Table of Contents

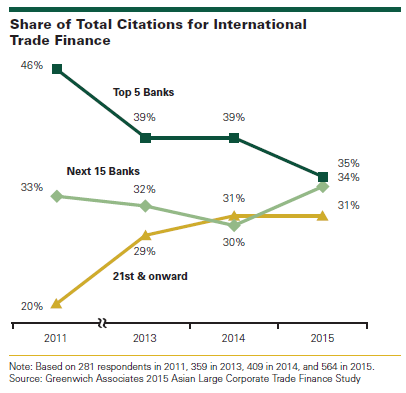

Falling pricing of trade finance is putting pressure on global banks, who have traditionally been the main providers to large Asian companies and MNC subsidiaries in Asia. The evolving market forces have created an opportunity that continues to be exploited aggressively by providers from Japan and other Asian markets—and even some western banks eager to build a presence in Asia. For large companies across Asia, the result has been a strong and ready supply of trade finance credit and a sharp decline in its price.

At the same time, trade finance has become more expensive for western banks due to higher capital and liquidity requirements. As a result, many global banks have become much more selective in choosing which Asian companies they will serve and when they will extend their balance sheets. This shift has occurred at time when Asian companies’ use of trade finance has been on the rise, not least of all due to falling prices. The share of large Asian companies employing some form of trade finance has increased steadily from just 61% in 2011 to 76% in 2015. That share now tops 85% in India and averages 82% in Southeast Asia ex-Singapore. In many of these markets, trade finance is used not primarily as a means to mitigate trade risk, but rather as an important alternative source of corporate funding.

Spoiled for Choice

The outlook five years ago, when capital and liquidity requirements were set to rise, was that trade finance would become more costly for large corporates. In reality, the opposite has occurred. Pricing for trade finance has fallen in recent years due to an influx of supply from Japanese banks, leading Asian banks, emerging regional players in Asia, and a few foreign banks that have prioritized Asia as a key growth area. “Many of these players have been willing to be extremely competitive in trade finance pricing, often motivated by gaining access to the broader relationship with large Asian companies that they believe will pay off in terms of cross-sell and profitability over a long-term horizon,” says Greenwich Associates consultant Paul Tan.

Greenwich Associates annual study of trade finance in Asia shows that large companies are spoiled for choice. In addition to the incumbents (notably, HSBC, Standard Chartered and Citi), large Asian companies increasingly turn to comparatively new entrants to the market. Over the past few years, large corporates increasingly cite trade finance relationships with leading local banks like HDFC, emerging regional players like DBS Bank, and one or two foreign banks like BNP Paribas that are looking to expand in the region.

Evolving Buying Behavior

Greenwich Associates research results show clearly that competitive pricing is by far the top consideration for large Asian companies when selecting a trade finance provider. The past 12 months has also brought a dramatic increase in the share of large Asian companies citing “availability of trade credit” as an important factor in selecting a provider. “After several years of low prices, Asian companies have come to expect favorable pricing as a basic cost of doing business for providers, and they are increasingly directing their business to banks most willing to extend trade credit,” says Greenwich Associates consultant Gaurav Arora. “Given the margin pressures faced by global banks and the growth strategies now being pursued by a wide variety of other banks, companies’ appetites for affordable and readily available trade finance is flattening the market and eroding the previously dominant competitive position of the globals.”

The study also revealed some clear differences across the region in the preferences of companies selecting trade finance providers. In large countries like China and India, in which the trade finance market can still be described as “developing,” clients place an emphasis on banks’ ability to understand their needs and to recommend the best products for meeting them. In the more developed markets of Hong Kong and Singapore, companies value turnaround time and business and finance ideas and strategies that can provide incremental value at a higher level.

