Table of Contents

- 1.Big Banks Continue to Capture Corporate Banking Relationships

- 2.Indian Corporates Eye International Expansion

- 3.Pushing Back Against Interest-Rate Headwinds

- 4.India’s Private Banks Up Their Game in Service and Digital Banking

- 5.Indian Corporates and Banks Embrace ESG

- 6.Greenwich Share and Quality Leaders and Greenwich Excellence Awards

Indian companies are joining forces with the country’s largest banks to help fuel their drive to become bigger, more international and more efficient.

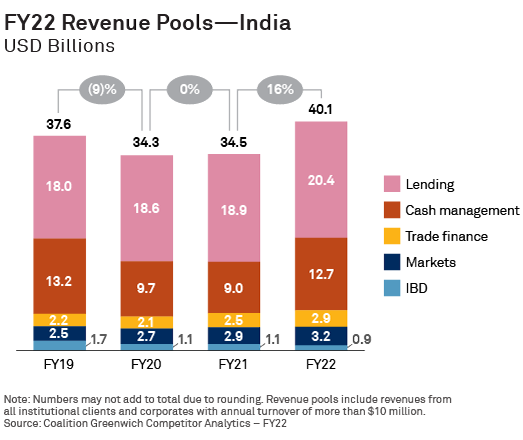

Industry revenue pools across banking grew by 16% overall year on year. The largest driver was the growth in cash management on the back of the higher rates environment. We also saw double-digit growth for domestic and cross-border trade. The capex cycle has been a key driver for growth in lending for banks in India as well.

Nearly 90% of the large and middle market Indian corporates participating in the most recent Coalition Greenwich India Corporate Banking Study are optimistic about the outlook for their businesses over the coming year. Fully a third of those companies say they are highly positive about that near-term future.

Those positive vibes reflect a robust economy powered by favorable demographics, a strong and growing consumer base and an influx of international capital from companies like Apple that are diversifying supply chains away from China. The favorable business conditions corporates in India are now experiencing are also a result of the Indian government taking steps over a number of years to create a more business-friendly environment. Corporates—and the Indian economy as a whole—are now reaping the benefit of various structural reforms introduced over the past decade or so, as well as the shifting geopolitical environment.

A treasury professional from a large Indian corporate described the current situation for his company: “We are quite stable and our dependence on debt is not much. Our bottom lines have been consistent. We don’t see much turbulence at all.” A study participant from a large Indian pharmaceutical company explains that his company sees huge opportunity if it can successfully roll out new products while managing costs. “If we can manage these two things better, we would see business outcomes that are extremely positive,” he says.

Big Banks Continue to Capture Corporate Banking Relationships

Large and middle market corporates are turning to the biggest banks in India—to help capitalize on current conditions and achieve ambitious plans for growth. The Reserve Bank of India’s 2020 circular put the country’s largest credit providers in an advantageous position in the competition for corporate banking relationships. The biggest domestic and foreign banks are building on that momentum at a moment when bank relationships are seen as especially important by Indian corporates and MNCs alike. Although companies in India are enjoying a favorable environment overall, rising interest rates represent a potential headwind in India as they do for other major economies globally. Strong banking relationships can help corporates maintain growth while mitigating any negative impact of rising rates.

