The derivatives market is no stranger to tumult and bad publicity. Just within the past year, the U.K. pension crisis erupted, the LME default process was challenged, and a single trade on Deutsche Bank CDS was blamed for a drop in bank share prices (though perhaps unfairly). Of course, the headlines don’t always reflect the current state of the derivatives market, nor are the improvements to the market structure implemented over the past years being properly acknowledged.

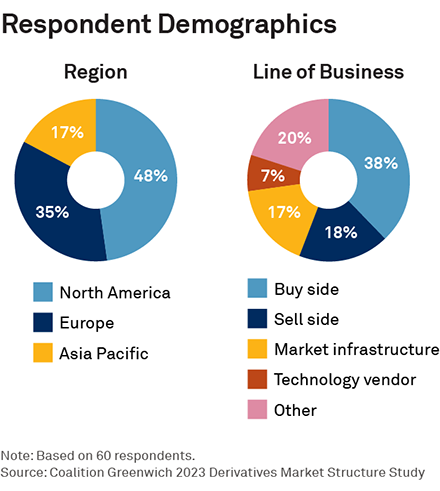

MethodologyIn January and February 2023, Coalition Greenwich conducted interviews with 60 senior derivatives market participants across North America, Europe and Asia to identify key trends in the derivatives market. Questions explored the investment priorities, challenges in today’s market, and how firms will respond to regulation and other market drivers.