Table of Contents

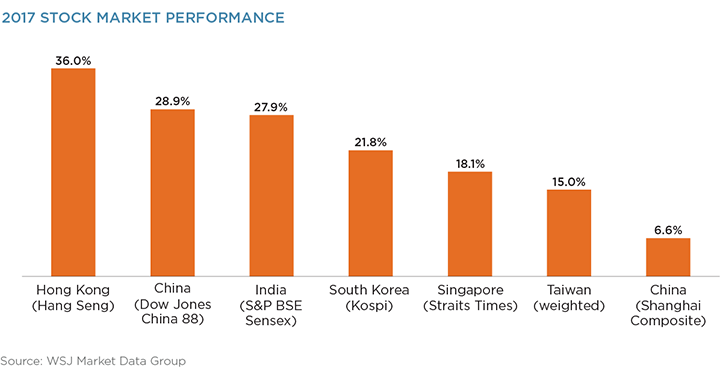

A surge in equity market valuations and a rebound in trading activity provided a major boost to Asia’s brokers in 2017. However, optimism about these favorable business conditions is tempered by worry about the looming impact of MiFID II, which could make 2018 a messy year.

As the combination of soaring stock markets and stepped-up volume increased broker trading revenues, Morgan Stanley and Bank of America Merrill Lynch deadlocked at the top of the market in terms of institutional equity trading share in Asia last year, followed by Citi and Credit Suisse, which were also statistically tied in market share, and yet another tie between CLSA Asia-Pacific Markets and UBS. These firms are the 2017 Greenwich Share Leaders℠ in Asian (ex-Japan/Australia) Equity Trading.

“The feeling among these firms is mixed,” says Greenwich Associates Managing Director John Feng. “On the one hand, they’ve had a good year with much-needed growth after a weak 2016. On the other hand, they have no way of knowing what 2018 will bring.”

The MiFID II Wildcard

Although the MiFID II rules governing investor payments for research officially apply only in the EU, the regulations will have a ripple effect around the world. Many large investors with exposure to multiple markets say they are unlikely to operate separate frameworks for Europe and other markets like Asia and North America. Instead, they will apply new MiFID II-compliant practices to their operations globally.

As recently as Q2 2017, brokers were hopeful that the final impact of MiFID II would be smaller than originally feared. At that time, there was little consensus among investors about how the new rules would affect their spending on equity research, or what mechanisms they would use to pay for research under the new framework. That all changed as the year progressed, and a string of large asset managers announced that they would no longer pass research costs onto clients under MiFID II and, instead, absorb research costs directly in their P&Ls.

The growing list of managers planning to absorb costs now includes such heavyweights as Allianz Global Investors, BlackRock, Deutsche Asset Management, Goldman Sachs Asset Management, J.P. Morgan Asset Management, Northern Trust, PIMCO, Schroders, UBS Global Asset Management, Vanguard, and many others.

These firms have not necessarily stated that they will implement their decisions outside of Europe and around the world—many will likely roll out any changes first in Europe. But due to the costs and complexity of running different models in different regions, it’s unlikely that global asset managers will ring-fence Europe permanently. “As the number of asset managers planning to absorb research costs internally grows, so does the downside risk for their external research spend and for firms that have historically depended on it for a significant portion of their revenues,” says Greenwich Associates consultant Parijat Banerjee.

A Potentially Messy Process

So at the close of a bullish 2017, Asian brokers don’t know how much investor research spending will decline, when exactly those reductions will materialize or the extent to which the payment model will change. Even for investors planning to pay from their own P&Ls, brokers are still working out pricing models ranging from full-service, “all-youcan-eat” coverage, including all research and advisory services, to a la carte pricing for research reports, analyst meetings, conference invites, and other items. At the end of the year, pricing negotiations were still going on between brokers and investors. As Greenwich Associates Managing Director Jay Bennett concludes, “The upshot is that 2018 could get messy.”

Morgan Stanley currently leads in Asian (ex-Japan/Australia) equity research/advisory impact, as measured by the firm’s share of APAC institutional investors’ research vote. Credit Suisse and Bank of America Merrill Lynch are tied for second place, followed by Citi, and a fifth-place tie between CLSA Asia-Pacific Markets and UBS. These firms are the 2017 Greenwich Share Leaders in Asian Equity Research/Advisory.

In the pre-MiFID world, the strong correlation between broker performance in research and trading was one of the key determinants of broker strategy and success. For now, brokers appear to be holding off on any major structural shifts to their platforms or models. In fact, some have even intensified their research coverage in the hopes of demonstrating value and maximizing research revenue post MiFID II.

Over time, however, the dramatic change to industry economics brought on by the unbundling of research from trading will have a major impact on the competitive landscape of equity brokers, globally and in Asia. Covering all of Asia’s vast and disparate country markets is an expensive undertaking. If unbundling ends up reducing broker revenues, some brokers will have to reassess the scope of their coverage, likely narrowing the focus to markets or sectors in which they have a genuine competitive advantage.

Electronic Trading

It’s widely assumed that MiFID II will accelerate the spread of electronic trading, though the effect has not yet materialized in Asia. Electronic trading volumes continued their gradual rise in 2017. The market could be poised for a bigger increase ahead, with or without MiFID. The reason: All the major brokers are continuing to invest heavily in their electronic trading platforms, and even smaller firms that historically have not been active in electronic trading now view it as an integral part of their execution platform. Bank of America Merrill Lynch tops the list of 2017 Greenwich Associates Share Leaders in Asian Equity Algorithmic Trading, followed by a second-place tie between Credit Suisse and Morgan Stanley, and a tie between UBS and Citi to round out the category.

Greenwich Quality Leaders

Between July and September 2017, Greenwich Associates interviewed 256 Asian equity fund managers and analysts, 111 buy-side trading desks and 43 users of equity derivative products in Asia. Study participants were asked to name the brokers they use in specific products, to estimate the amount of business they did with those firms and to rate the quality of these brokers in a series of service and product categories. Brokers receiving quality ratings topping those of competitors by a statistically significant margin were named Greenwich Quality Leaders.

Consultants Jay Bennett, John Feng and Parijat Banerjee advise on the institutional equity markets in Asia.

MethodologyBetween July and September 2017, Greenwich Associates conducted interviews with 256 Asian equity fund managers and analysts, 111 buy-side trading desks and 43 users of equity derivative products at institutions based in Asia. Interview topics included overall market trends, compensation and broker relationships.