Table of Contents

U.S. institutional investors are casting a wide net in their search for liquidity and investment ideas by maintaining relationships with scores of U.S. equity brokers. That dynamic has not undermined the leadership position of the four full-service brokers, which have increased their lead over rivals in terms of commission share in U.S. equity trading and research/advisory services.

As part of its 2015 U.S. Equity Investors Study, Greenwich Associates interviewed 243 institutional portfolio managers and 321 institutional traders about the brokers they use for U.S. equities.

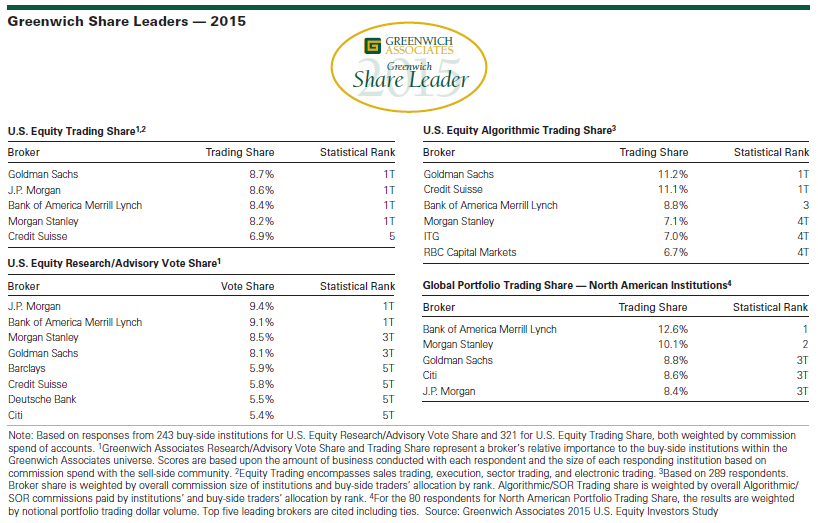

The study results show Goldman Sachs, J.P. Morgan, Bank of America Merrill Lynch, and Morgan Stanley deadlocked atop the U.S. equity trading business with commission shares of 8.2–8.7%. Credit Suisse rounds out the top five with a share of 6.9%. These firms are the 2015 Greenwich Share Leaders in U.S. Equity Trading. The 2015 Greenwich Quality Leaders in U.S. Equity Sales Trading & Execution Service are Goldman Sachs, J.P. Morgan and Morgan Stanley.

In U.S. Equity Research/Advisory Vote Share, the same four firms lead the market, with J.P. Morgan and Bank of America Merrill Lynch tied at the top with commission-weighted vote shares of 9.1–9.4%, followed by Morgan Stanley and Goldman Sachs, which are statistically tied with vote shares of 8.1–8.5%. A second tier of four brokers each earns between 5.4 and 5.9% vote share. These firms are the 2015 Greenwich Leaders in U.S. Equity Research/Advisory Services Vote Share. The 2015 Greenwich Quality Leaders in U.S. Equity Research Product & Analyst Service are J.P. Morgan, Morgan Stanley and Sanford C. Bernstein.

Institutions Seeking Liquidity and Alpha Support Long List of Brokers

All of the full-service investment banks that make up the top rank of the U.S. equity brokers have been forced to reassess their business models to contend with changes in regulation and market structure. Many of these firms have decided to narrow their strategic focus in order to maintain attractive overall returns on equity. As a result, most of these leading brokers have become more selective in their coverage and less focused on amassing market share from any and all institutional clients.

“As these shifts played out over the past 12 months, a clear separation has emerged between the biggest brokers and the rest of the market in terms of share in both research/advisory services and trading,” says Greenwich Associates consultant Jay Bennett. “The result is a segmented market composed of the four leading firms, the rest of the bulge bracket, and a long tail of competitors with relatively smaller shares.”

That long tail of brokers is supported by institutional investors that are using anywhere from 35 to 60 brokers on average for research/advisory services and about 40–60 brokers for equity trading.

“Institutions are hungry for liquidity and for alpha-generating investment ideas,” says Greenwich Associates consultant John Feng. “The best way to secure access to these essential items is by maintaining relationships with large numbers of full-service investment banks, regional or mid-sized broker-dealers and specialist firms.”

Brokers’ Performance in Trading Influenced by Research, Electronic and Portfolio Trading Platforms

The U.S. equity trading and research/advisory businesses are closely linked. Buy-side trading desks allocate about 60% of their U.S. equity trade commission payments to compensate providers of research/advisory services, including analyst service, sales, corporate access, and other services. Some brokers capture incremental trading business above and beyond that generated by their research functions due to their willingness to commit capital and other factors.

Several firms get a sizable boost in trading due to their strength in electronic trading. “Low-touch” electronic trades now make up about 45% of overall U.S. equity algorithmic trading volume and about 15% of the annual commission pool.

Credit Suisse and Goldman Sachs are the leaders in U.S. Equity Algorithmic Trading, with trading shares of 11.1–11.2%. Bank of America Merrill Lynch is third with a share of 8.8%, while Morgan Stanley, RBC Capital Markets and ITG round out the leaders group. These firms are the 2015 Greenwich Leaders in U.S. Equity Algorithmic Trading Share. The 2015 Greenwich Quality Leaders in U.S. Equity Electronic Trading are RBC Capital Markets and Sanford C. Bernstein.

The 2015 Greenwich Share Leaders in Global Portfolio Trading—North American Institutions are Bank of America Merrill Lynch, with a 12.6% weighted trading share, followed by Morgan Stanley, with a share of 10.1%, and Goldman Sachs, Citi, and J.P. Morgan, which are tied with shares of 8.4–8.8%.

Small-Cap Stocks

The market for research and advisory services in small and mid-cap U.S. equities is dominated by a group of full-service, non-bulge bracket brokers with deep expertise and strong relationships with the buy side - especially mid-sized institutions.

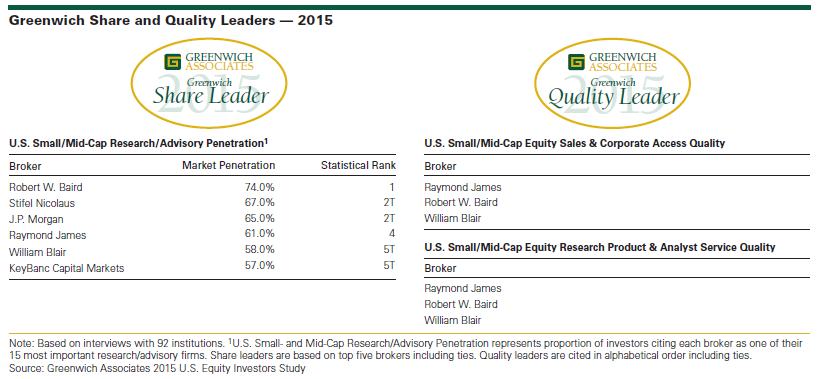

Nearly three-quarters of U.S. institutions active in small and mid-cap stocks use Robert W. Baird. In second place are Stifel Nicolaus and J.P. Morgan (the lone bulge bracket firm on the list), which are tied with market penetration scores of 65–67%, followed by Raymond James at 61%, and William Blair and KeyBanc, which are tied at 57–58%. These firms are the 2015 Greenwich Share Leaders in U.S. Small/Mid-Cap Research/Advisory Penetration.

“Some of these firms might not have the flashiest presence, but they provide consistent, high-quality coverage, usually with a specialty in some particular industries or regions,” says Jay Bennett. “Clearly, the buy side likes what it’s getting from these providers.”

Raymond James, Robert W. Baird and William Blair are the 2015 Greenwich Quality Leaders among small/mid-cap portfolio managers in both Equity Sales & Corporate Access and Equity Research Product & Analyst Service.

Consultants Jay Bennett, John Colon, John Feng, and David Stryker advise on institutional equity markets globally.

MethodologyBetween December 2014 and February 2015, Greenwich Associates interviewed 243 U.S. generalist equity portfolio managers, 92 small/ mid-cap fund managers and 297 U.S. equity traders at buy-side institutions. The study participants were asked to evaluate the sales, research and trading services they receive from their equity brokers and to report on important market practices and trends.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.