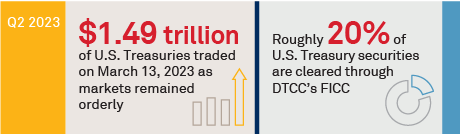

Several disruptions over the past years in both the U.S. Treasury and repo markets have inspired the U.S. Securities and Exchange Commission (SEC) to take a closer look at trading dynamics and the possibility of expanded clearing. According to a July 2021 Group of 30 (G30) report, 20% of U.S. Treasury commitments were cleared through DTCC’s Fixed Income Clearing Corporation (FICC). Meanwhile, repo and reverse repo cleared activity stood at 20% and 30%, respectively. Many transactions are settled bilaterally between clearing agent (Treasury CCP) direct participants and indirect participants, including principal trading firms (PTFs) which, as a group, transact in large volumes.

MethodologyFrom Q4 2022 through Q1 2023, Coalition Greenwich interviewed 40 buy-side and sell-side markets professionals to get their views on the SEC’s U.S. Treasury Clearing proposal. Respondents were based in the U.S., Europe and Asia.