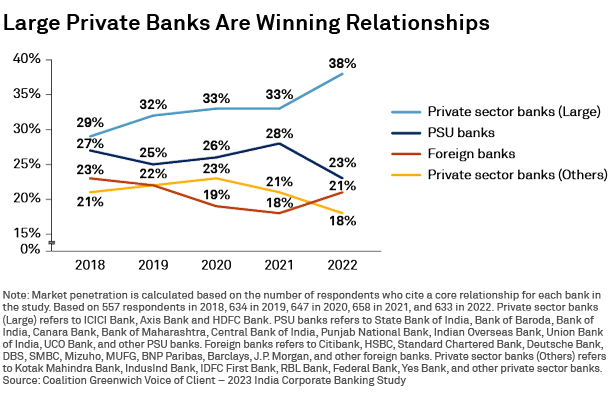

From 2021 to 2022, the share of Indian corporates working with one of the largest Indian private sector banks for overall corporate banking services increased to 38% from 33%. Over the same period, the share of corporates working with at least one large foreign bank climbed to 21% from 18%. That increase in penetration reversed what had been a three-year decline in market penetration among foreign providers, and reflects a growing aggressiveness on the part of foreign banks to provide credit not only to the largest Indian companies, but to middle market corporates as well.

Many of the gains for large private sector and foreign banks came at the expense of the smaller banks, including some of India’s public sector banks. But even among the PSUs, the trend toward consolidation among the largest providers persisted, with State Bank of India doing a better job than smaller banks at maintaining corporate relationships. Over the 12-month period, the share of Indian corporates working with at least one of the country’s other, smaller, private sector banks dropped to 18% from 21%.

The same trends were evident in the domestic cash management business, in which large private sector banks increased their market penetration to 46% of Indian corporates in 2023 from 40% in 2022, while foreign banks expanded to 21% from 18%. Meanwhile, market share contracted among both public sector banks and smaller private sector providers. Those shifts mark a continuation of the consolidation trend that started in 2020. This is in contrast to the broader regional trends in Asia where corporates have again begun diversifying their cash management relationships after a period of contraction during COVID-19.

Indian Corporates Eye International Expansion

Encouraged by their optimistic outlook, Indian corporates are rolling out ambitious growth plans. Many companies see international expansion as a key source of that future growth. Over the past two years, the share of large and middle market Indian corporates with international business and operations requiring bank support increased from less than three-quarters (73%) to 81%.

Nearly half of those companies employ a foreign bank to meet their international cash management needs, with the biggest global banks holding a majority of those relationships. “Because we are expanding internationally on a large scale, we are looking toward [a large global bank] to serve our international needs,” says a treasury professional from a large Indian packaged food provider. “We expect our banks to be able to offer products which suit our international needs as we now have presence in several countries,” adds a study participant from a large Indian corporate.

