The global fixed income market has seen an upswing in ESG assets over the past 18-24 months.

Asset managers are actively revamping their investment practices to integrate ESG across their corporate bond, private debt, and municipal bond portfolios. Regulations in Europe have also been supportive.

The desired outcomes, however, are stymied by lack of fixed income-focused ESG assessments/ ratings, weak data disclosures in high-yield/ private markets, insufficient issuer-level climate and social risk data, and absence of voting rights.

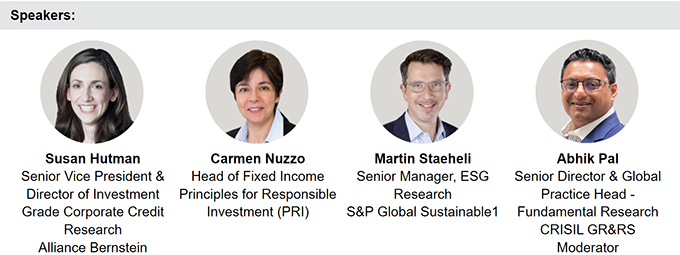

With this context in mind, CRISIL and S&P Global Sustainable1 are co-hosting the webinar titled ESG in fixed income - Navigating the next phase of sustainability.

At the webinar, global experts will share their insights on how to manage ESG integration hurdles in the corporate credit and municipal bond markets. The topics will include:

- Best practices to address data gaps and integrate ESG into high-yield/ investment-grade bonds, private debt, and municipal bonds

- Customising materiality frameworks and scores for fixed income across industries and regions

- Approaches to integrate climate and social risks into credit portfolios

- Product strategies to navigate a highly competitive and regulated market

- Impact of emerging sustainability regulations on the corporate bond, private debt, and municipal bond portfolio