In this report, we examine the role that investment research/content plays in the institutional investment landscape and how that role has changed in the past five years. In today’s new normal, providing personalized or tailored investment research is more important than ever. With less face-to-face contact, asset managers must make a conscious effort to provide the personal touch that many institutional investors have come to expect.

Brand reputation remains a top factor in the decision-making process of institutional investors, but how asset managers build their brand presence has evolved over the last five years. With institutional investors spending more time on social media, asset managers that are savvy adopters of these trends have a unique opportunity to grow mind share as well as market share.

Looking forward, content creation and distribution by asset managers will become evermore fluid, with customized research distributed across multiple channels to ensure clients and asset managers meet where they are. Yet despite all this progress toward a more digital world, relationships matter. The source of the content, both the firm and the individual, and the ability of that content provider to follow up will still, over time, act as the tipping point between the haves and the have nots.

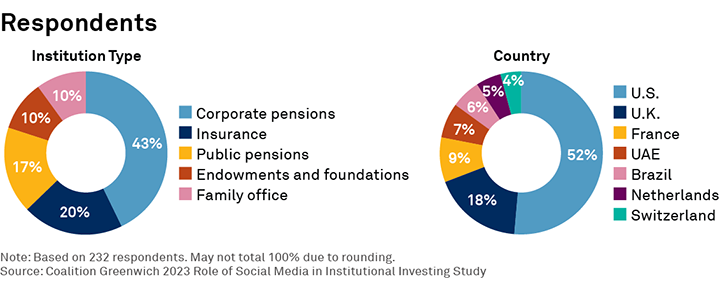

MethodologyIn Q4 2022 and Q1 2023, Coalition Greenwich interviewed 232 institutional investors located in the United States, EMEA and Latin America. The study asked senior investment professionals at corporate pensions, insurance companies, endowments and foundations, and family offices about their habits and views regarding the consumption of digital media in the investment process and its impact on investment decisions. This report was commissioned by LinkedIn.