Table of Contents

For a business that is generally considered stable and rather slow to evolve, large corporate banking is changing fast. The globalization of U.S. corporate business coupled with a disruptive trade war, the proliferation of digital technology, the rise of fintech providers, and the strategic retreat of certain global banks are just some of the variables shaking up the corporate banking industry and putting more corporate clients and business up for grabs.

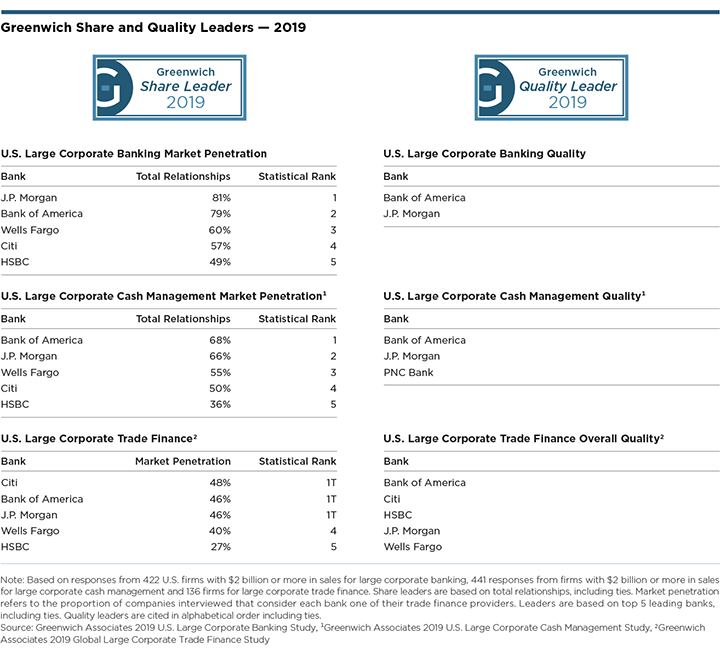

For the 2019 Greenwich Share and Quality Leaders℠ in U.S. Large Corporate Banking, this unusually large amount of “money in motion” represents an opportunity to win new clients and capture market share. In U.S. Large Corporate Banking, that list of 2019 Share Leaders is topped by J.P. Morgan in first place and Bank of America at No. 2, followed by Wells Fargo, Citi and HSBC. Bank of America takes the top spot in U.S. Large Corporate Cash Management, followed by J.P. Morgan, Wells Fargo, Citi and HSBC. The 2019 Greenwich Quality Leaders in U.S. Large Corporate Banking are Bank of America and J.P. Morgan. Those two banks also claim the title of 2019 Greenwich Quality Leaders in U.S. Large Corporate Cash Management, along with PNC Bank.

“Churn” in Corporate Bank Lists

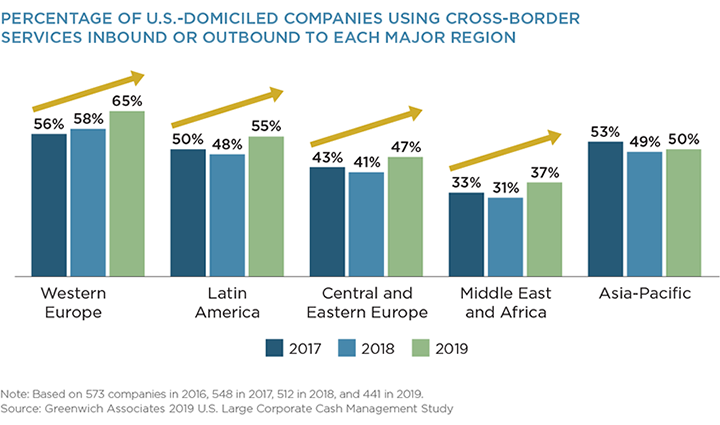

Despite the trade war between the United States and China, the ongoing Brexit saga and other signs suggesting that globalization might have temporarily peaked, U.S. companies actually increased their exposure to overseas markets last year—at least in terms of their banking needs. For example, the share of large U.S. companies using at least one bank for payments/receivables and/or cash management in Western Europe increased to approximately two-thirds in 2019 from just 58% in 2018. The uptick was equally impressive in Latin America, Central and Eastern Europe, and the Middle East and Africa.

