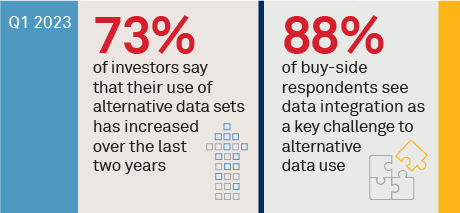

So many institutions are using alternative data (alt data) today—data not traditionally used for investing—that the label is increasingly a misnomer. In fact, 44% of institutional asset managers and hedge funds in our recent study are currently using alt data sets as part of their portfolio construction (or trading process), and 73% say that their use of alt data sets has increased over the last two years.

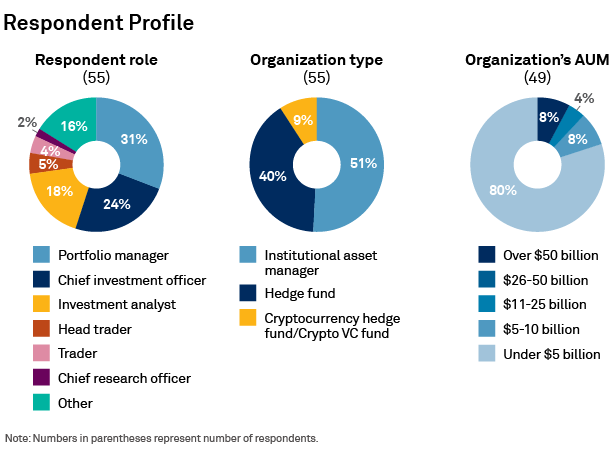

MethodologyBetween October and November of 2022, we interviewed 55 executives at institutional asset managers and hedge funds primarily in the U.S., with a few in EMEA, to better understand the usage of alt data, spending trends, types of data sets used, and pain points in adoption. Respondents were comprised mostly of asset managers and included a mix of investment styles across fundamental equity, quantitative and hybrid strategies. We spoke with investment professionals including Portfolio Managers, Chief Investment Officers, Investment Analysts, traders, and others.