Table of Contents

Financial institutions and companies reduced the share of their foreign exchange trading volume executed through the world’s leading FX dealers last year.

The distribution of trading flows to a broader list of dealers was driven by decisions made by both sell-side firms and customers as they reacted to changes in the marketplace— and by the increasingly electronic nature of FX.

In the current environment, a less concentrated FX market might actually be welcomed by some of the world’s biggest FX dealers. These banks have been under intense regulatory pressure, first from the fallout of the financial crisis and more recently from the FX “rate-rigging scandal.”

Facing balance sheet pressure and continued scrutiny by regulators have prompted some of the market’s leading dealers to take a more balanced approach between maximizing market share and client profitability. It has also made some firms more hesitant to provide clients with “market color,” for fear of running afoul of regulators, thereby diminishing some of the value clients derive from interacting with major dealers on the telephone.

These developments have prompted some leading dealers to shift away from strategies aiming to maximize market share while more carefully segmenting their customer bases. These banks are focusing their attention and capital on clients with the biggest profit potential and limiting the resources devoted to the rest of the marketplace. These changes are pushing some customers toward lower-cost electronic execution and contributing to the movement of trading volume away from the world’s top dealers.

For their part, companies and financial institutions are always on the search for reliable liquidity sources. In addition, FX users have a natural desire to decrease their reliance on the handful of top dealers as a simple risk management practice. The evolution of the FX marketplace is making it easier for clients to achieve both of those goals. Not only is a large majority of FX trading volume flowing to electronic platforms, but companies and financial institutions are sending more of their business to multi-dealer execution platforms.

“Routing trades to electronic multi-dealer platforms makes it very easy for FX customers to access liquidity from a larger group of dealers,” says Greenwich Associates consultant Woody Canaday. “With the business moving rapidly in that direction, it’s logical to think that trading volumes will become less concentrated.”

Three-quarters of customer-generated foreign exchange trading volume was executed on electronic platforms last year. Multi-dealer platforms capture about half of global FX customer trading volume, with phone execution accounting for about 20% and single-dealer platforms attracting slightly less than 15%. The results of Greenwich Associates 2014 Global Foreign Exchange Services Study show that FX users expect to move volume to multi-bank platforms in a big way. Two-thirds of the 1,612 top-tier foreign exchange users participating in the study expect to increase their activity on multi-dealer platforms in the coming year.

“With customers finding it easier to transact with new counterparties on multi-dealer platforms, companies and financial institutions increased the number of dealers they use for FX trades to an average 8.1 in 2014 from 7.6 in 2013,” says Greenwich Associates consultant James Borger.

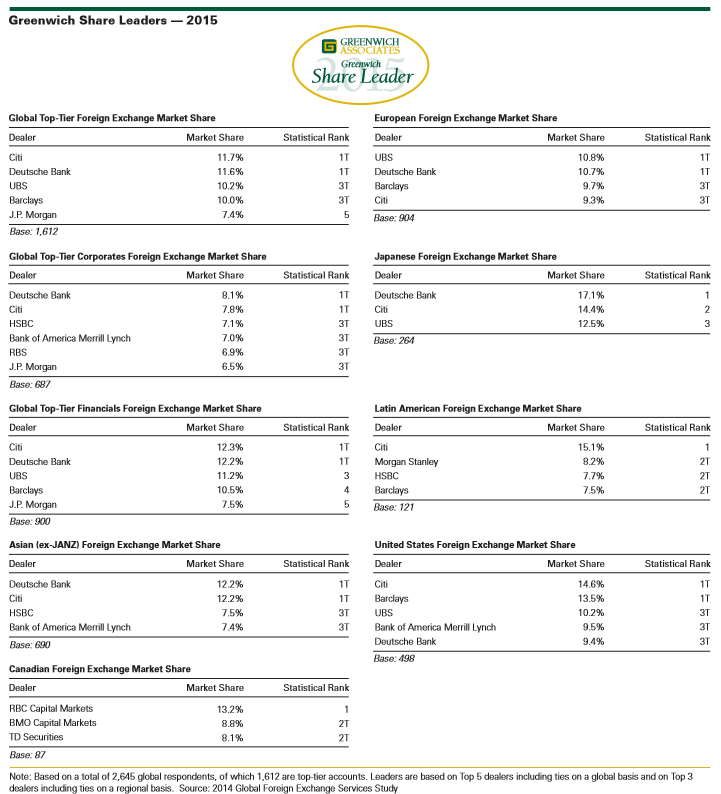

2015 Greenwich Share Leaders

Citi and Deutsche Bank are deadlocked atop the global FX market with market shares in trading of 11.6-11.7%. UBS and Barclays are next, tied with market shares of 10.0–10.2%. J.P. Morgan rounds out the global Top 5 with a market share of 7.4%. These firms are the 2015 Greenwich Share Leaders in Global Top-Tier Foreign Exchange.