The only region not to record a significant increase last year was Asia-Pacific ex.-Japan, where the share of U.S. companies using a bank for inbound or outbound services hovered around 50% from year to year. However, that stability masks significant turmoil beneath the surface. U.S. sanctions on China and other fallout from the trade war are altering global trade patterns. Companies are shifting supply chains and relocating them in part or in whole out of China and into Vietnam, the Philippines or other less risky places. (A similar, if less intense, process is playing out in Europe, where Brexit has driven many companies to consider a shift in operations out of the U.K. This shift has probably contributed to the increased demand among U.S. companies for banking services in Western Europe, as well as Eastern and Central Europe.)

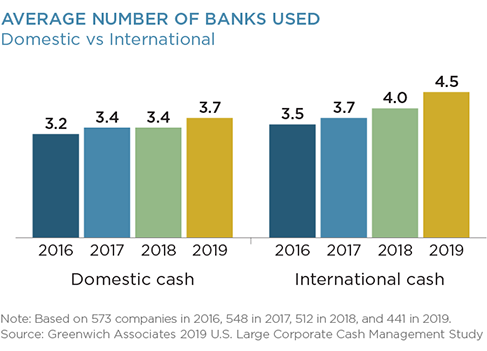

As their expanding global businesses and geopolitical turmoil force them to find banking coverage in new countries, U.S. companies are looking beyond the global banks and considering local providers. These are often thought of as “regional champions” with specific expertise in these markets. As a result, the average number of banks used by large U.S. companies for international cash management increased to 4.5 in 2019 from 4.0 in 2018. “That’s a sizable jump in any one-year period, but especially at a time when most companies say they are trying to increase efficiency by streamlining the number of banks they use, as opposed to expanding their provider lists,” says Greenwich Associates Managing Director Don Raftery. “We are also hearing about increased use of fintechs directly by the corporates to fill in gaps in capabilities or automate processes not yet addressed by the banks.”

Both at home and abroad, U.S. companies might be experiencing even more turnover in their bank relationships than these numbers suggest, due to the changing landscape of providers. In particular, the rise of fintech providers is disrupting the payments business and also having an impact in the area of fraud and security. The entry of these new players probably contributed to the slight increase in the average number of banks used for domestic cash management, which rose to 3.7 in 2019 from 3.4 in 2018. Meanwhile, a strategic reset by certain prominent European banks has forced some companies to find replacement providers in some markets. “Together, all of these factors have created an environment in which nearly half of large U.S. companies anticipate moving business from one bank to another in the next 12 months,” says Greenwich Associates Managing Director John Colon.

Companies Feeling Positive Impact from Analytics, AI and Other Bank Technology

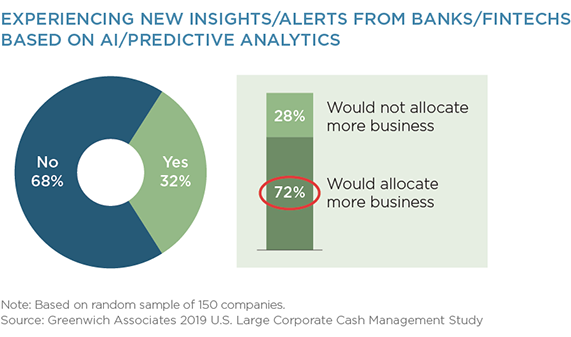

In addition to turnover in their lists of banks, companies are also experiencing some dramatic changes in their relationships with their current providers. In particular, companies are starting to feel the impact of technology investments made by their banks—and by new fintech providers. One-third of the large U.S. companies participating in this year’s study say they are benefiting from new insights and alerts from data analytics and artificial intelligence features on their banks’ digital platforms. “Our data shows that 72% of corporates would allocate more business to providers delivering new insights based on predictive analytics and AI,” says Don Raftery.