Pushing Back Against Interest-Rate Headwinds

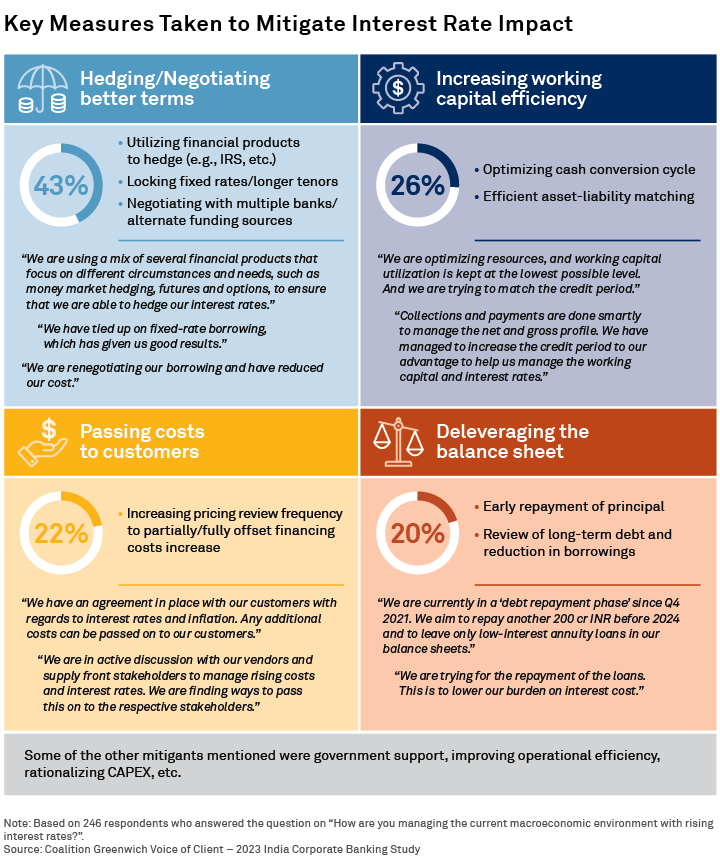

Even as Indian corporates implement growth plans, most are also working to minimize the potential negative impact of rising interest rates on their businesses. Two-thirds of the large and middle market companies participating in the study say they are taking proactive steps to mitigate the effects of rising rates. Companies are working to optimize efficiencies in cash and inventory management, taking a microscope to operational costs, and deleveraging.

It is important to recognize that a sizeable minority of Indian corporates are not taking any specific steps with regard to rising rates. Relative to the low/zero interest rate regime in most of the major economies for much of the past decade, rates in India have been relatively higher. A sizeable number of corporates have been generally less leveraged and have proven to be less vulnerable to rate increases.

The following graphic shows the most common steps Indian companies are taking in response to rate increases.

India’s Private Banks Up Their Game in Service and Digital Banking

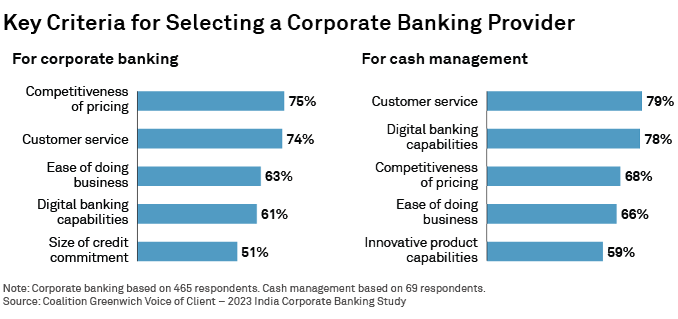

For corporates in India, the quality of a bank’s overall service level is now equally or more important than price when it comes to selecting a provider for corporate banking and cash management.

The graphic above shows the most important criteria considered by corporates in India in their assessments of the banks competing for their business. As the charts illustrate, factors like customer service, digital banking capabilities and ease of doing business now match or outweigh the impact of pricing—a situation that would have seemed incredible just a few years ago, when the Indian corporate banking market was more price sensitive. In cash management, service and digital capabilities have skyrocketed in importance to Indian corporates over the past 12 months and now rank as by far the most important selection criteria.

At first glance, it might seem like the increased emphasis on digital capabilities and overall service quality would benefit the largest global banks, which have vast resources to devote to technology and have been investing on a global basis in digital. However, we see large Indian corporates rank with foreign banks in delivering the best digital experience, as Indian banks have been investing heavily in their digital capabilities. The domestic players typically tend to be more nimble and faster-to-market relative to the biggest global banks. Indian banks have impressed companies with their ability to respond to customer demand and quickly get to market with new digital features. As a result, two Indian banks, ICICI Bank and HDFC Bank, score spots in the top five for digital experience, as measured by ratings from large and middle market corporates.

Indian corporates described some of the features that help their current banks deliver a great digital experience:

“The site fetches the data from DGFT for export sales registration; we enter commercial invoice details there. Once exports are lodged, payment gets processed digitally.”

“We are doing most transactions digitally via the bank. For example, we can make LCs online. Also, remittances can be done online. Physical paper transactions are almost nil. Touch and feel of their digital platform is very good.”

“The interface is easy to understand, easy to use. Log-in systems are secured. The transactions flow smoothly, and there are much fewer errors.”

“The ease of integration, host-to-host integration, the API they provide, and the success rate are some of the features which makes it a good digital experience.”

