Table of Contents

Three global brokers are pulling away from the pack in the Asian equity research/advisory business—a break from historical patterns characterized by a more gradual slope among major competitors.

Credit Suisse, Bank of America Merrill Lynch and Morgan Stanley are statistically deadlocked atop the list of 2016 Greenwich Leaders in Asian Equity Research/Advisory Vote Share. These three firms have opened a significant lead over UBS, CLSA Asia-Pacific Markets and J.P. Morgan, which are also virtually tied in terms of vote share and round out the list of this year’s winners.

In Asian Equity Trading, the same three firms are statistically tied for the top spot in overall share, but in this business, their lead over fellow Greenwich Share Leaders CLSA, UBS and Citi is much narrower. In the growing algorithmic trading business, Bank of America Merrill Lynch widened its lead over the competition. Credit Suisse and Morgan Stanley claim the title of 2016 Greenwich Quality Leaders in Asian Equity Research Product & Analyst Service, and along with Bank of America Merrill Lynch are the Greenwich Quality Leaders in Sales and Corporate Access. In Sales Trading & Execution Service, the 2016 Greenwich Quality Leaders are Bank of America Merrill Lynch, Credit Suisse, Morgan Stanley and UBS.

These brokers spent much of 2016 battling for market share in a tough environment. Since 2015, the pool of commissions paid by institutional investors to brokers on trades of Asian equities has shrunk by approximately 16%. That decline seemed even more pronounced to market participants, due to the steep fall-off in activity from the first half of 2015, when trading volumes were surging across the region. Market uncertainties since then, however, driven largely by a slowdown in China, have diminished trade flows and brokerage commissions.

The good news for brokers and investors alike is that trading activities showed signs of a rebound as 2016 progressed. This pickup coincided with an uptick in the overall securities business earnings of global firms in Q3 2016 and, along with post-election gains, started to create some level of confidence that better conditions would prevail in the near future. “But for most of 2016, the story in Asian equities was one of questionable economic direction and a shrinking commission pool that forced investors and brokers to figure out ways to do more with less,” says Greenwich Associates Managing Director John Feng.

MiFID II

Amid this uncertainty rose another huge variable: MiFID II. Although a European regulatory initiative, many of the biggest and most active investors in Asia are global companies that either have sizable operations in Europe or manage European assets and must therefore comply with MiFID II’s impending “unbundling” rules. As they move to do so, many are expected to implement changes across their entire organizations, so as to avoid the inefficiencies that would arise from maintaining differing practices and processes across geographic markets. (Greenwich Associates will publish in Q1 2017 the results of a special research study on how institutional investors are adjusting their research budgeting and the broker vote process in preparation for MiFID II.)

