Table of Contents

In a market increasingly defined by the implementation and consequences of new regulations, Deutsche Bank has established itself as the leader in global fixedincome trading market share. Meanwhile, at a time when the industry is increasingly characterized by cost-cutting and the rationalization of capital, J.P. Morgan and Citi have distinguished themselves by providing the best quality of service to fixed-income investors. Amid all these changes, the concentration of global trading volume flowing to the world’s three biggest dealers increased last year.

The past several years have seen major shifts in the competitive landscape as some of the world’s largest banks decided to shift their strategies, scale back, and in some high-profile cases, pull out entirely of some specific fixed-income products.

Banks have not made these strategic shifts in unison. The reason: The changes are being driven in large part by the new capital reserve requirements imposed by the Basel III accords, which have dramatically changed the economics of these businesses.

Basel III capital rules are being implemented at different speeds by regulators in different regions, and this uneven schedule has had a huge influence on the competitive positioning, market share and profitability of the world’s largest fixed-income dealers.

In December, the Basel Committee on Banking Supervision issued a report saying the European Union has fallen behind the United States, Switzerland and Japan in implementing Basel III rules. While the U.S. was graded as “largely compliant” with the Basel III rules, the EU was dubbed “materially noncompliant.”

Anyone hoping to see a more consistent regulatory framework in 2015 will likely be disappointed. Last year, the U.S. Federal Reserve proposed a new and stricter rule that would require “systemically important” banks to hold CET I capital of up to 14% of riskweighted assets by 2019. The proposal immediately fueled speculation that the implementation of these stricter requirements in the U.S. might prompt European regulators to follow suit with enhanced capital rules of their own.

Banks Respond to New Regulation

The new rules and the inconsistent implementation have caused banks to diverge in their strategies and approaches, as each firm seeks out the business model that best utilizes its own strengths to maximize profitability. But the capital requirements have also triggered common responses that are having a broad impact on the market.

As capital is removed from the business, trading liquidity has been eroded. Fixed-income research has also been cut back—in cases significantly. Across the board, smaller investors that don’t qualify for dealers’ target client lists are seeing reductions in coverage, research and liquidity.

“Investors and the sell side are experimenting with alternative execution venues such as e-trading and agency-based approaches,” says Greenwich Associates consultant Frank Feenstra. “But agency trading platforms are still in the developmental stage, and e-trading platforms, while growing, are not a good fit for many illiquid fixed-income products, and in an all cases still rely on the support of dealers, which could evaporate quickly with a spike in volatility.”

2014 Greenwich Leaders

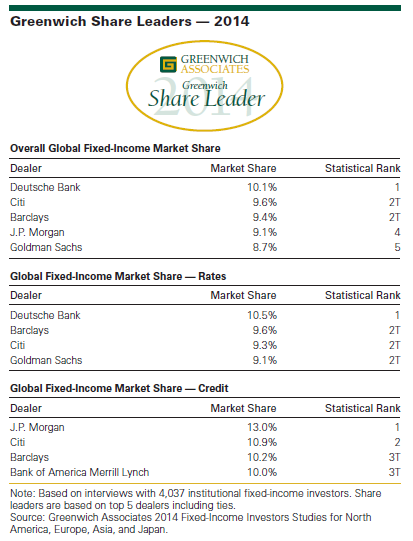

In this rapidly changing market, Deutsche Bank holds the position as the No. 1 fixed-income dealer with a 10.1% market share globally. Citi and Barclays are tied in the second spot with market shares of 9.6% and 9.4%, respectively, followed by J.P. Morgan at 9.1% and Goldman Sachs at 8.7%. These firms are the 2014 Greenwich Share Leaders in Overall Global Fixed Income.

Citi, Bank of America Merrill Lynch and Goldman Sachs are all gaining share, as the effects of Basel III and banks’ strategic responses to the new rules take effect.

The 2014 Greenwich Share Leaders in Global Fixed- Income Rates are led by Deutsche Bank, which has a market share of 10.5%, followed by a three-way tie between Barclays, Citi and Goldman Sachs. In credit products, J.P. Morgan is the clear leader with a 13% market share, followed by Citi (10.9%) and then, tied for the third spot, Barclays (10.2%) and Bank of America Merrill Lynch (10%). These firms are the 2014 Greenwich Share Leaders in Global Fixed- Income Credit.

“Banks are moving forward with different strategies,” says Greenwich Associates consultant Woody Canaday. “Some banks are offering only certain products. Others offer everything, but only to certain clients.”

For example, although Deutsche Bank is, like all banks, rationalizing its capital commitments, the bank remained committed in 2014 to maintaining a broad fixed-income platform. Barclays, too, repositioned itself to focus on a broad range of businesses in which it has a strategic advantage, de-emphasizing some marginal businesses, and continues to be one of the largest global players in fixed income. It also improved its position in the United States, the largest fixed-income market.

Goldman Sachs has been making gains in U.S. rates products, ranking among the top dealers in U.S. Treasuries and winning share in pass-throughs and interest-rate swaps. The bank also ranks No. 1 in trading share among hedge funds globally. Bank of America Merrill Lynch has gained ground in U.S. Treasuries and ranks as the industry leader in high yield. The bank has also won share in Asia, although the relatively small size of that market means that increases there have little impact on global results.

At a time when cost-cutting is having an obvious and significant negative impact on coverage intensity and quality, J.P. Morgan and Citi have distinguished themselves by delivering the industry’s best service quality. These two firms are the 2014 Greenwich Quality Leaders in Global Fixed Income.

J.P. Morgan has demonstrated a clear commitment to FICC businesses broadly. Citi has returned to form, and is demonstrating strength across a wide variety of products ranging from emerging market debt to U.S. Treasuries. Citi also ranks second only to Goldman Sachs in global trading share among hedge funds.

Consultants Andrew Awad, James Borger, Woody Canaday, Peter D’Amario, Frank Feenstra, John Feng, Brian Jones, Peter Kane, Tim Sangston, Abhi Shroff, David Stryker, Taeko Sumiyoshi, and Tomio Sumiyoshi advise on the institutional fixed-income markets.

MethodologyInterview topics included service provider assessments, trading practices, market trend analysis, and investor compensation.

Asia (ex-Japan)

Between April and July 2014, Greenwich Associates conducted 881 interviews with fixed-income investment professionals at domestic and foreign banks, private banks, investment managers, insurance companies, hedge funds, corporations, central banks, and other institutions throughout Asia (ex-Japan). Countries and regions where interviews were conducted include Australia/New Zealand, China/ Hong Kong/Macau, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Sri Lanka, Taiwan, and Thailand.

North America

Between February and April 2014, Greenwich Associates conducted in-person interviews with 125 institutional fixed-income investors in Canada, 187 in Latin America and 1,067 in the United States.

Europe

Between May and July 2014, Greenwich Associates conducted 1,265 interviews with senior fixed-income investment professionals at banks, fund managers/advisors, insurance companies, corporations, central banks, hedge funds and other institutions throughout Europe. Countries where interviews were conducted include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Luxembourg, Malta, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and select interviews conducted in Central & Eastern Europe and the Middle East.

Japan

Between May and July 2014, Greenwich Associates conducted 328 interviews with senior investment professionals in Japan investing in domestic fixed income and 162 interviews with senior investment professionals in Japan investing in international fixed income. Interviews were conducted with banks (regional banks, shinkin banks, agricultural banks, trust banks, and others), investment companies and insurance companies.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.