Indian Corporates and Banks Embrace ESG

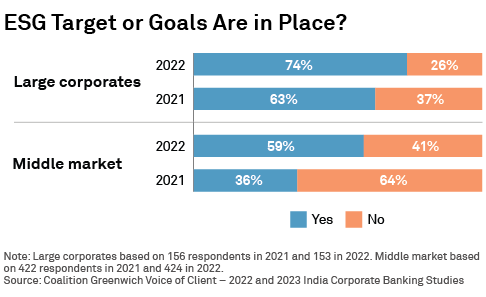

Indian corporates are embracing environmental, social and governance in a big way. Over just the past 12 months, the share of companies in India with established ESG targets increased from less than half (43%) to nearly two-thirds (63%). Almost three-quarters of large Indian corporates now have formal ESG goals.

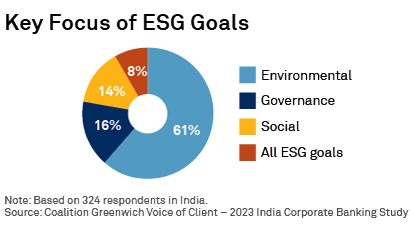

Banks are playing a key role in helping companies in India and elsewhere set and achieve their ESG goals. For most Indian companies, environmental issues are the focus of ESG targets. To meet those targets, more than a third (of those who cited using green banking products) of the corporates are using green bonds, with about another third using ESG-linked loans. In addition to sourcing these products from banks, Indian corporates are looking for support in other areas. For example, about 3 in 10 corporates in India said they are getting help from banks to help develop sustainable supply chains.

Going forward, banks have an opportunity to deepen their relationships with Indian corporates by helping clients build out ESG programs or establish them for the first time. Among companies currently without formal ESG targets, more than a quarter say they have not taken action due to a lack of knowledge about ESG issues. Another third cite a lack of resources or funding. Banks can help clients bridge gaps in both areas.

Although foreign banks are seen as the leaders in ESG, Indian banks are closing the gap quickly. Every year, Coalition Greenwich asks Indian corporates which banks have been most active in approaching them to discuss ESG topics. From 2021 to 2022, citations increased by more than 16 percentage points for ICICI Bank and by at least 10 percentage points for Yes Bank and HDFC. Citations for State Bank of India increased by six percentage points. Clearly, increases of that magnitude reflect both strategic choices to focus on ESG and execution that has brought that focus to clients.