Among the leading dealers, J.P. Morgan stood out in 2014 for gaining market share, a feat that narrowed the gap between the bank and the four largest traditional global FX dealers. Citi was also notable for maintaining stable market share from year to year. Bank of America Merrill Lynch posted the largest gain in market share this year. BNP Paribas and Goldman Sachs also gained meaningful share.

“With market shares trending lower among the world’s largest FX dealers, stable is the new up,” says Greenwich Associates consultant Tim Sangston.

Citi and Deutsche Bank’s market-leading position is driven largely by their strength among the financial clients that drive the bulk of global FX trading business. Among this critical customer segment, the two firms are tied with market shares of 12.2–12.3%, followed by UBS at 11.2%, Barclays at 10.5% and J.P. Morgan at 7.5%. These banks are the 2015 Greenwich Share Leaders in Global Top-Tier Financials Foreign Exchange.

J.P. Morgan stands out among these leaders for a year-toyear pick-up in market share among financials. Outside of the Top 5, Bank of America Merrill Lynch achieved notable gains, along with BNP Paribas and Goldman Sachs.

Although Deutsche Bank and Citi also top the market among corporate FX clients, their lead over the rest of the pack is narrower. The two banks are tied with market shares of 7.8–8.1%, followed by a four-way tie among HSBC, Bank of America Merrill Lynch, RBS, and J.P. Morgan, all with market shares of 6.5–7.1%. These banks are the 2015 Greenwich Share Leaders in Global Top- Tier Corporates Foreign Exchange.

Among corporates, Bank of America Merrill Lynch made impressive gains last year, as did RBS and, outside of the Top 5, Société Générale.

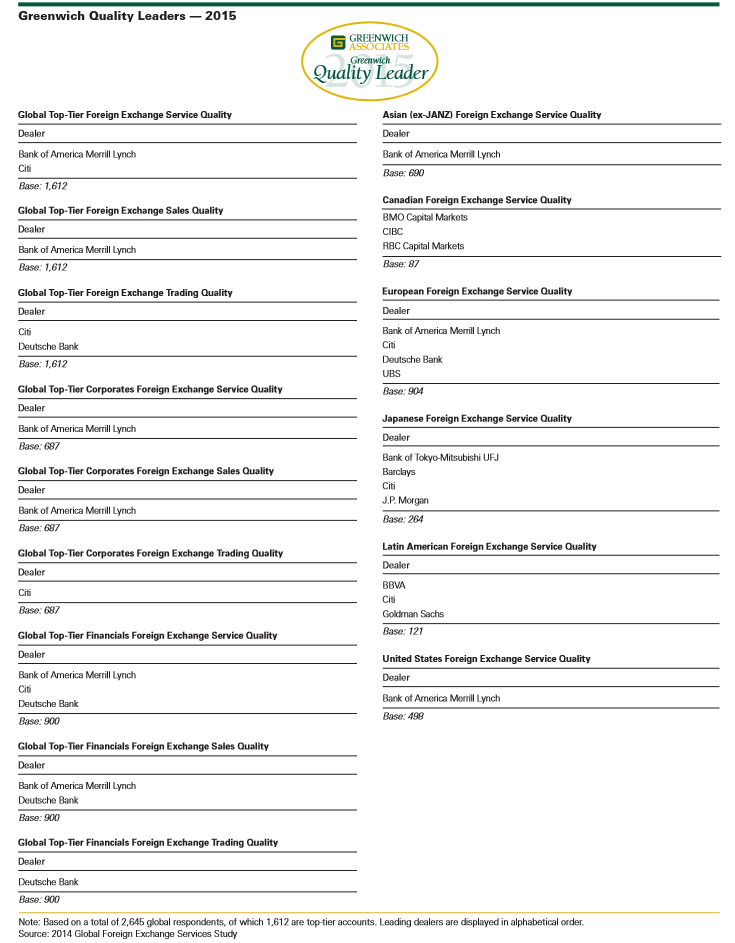

2015 Greenwich Quality Leaders

As part of its annual Global Foreign Exchange Services Study, Greenwich Associates asks participants to rate the dealers they use in a series of product and service categories. Firms receiving customer ratings that top those awarded to competitors by a statistically significant margin are named Greenwich Quality Leaders.

