Table of Contents

Despite the recent wild gyrations in global stock markets, 2015 could represent the calm before the storm for European equity brokers. They are awaiting word from regulators on new “unbundling” rules that could upend the economics of their business.

The competitive landscape of the European brokerage market has been in flux since the onset of the global financial crisis, driven by changes in regulation, market structure and in the balance sheets and business strategies of global banks. These changes could accelerate when European regulators announce their final decision on new rules limiting and possibly even prohibiting the use of client commissions to pay for equity research and advisory services.

“For now, the industry has settled into a holding pattern as banks wait until the rules of the game are set,” says Greenwich Associates consultant John Colon.

This year’s market volatility has provided brokers with some relief in the form of an upsurge in trading volumes and commission revenues following an extended period of stagnation and decline. Looking ahead, however, many brokers and buy-side firms are convinced that the new rules on the use of client commissions in MiFID II will reduce the amount of research consumed by institutional investors. A recent white paper from Greenwich Associates, A Brave New World for Asset Managers—and the Brokers Who Serve Them, reports that even investors in North America believe such rules would have a significant negative impact—even if regulators stop short of full “unbundling.”

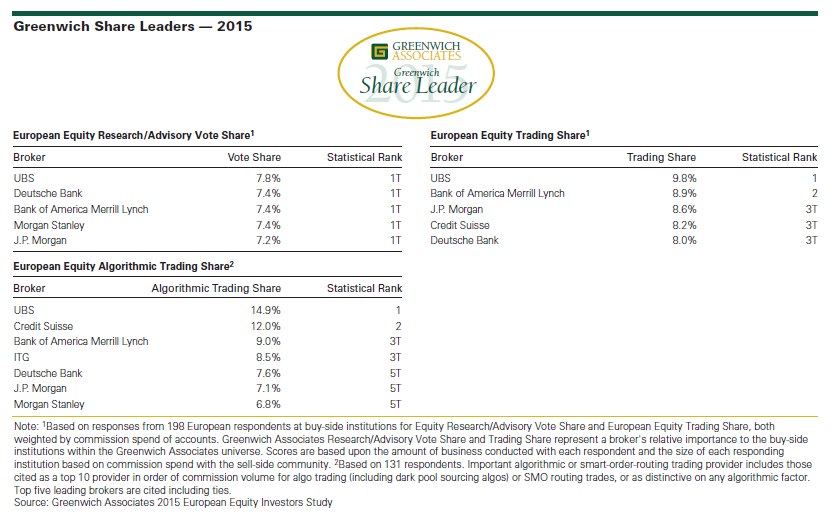

Greenwich Share Leaders

Brokers’ uncertainty about the future of the equity research business might explain why no fewer than five firms are currently deadlocked atop the market for European equity research/advisory services. With commission-weighted vote shares that are statistically tied between 7.2% and 7.8%, UBS, Deutsche Bank, Bank of America Merrill Lynch, Morgan Stanley and J.P. Morgan all claim a top spot on the list of 2015 Greenwich Share Leaders in European Equity Research/ Advisory Services.

“Consistency over time and the breadth of coverage across markets and sectors play a big role in determining the weighted vote share in sales and research commission allocations, “says Greenwich Associates consultant Jay Bennett. “Over the past several years, however, there has been a significant shift in the sell side’s view of the economics of this business, which has, in turn, led to a “rightsizing” of research and sales platforms based on perceived revenue opportunities.”

In the European equity trading business (encompassing high-touch and low-touch business), UBS leads with a commission share of 9.8%, followed by Bank of America Merrill Lynch at 8.9% and the trio of J.P. Morgan, Credit Suisse and Deutsche Bank, which are statistically tied with shares between 8.0% and 8.6%. These firms are the 2015 Greenwich Share Leaders in European Equity Trading.

UBS tops the market in algorithmic trading with an estimated commission share of 14.9%, followed by Credit Suisse at 12.0%, Bank of America Merrill Lynch and ITG, which are statistically tied with shares between 8.5% and 9.0%, and the trio of Deutsche Bank, J.P. Morgan and Morgan Stanley, which are tied with market shares between 6.8% and 7.6%. These firms are the 2015 Greenwich Share Leaders in European Equity Algorithmic Trading.

Greenwich Quality Leaders

Greenwich Quality Leaders are firms whose institutional clients award them with quality ratings that top those of competitors by a statistically significant margin. The 2015 Greenwich Quality Leaders in European Equity Sales & Corporate Access are Exane BNP Paribas and UBS. The 2015 Greenwich Quality Leaders in European Equity Research & Analyst Service are Exane BNP Paribas, Morgan Stanley and UBS. Bank of America Merrill Lynch and UBS are the 2015 Greenwich Quality Leaders in European Equity Sales Trading & Execution Service.

Electronic trading now accounts for about 15% of the commissions brokers generate on trades of European equities. Brokers able to “punch above their weight” in terms of their share in trading relative to the size and reach of their research franchise often do so because they have invested heavily in their electronic trading platforms and algorithmic trading. Generally, these are large global firms with the resources needed to develop and support these costly platforms. ITG and UBS claim the title of 2015 Greenwich Quality Leaders in European Equity Electronic Trading.

Consultants Jay Bennett, John Colon and John Feng advise on the institutional equity markets globally.

MethodologyFrom March to May 2015, Greenwich Associates interviewed 198 portfolio managers and 185 traders at European institutions about the research, sales and trading services they receive from their brokers. These portfolio managers and traders were also asked about current market practices, trends and compensation.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. Javelin Research & Strategy is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.