This Greenwich Report explores several drivers of investment in surveillance technology. These range from the system upgrades via new technology, better data, more analysis tools and methods, and connecting disparate systems and information. More specifically:

- Surveillance capabilities have grown substantially over the past three years, driven in part by the global pandemic and the subsequent emergence of new communication channels and the explosion of data. Research respondents commented that the volume of data fed into surveillance tools has increased anywhere from 12% to 15% in just the last year.

- Consequentially, investments in regtech have increased steadily (by 20% each year since 2020), culminating in an estimated $1.8 billion on technology spending globally in 2022. Steady increases were observed across both buy-and sell-side firms. Drivers include post-pandemic and macro effects, such as the introduction of more communications channels resulting from work-from-home and hybrid work environments coupled with unpredictable and volatile markets.

- Surveillance gaps have arisen out of a confluence of factors: increased volatility in the market, growing trading volumes, new communication modalities used by regulated employees, operational uncertainty, and regulatory and reputational concerns. As a result, 72% of study respondents believe technology spending will continue to accelerate in 2023 and beyond.

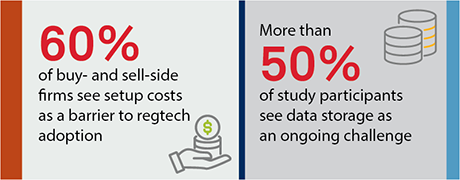

- Regtech barriers still exist. Although firms have many regtech aspirations and wants, approximately 60% of buy- and sell-side firms in this study feel that set up costs—including technology infrastructure, internal support staff and even time needed to learn and adapt to new systems—are a non-trivial barrier to implementing modern regtech.1 Some of the more forward-looking professionals we spoke with believe these costs are well worth it in the longer term and will save resources and time, ultimately reducing total cost of ownership (TCO).

- Overall, the future is bright for regtech improvements and investment despite cost challenges. Study participants feel optimistic about modern tech adoption, such as AI/ML and cloud, and better integration of systems. When asked whether the industry is at a turning point that demands more modern compliance systems and technology, over 50% agree the space is ripe for a tech upgrade.2

In Q3 2022, Coalition Greenwich interviewed several dozen compliance, front-office and risk professionals of Tier 1 and regional sell-side banks and brokers, buy-side investment firms, numerous data providers, as well as major service providers in the United States to better understand trends in surveillance spending and challenges presented by evolving communications channels and growing data sets. The heads of business and executives participating in this research represent a meaningful portion of the capital markets surveillance technology ecosystem. Coalition Greenwich estimates and analyses are based on these conversations and proprietary data.