The 2015 Greenwich Quality Leaders in Global Top-Tier Foreign Exchange Service are Bank of America Merrill Lynch and Citi. Bank of America Merrill Lynch’s scores increased sharply last year resulting in its claim as the 2015 Greenwich Quality Leader in Global Top-Tier Foreign Exchange Sales. Meanwhile, Citi and Deutsche Bank won the Greenwich Quality Leader title in Foreign Exchange Trading.

2015 Greenwich Leaders by Region

Asia (ex-JANZ)

The list of 2015 Greenwich Share Leaders in Asia (ex- JANZ) is topped by Deutsche Bank and Citi, which are tied with market shares of 12.2%, followed by HSBC and Bank of America Merrill Lynch, which are tied at 7.4–7.5%. The 2015 Greenwich Quality Leader in Asian (ex-JANZ) Foreign Exchange Service is Bank of America Merrill Lynch.

Among notable gainers in market share were Citi and Bank of America Merrill Lynch. “Bank of America Merrill Lynch appears committed to building its Asian business, and the bank’s sizable gains in market share in 2014 continue a multi-year trend,” says Greenwich Associates consultant Ahbi Shroff.

Canada

Canada’s Big 5 or Big 6 domestic dealers strengthened their already dominant positions in FX trading last year as they captured market share from U.S. and European rivals. The list of 2015 Greenwich Share Leaders in Canadian Foreign Exchange is headed by RBC Capital Markets, with a market share of 13.2%, followed by BMO Capital Markets and TD Securities, which are tied with market shares of 8.1–8.8%. The 2015 Greenwich Quality Leaders are BMO Capital Markets, CIBC and RBC Capital Markets.

Europe

UBS and Deutsche Bank are tied atop the fiercely competitive European foreign exchange market with market shares of 10.7–10.8%, followed by a tie between Barclays and Citi, with market shares of 9.3–9.7%. These firms are the 2015 Greenwich Share Leaders in European Foreign Exchange. The 2015 Greenwich Quality Leaders are Bank of America Merrill Lynch, Citi, Deutsche Bank, and UBS.

Japan

FX trading volume declined last year in Japan amid a significant slowdown in the retail trading that drives market activity. In a highly electronic market dominated by massive retail aggregators, Deutsche Bank leads dealers with a commanding market share of 17.1%, followed by Citi at 14.4% and UBS at 12.5%. These firms are the 2015 Greenwich Share Leaders in Japanese Foreign Exchange. The 2015 Greenwich Quality Leaders are Bank of Tokyo Mitsubishi UFJ, Barclays, Citi, and J.P. Morgan.

United States

Citi and Barclays top the list of 2015 Greenwich Share Leaders in U.S. Foreign Exchange. The two firms are statistically tied with market shares of 13.5–14.6%. At some distance behind is another closely matched group of dealers consisting of UBS, Bank of America Merrill Lynch and Deutsche Bank. These firms are tied with market shares of 9.4–10.2%. The 2015 Greenwich Quality Leader is Bank of America Merrill Lynch.

Greenwich Associates consultants Andrew Awad, James Borger, Woody Canaday, Peter D’Amario, Frank Feenstra, Brian Jones, Peter Kane, Tim Sangston, Abhi Shroff, Taeko Sumiyoshi, and Tomio Sumiyoshi specialize in foreign exchange and derivatives globally.

MethodologyGreenwich Associates conducted interviews with 2,645 users of foreign exchange globally, of which 1,612 are top-tier accounts, at large corporations and financial institutions on market trends and their relationships with their dealers. To be considered top tier, a firm must be either a central bank, a government agency, a hedge fund, a fund manager, a FT100 global firm, a firm with reported trading volume of more than $10 billion, or a firm with reported sales of more than $5 billion. Interviews were conducted in North America, Latin America, Europe, Asia, and Japan between September and November 2014.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.