Electronification has created opportunities and perhaps the most interesting and most analyzed second-order effect is the spread of algorithmic trading.

Electronification has created opportunities and perhaps the most interesting and most analyzed second-order effect is the spread of algorithmic trading.

With the buy side trading desk allocating just over one-third of its budget to technology, traders have more tools and flexibility than ever at their disposal.

Buy-side firms are increasingly willing to invest in a TCA platform rather than make do with free services or proprietary tools.

Derivatives help a wide range of end users manage risks and improve returns.

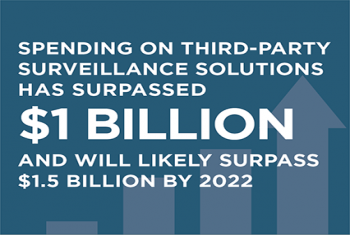

Corporate treasury departments are increasingly recognized for what they have always been: centers of analytical excellence. Thus, as the demands on the corporate treasurer expand, treasury departments are looking to new technologies and third-party...

Best-in-class managers leverage technology to enhance client relationships through the delivery of data and insights in an automated and customized manner. In the next 3–5 years, a manager’s technical capabilities will play an increased role in how...

Greenwich Associates reflects on the change to zero trading commissions by the major retail brokerages and its impact on retail trading and execution.

Despite the many changes in commercial banking over the past decade, the relationship manager remains the lynchpin of the relationship between...

Just as markets are never static, the same is true for market structure. New technologies, products, business practices, and competitive dynamics continually change the nature of markets.

Regtech implementation has followed a reactive approach to new regulation since the financial crisis but firms are increasingly realizing the value of adopting a proactive approach.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder