Table of Contents

For the second consecutive year, the volume of structured products distributed to retail and high net worth individuals increased to just over $70 billion (a 35% increase on a matched sample basis versus a year ago). With this growth, banks have been showing renewed interest to build out their client franchises, and we are seeing a number of issuers adding resources in an attempt to increase their footprint among distributors in the United States.

At the same time, technology providers are looking for ways to improve the efficiency for issuers and distributors alike. Three platforms in particular are top of mind for clients: SIMON, Luma and Halo. Nearly 1 in 3 distributors are either actively using one of these platforms or are considering them in the near future. These platforms have provided distributors with better trade lifecycle management, easier access to educational materials and better supervisory control. We expect the interest and growth of these technology platforms to only continue.

Other key highlights from the research findings:

- Fee-based accounts continue to be an important distribution channel for issuers. Twenty-five percent of structured products are now sold into fee-based accounts.

- The typical distributor requires an issuer to have a credit rating of BBB+ (at a minimum) to be on their platform. About 1 in 4 require a minimum rating of A- or higher.

- The competitiveness of pricing continues to be the top criterion distributors consider when deciding to work with an issuer (80% rank it among their top three criteria), followed by the expertise of an issuer’s sales team (60%). Significantly more distributors noted this year that they consider secondary market liquidity and an issuer’s marketing support.

- Distributors do not always wait for issuers to come to them with product ideas. Nearly 30% of all structured products volume in the U.S. is based upon client inquiries.

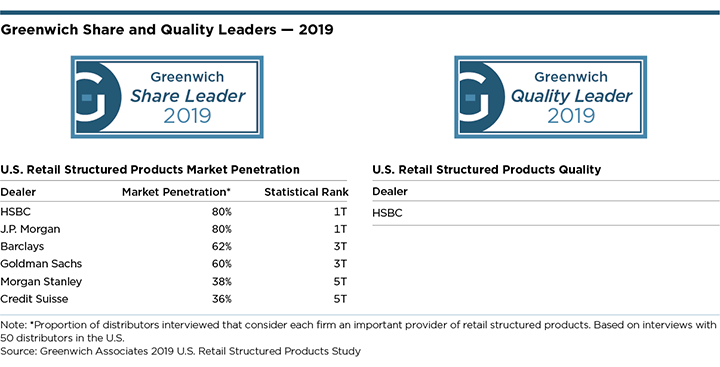

Greenwich Share and Quality Leaders

The competitive landscape in U.S. retail structured products is getting more crowded, but continues to be dominated by two issuers—HSBC and J.P. Morgan.

HSBC and J.P. Morgan rank in a tie for first atop the list of 2019 Greenwich Share Leaders℠ in U.S. Retail Structured Products. Goldman Sachs has effectively closed the gap with Barclays, and the two rank in a statistical tie for third place, followed by Credit Suisse and Morgan Stanley.

HSBC continues to provide unmatched service to its clients and, as a result, the bank earns the title of 2019 Greenwich Quality Leader℠ in U.S. Retail Structured Products.

Consultant David Stryker advises on the retail structured products and fixed-income markets.

MethodologyBetween April and June 2019, Greenwich Associates conducted telephone interviews with 50 distributors of retail structured products in the United States to better understand product demand, distributor preferences and the competitive landscape. Respondents were asked to name the firms they use for retail structured products and to rate those providers in a series of product and service quality categories. Quality Leaders have distinguished themselves from their competitors by receiving service quality ratings that exceed those of competitors by a statistically significant margin.