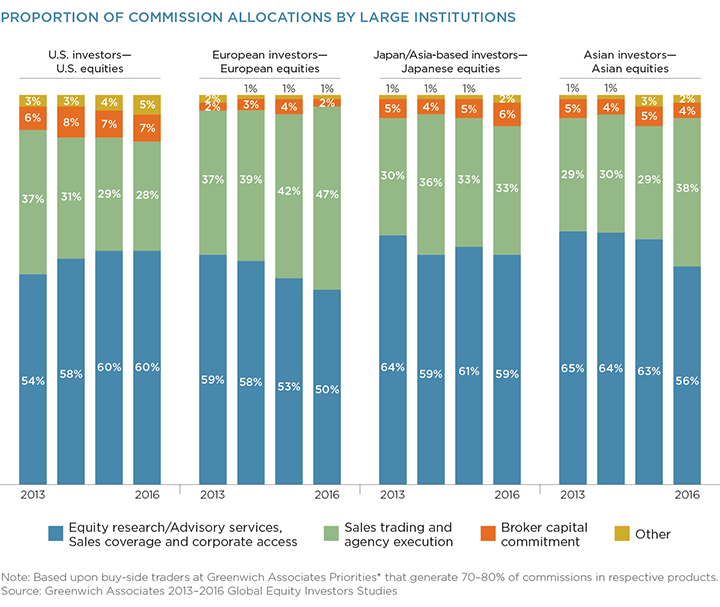

With MiFID II’s implementation date now less than 12 months away, the impacts of this regulatory shift can be seen in the Asian equity market. When trading Asian stocks, institutional investors are cutting back on the share of their commission payments used to compensate sell-side providers for their equity research and advisory services, including sales coverage and corporate access. In 2014, allocations to this function accounted for 65% of all cash equity commission payments. That share fell to 63% in 2015 and dropped to 61% in 2016.

The drop-off was even more pronounced among the big institutional investors that account for the bulk of Asian equity trading volume and commission payments. Among these larger institutions, the share of commissions allocated to research and advisory services plummeted to 56% in 2016 from 64% in 2014. “These are the largest investment organizations that face a more urgent need to be compliant with MiFID II and are moving to adopt practices consistent at a global level,” says Greenwich Associates Managing Director Jay Bennett.

Indeed, the 56% now allocated to research and advisory services among this group is approaching the 50% reported by large institutional investors on trades of European equities. In Japan and the United States, the MiFID II impact has been more muted. In these markets, which support a relatively large number of domestic investors that presumably would not be affected by rule changes in Europe, allocations to research and advisory services have been relatively stable at about 60% of cash equity commission payments.

Electronic Trading

Steady growth in electronic trading last year could be another sign that investors in Asia are looking to adapt to a post-MiFID II environment. Although e-trading volumes in Asia have lagged those in other, less heterogeneous markets, electronic trading at a secular level has been on a growth trajectory around the world for the past decade.

However, when trading activity and commission payments have stalled out or fallen in Asia or other markets, investors have responded in the past by slowing their move to electronic execution and, in some cases, reducing the share of their trading volumes executed electronically. The reason: Research and sell-side advisory services like corporate access represent largely fixed costs. Portfolio managers and analysts need access to these products and services regardless of the trading environment. When trading activity falls, institutional investors have less commission “currency” with which to pay their providers. As a result, institutions may pull back on electronic trades that are essentially “unbundled” and route these flows to “high-touch” trades, which include commissions that can be allocated to reward brokers for research and advisory services.

Although 2016 embodied this type of environment, the expected slowdown in e-trading in Asia never materialized. Instead, investors made a significant move in the opposite direction. From 2015 to 2016, large institutions cut the share of trading volume executed through high-touch, single-stock trades facilitated by broker sales traders to 58% from 65%. Meanwhile, the share of trading volume executed by this group through algorithmic trades jumped to 26% from 20%, and to 31%—up from 26%—when including both algorithmic trades and crossing networks, with portfolio trading accounting for another 10%.

“The fact that institutions continued to shift trade volumes to electronic platforms amid a meaningful contraction in the commission pool is another indication that the link between trade execution and research could be weakening,” says Greenwich Associates consultant Parijat Banerjee. “However, the consistency among brokers on the list of Greenwich Leaders in Trading and Research shows that for now at least, that correlation is still significant.”

Greenwich Share and Quality Leaders

Between July and September 2016, Greenwich Associates interviewed 219 Asian equity fund managers and analysts, 128 buy-side trading desks and 42 users of equity derivative products in Asia. Study participants were asked to name the brokers they use in specific products, to estimate the amount of business they did with those firms and to rate the quality of these brokers in a series of service and product categories. Brokers receiving quality ratings topping those of competitors by a statistically significant margin were named Greenwich Quality Leaders.

Consultants Jay Bennett, John Feng and Parijat Banerjee advise on the institutional equity markets in Asia.

MethodologyBetween July and September 2016, Greenwich Associates conducted interviews with 219 Asian equity fund managers and analysts, 128 buy-side trading desks and 42 users of equity derivative products at institutions based in Asia. Interview topics included overall market trends, compensation and broker relationships.