The 2008 financial crisis was a wake-up call for the pensions industry. By 2009, total assets managed by U.S. pension funds were down 22% from their peak in 20071. Public and corporate pension retirement systems were confronting a worsened underfunding crisis—with investment returns on current assets indicating the funds would be unable to meet future liabilities.

In response to this, many pension systems reviewed their investment strategy and increased allocations to alternatives, such as real estate, private equity and hedge funds, in search of higher returns. Yet, almost 10 years after the economy crashed, most corporate and public pension plans remain seriously underfunded.

Many institutional investors are now looking to the listed options market to:

- protect their portfolio following a long bull market,

- increase income from investment holdings,

- and improve their overall risk-return profile.

Exchange-listed options are a popular tool, as they offer relatively high transparency and price discovery compared to some other derivatives products. They also provide lower regulatory complexity and counterparty risk.

In this Greenwich Report, we explore how institutional investors are embracing active management approaches by using exchange-listed options strategies to help them decrease portfolio volatility, increase yields, protect portfolios, and improve funding ratios. We analyze the types of options strategies being implemented and identify the key drivers that can lead a firm to implement listed options strategies.

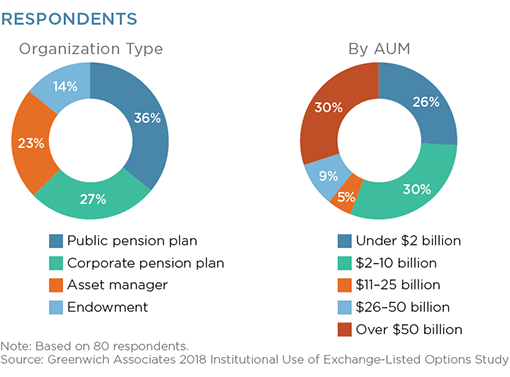

Between December 2017 and March 2018, Greenwich Associates conducted telephone interviews with 80 institutional investors in the U.S., including asset managers, corporate pension plans, public pension plans, and endowments. Respondents were asked a series of questions to understand their perceptions of listed options strategies. Total AUM for the funds in our sample was more than $1 trillion.

In addition, this study incorporates contextual information gathered from four “deep dive” conversations with listed options users.