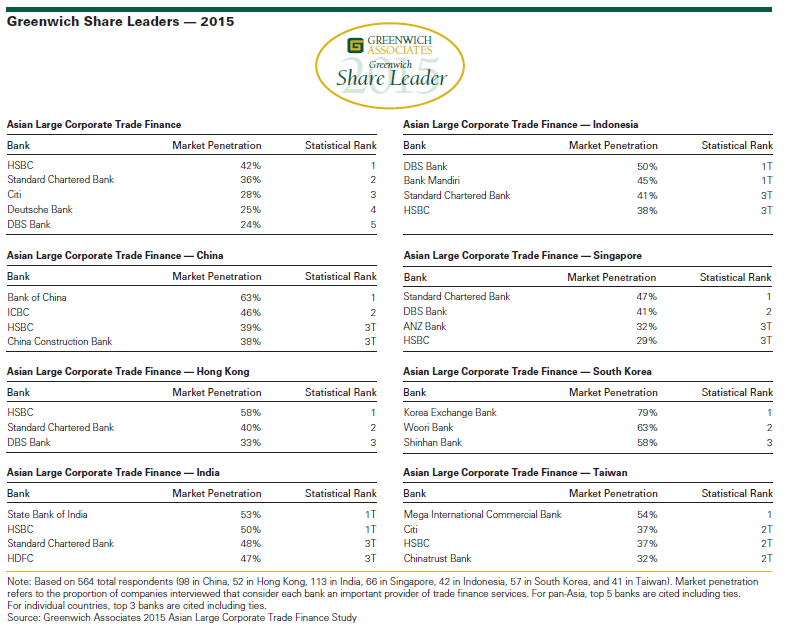

Greenwich Leaders – Pan-Asia

Reflecting those shifts, the list of 2015 Greenwich Share Leaders in Asian Large Corporate Trade Finance consists of the familiar, global names of HSBC, which tops the market with a market penetration score of 42%, followed by Standard Chartered at 36%, Citi at 28%, and Deutsche Bank at 25%. However, the presence of DBS Bank in that list with a market penetration score of 24% illustrates how the gap between the leading global banks and the rest of the market is narrowing, with the likes of ANZ Bank, BNP Paribas and Bank of China all putting in a strong showing and, at a lower level of penetration, competitors like BTMU, ICBC, Mizuho, and State bank of India all main-taining meaningful footprints.

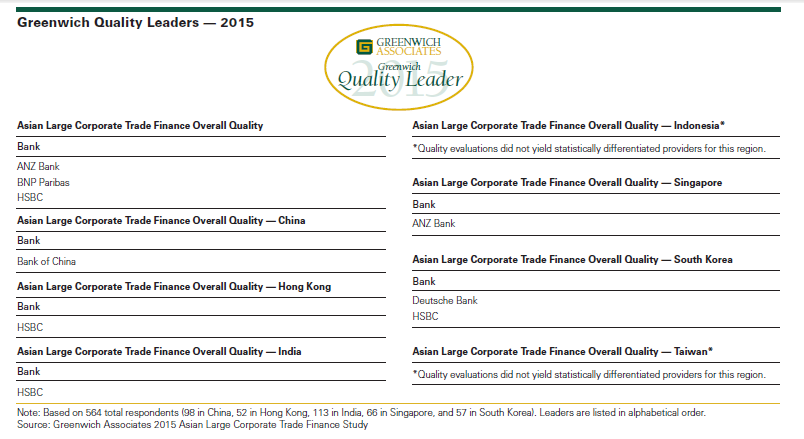

The 2015 Greenwich Quality Leaders in Asian Large Corporate Trade Finance are ANZ Bank, BNP Paribas and HSBC.

Greenwich Leaders – Select Markets

The 2015 Greenwich Share Leaders in Large Corporate Trade Finance in Hong Kong are HSBC, which has a market penetration score of 58%, followed by Standard Chartered in second place and DBS Bank in third, with market penetration scores of 40% and 33% respectively. The 2015 Greenwich Quality Leader in Hong Kong is HSBC. In Singapore, the 2015 Greenwich Share Leaders are Standard Chartered at 47%, DBS Bank at 41%, and ANZ Bank and HSBC, which are tied at 29%–32%. ANZ Bank is the 2015 Greenwich Quality Leader in Singapore.

Consultants Paul Tan and Gaurav Arora specialize in corporate and transaction banking in Asia. For more information: ContactUsAsia@greenwich.com.

From April to June of 2015, Greenwich Associates conducted 564 interviews in trade finance with financial officers (e.g., CFOs, finance directors and treasurers) at companies in China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. Subjects covered included product demand, quality of coverage, and capabilities in specific product areas.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.