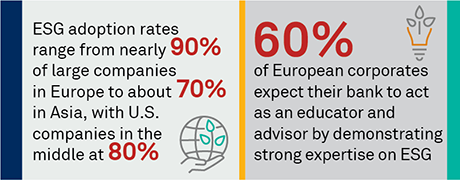

Corporate banks have invested millions of dollars in ESG capabilities designed to help large companies integrate environmental, social and governance standards. Banks made ESG a priority because they understand that companies around the world are under increasing pressure to adopt ESG goals and principles into their business plans, operating models and funding strategies. Despite these pressures, demand for ESG services has fallen short of bank expectations.

In this report, we examine the challenges facing large companies in the United States, Europe and Asia as they work to integrate ESG. We then analyze the still-evolving set of best practices that companies are using as they introduce ESG into their organizations and workflows. We include a detailed review of how large companies are employing ESG in their treasury departments, including critical functions like trade finance, cash management and corporate reporting.

Next, we document the ESG capabilities offered by leading corporate banks and identify the individual banks named by large companies around the world as leaders in ESG. In conclusion, we discuss specific ways large companies can benefit from taking their banks up on their offer to help them navigate the complex and increasingly important landscape of ESG.