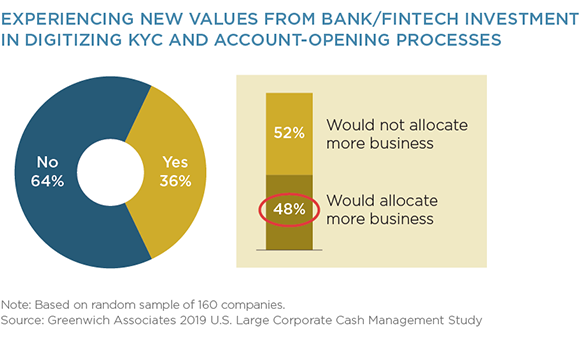

More than a third of corporates say they are feeling the positive impact of new bank technology in KYC and account opening. “Overall, half of companies would allocate more business to those streamlining and digitizing their onboarding process,” says Greenwich Associates Managing Director Chris McDonnell. “It’s becoming clear that companies are receiving real value from these technology rollouts. The question for banks now is whether companies will pay extra or allocate incremental business for these tools, as nearly half of respondents indicate they would do.”

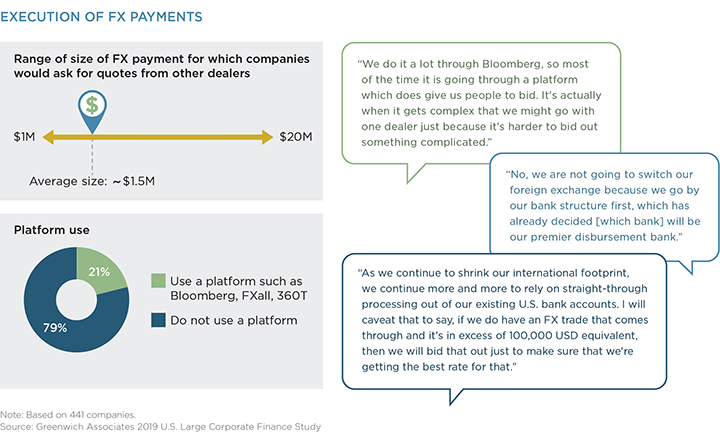

Banks Charge into Cash Management

The biggest U.S. banks are placing a new strategic focus on the cash management business. In part, this new emphasis comes from a desire to capture the cash deposits of large companies, which provide a much-needed source of balance sheet stability. Yet banks are also looking to capitalize on an inefficiency in corporate treasury management by creating new client values. International payments, receivables transactions and even corporate cash transfers often trigger a corresponding foreign exchange trade. Some companies put those trades out to bid—but many don’t. Even for trades up to $20 million in size, many companies simply pass the trade on to their cash management providers. For that reason, margins for FX transactions on the back-end of international cash management transactions can be especially attractive.

U.S. Trade Finance among Large Corporates

Trade finance is an area of renewed interest by the major banks. Citi, Bank of America and J.P. Morgan all vie aggressively to be the lead trade finance provider among U.S. large corporates, with each bank doing business with just under half of the market. Wells Fargo and HSBC round out the top five banks. Bank of America, Citi, HSBC, J.P. Morgan, and Wells Fargo are all recognized for distinctive quality and share the title of Greenwich Quality Leader.

Greenwich Share and Quality Leaders

The accompanying tables present the complete list of 2019 Greenwich Share and Quality Leaders in U.S. Large Corporate Banking, Cash Management and Trade Finance.

Greenwich Excellence Awards

The accompanying table presents the complete list of 2019 Greenwich Excellence Awards in U.S. Large Corporate Banking and Cash Management.

Consultants John Colon, Don Raftery and Chris McDonnell specialize in corporate banking, cash management and trade finance services in North America. Consultant Chris McDonnell also specializes in digital banking.

MethodologyFrom April through September 2019, Greenwich Associates conducted interviews at U.S.-based companies with $2 billion or more in annual revenue with 422 chief financial officers, treasurers and assistant treasurers, 441 cash managers and other financial professionals in cash management, and 136 corporate trade finance professionals. Participants were asked about market trends and their relationships with their banks. Trade finance interview topics included product demand, quality of coverage and capabilities in specific product areas.