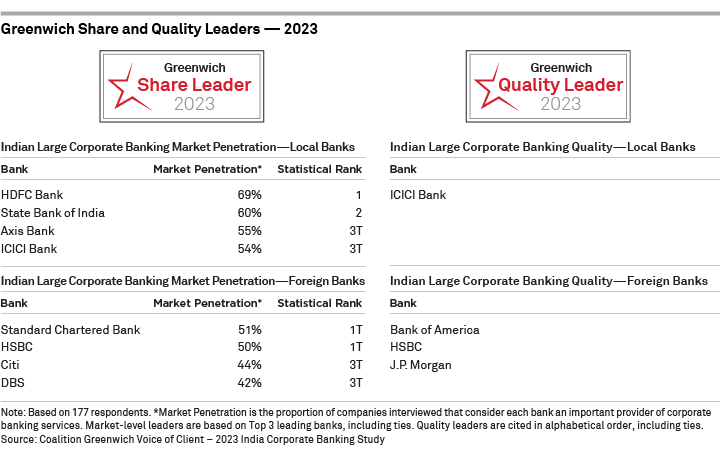

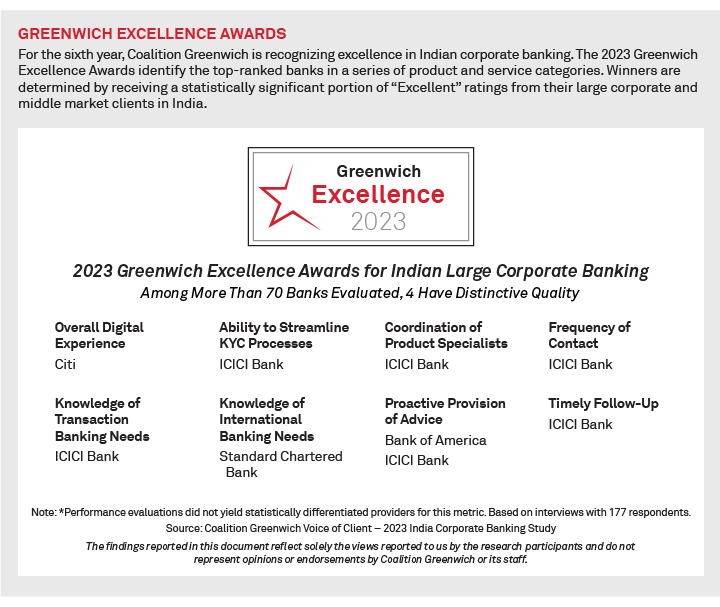

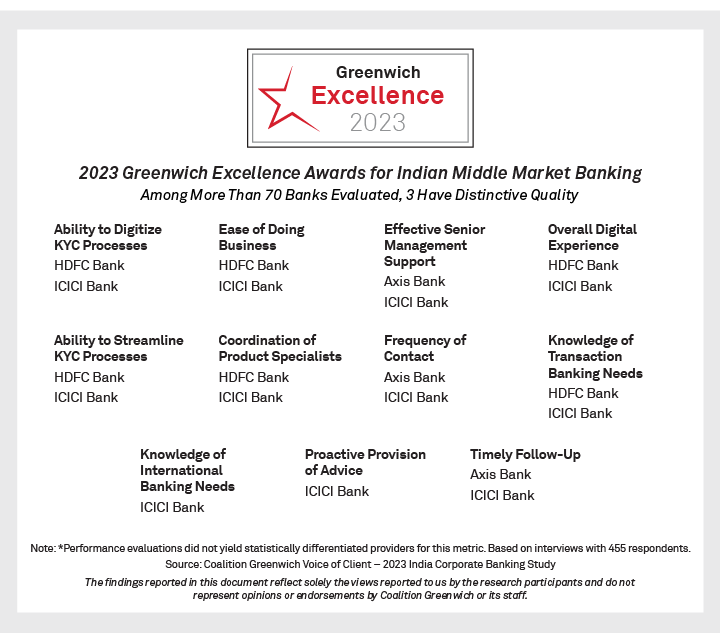

Greenwich Share and Quality Leaders and Greenwich Excellence Awards

The following tables present the 2023 Greenwich Share and Quality Leaders in Indian Large Corporate and Middle Market Banking and the winners of the 2023 Greenwich Excellence Awards in several important categories.

Global Head of Competitor Analytics, Gaurav Arora, Ruchirangad Agarwal, Wesley Han and Pushpak Vanjari specialize in Asian corporate/transaction banking and treasury services.

MethodologyFrom September 2022 to March 2023, Coalition Greenwich conducted interviews with 177 large corporates and 455 middle market businesses in India, focusing on key areas such as banking relationships, quality perceptions of the respective relationships and products used including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking.

The Greenwich Quality Index (“GQI”) comprises metrics that measure Institutional Relationship Quality and Overall Coverage (i.e., “People”) Quality. Institutional Relationship Quality factors include “Effective Senior Management Support,” “Ease of Doing Business,” “Willingness to Lend,” “Most Competitive Pricing,” and “Ability to Communicate Upfront on KYC Requirements.” Coverage Quality factors include “RM’s Proactive Provision of Advice,” “Knowledge of Transaction Banking Needs,” “Knowledge of International Needs,” “Frequency of Visits,” “Timely Follow Up on Requests,” and “Effective Coordination of Product Specialists.” Study participants were then asked to rate their banks in 14 product and service categories. Subjects covered included product demand, quality of coverage and capabilities in specific product areas.