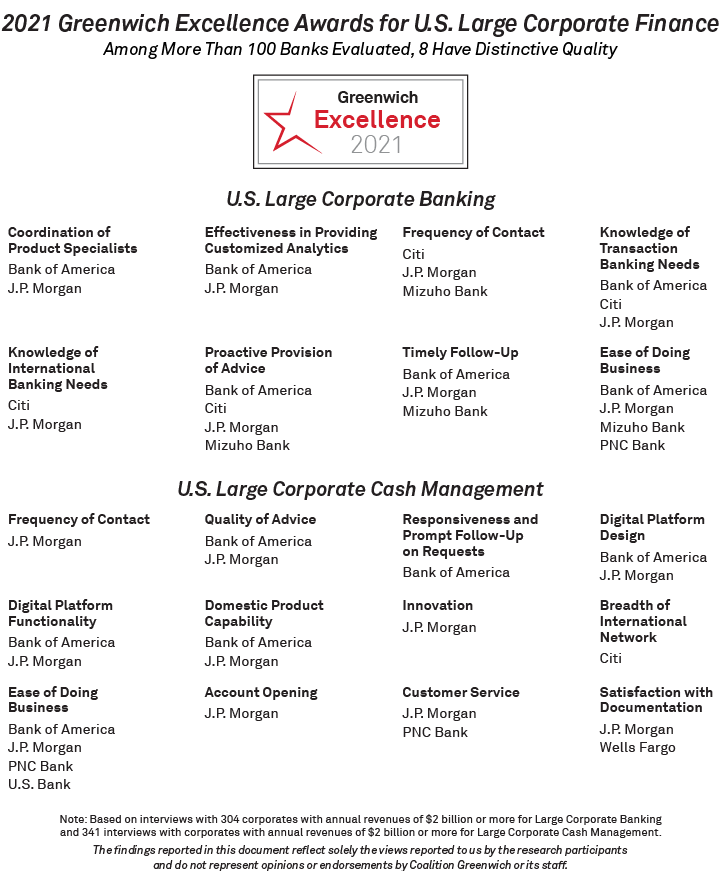

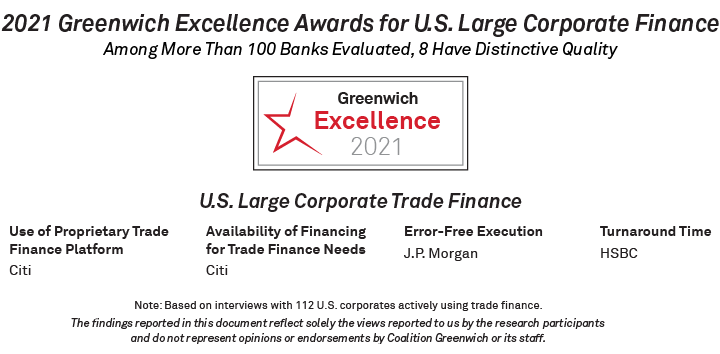

Greenwich Share and Quality Leaders, and Greenwich Excellence Awards

The following tables present the complete list of 2021 Greenwich Share and Quality Leaders in U.S. Large Corporate Banking, Cash Management and Trade Finance, as well as the 2021 Greenwich Excellence Awards.

Consultants Dr. Tobias Miarka, Chris McDonnell and Don Raftery specialize in corporate banking, cash management, trade finance, and digital banking.

MethodologyFrom June through December 2021, Coalition Greenwich conducted 304 interviews in large corporate banking, 341 interviews in large corporate cash management and 112 interviews in trade finance at U.S.-based companies with $2 billion or more in annual revenue. Participants were asked about market trends and their relationships with their banks. Trade finance interview topics included product demand, quality of coverage and capabilities in specific product areas.