Table of Contents

Announcing 2015 Share and Quality Leaders in Japanese Fixed Income

The dearth of client trading activity in Japanese government bonds has triggered a push by the country’s largest domestic fixed-income dealers into non-yen products, particularly non-yen government bonds.

Continuous, aggressive and widespread buying of Japanese government bonds (JGBs) by the country’s central bank as part of the Abe government’s policy of quantitative easing has cut the number of JGBs in circulation and dramatically reduced available liquidity for investors looking to trade in the product.

The results of the most recent Greenwich Associates Japanese Fixed-Income Investors Study show a 20%–30% drop in JGB client trading volume from 2014–2015. Major dealers competing in Japan believe the decline in trading volume over that period could have been even more pronounced.

Facing the rapid contraction in their traditional core product market, Japan’s leading fixed-income dealers have been forced to look elsewhere for new revenue opportunities. The list of 2015 Greenwich Leaders in Japanese Fixed-Income Trading shows they have found this opportunity in non-yen bonds.

2015 Greenwich Leaders - Japanese Fixed Income: Non-Yen Bonds

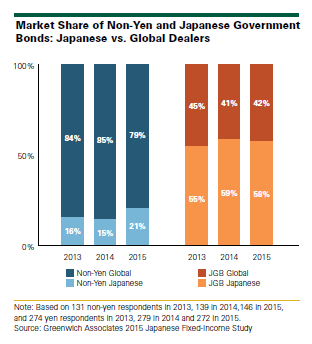

Although foreign firms still dominate the top ranks of Greenwich Share Leaders in Non-Yen Bond trading, Japanese dealers are capturing market share in this product at a startling rate. In 2014, domestic Japanese dealers controlled only 15% of market share in the trading of non-yen government bonds. In 2015, that share soared to 21%.

At present, Citi tops the list of Greenwich Share Leaders in Non-Yen Bonds with a market share of 10.9%. Next is the only Japanese dealer on the list—Nomura Securities—which is statistically tied with Deutsche Bank with market shares of 9.4%–9.5%.

Some of the gains by Japanese dealers in non-yen bonds can be attributed to a pullback on the part of global dealers. However, that is not to say the advance of Japanese firms in non-yen bonds is a product of retrenchment by their competitors.

To the contrary, Japanese dealers are picking up significant market share among Japanese mega-banks, trust banks and life companies—all of which are viewed as important target clients by global and domestic dealers alike. “As they shift their focus from JGBs, Japanese dealers are leveraging their high quality platforms and deep ties to domestic investors to expand their presence in non-yen bonds,” says Greenwich Associates consultant Tomio Sumiyoshi.

2015 Greenwich Leaders - Japanese Fixed Income: Yen Bonds

Japanese dealers have maintained their dominant market shares in the shrinking JGB market. Mitsubishi UFJ Morgan Stanley Securities and Mizuho Securities rank first and second in this product with market shares of 15.4%–14.1%, respectively.

Domestic Japanese dealers entirely dominate the list of 2015 Greenwich Quality Leaders in Yen Bonds, with Mitsubishi UFJ Morgan Stanley Securities and Mizuho Securities taking the honors in Trading, Mitsubishi UFJ Morgan Stanley Securities and Nomura Securities claiming the title in Research and the quartet of Mitsubishi UFJ Morgan Stanley Securities, Mizuho Securities, Nomura Securities, and SMBC Nikko Securities winning the title in Sales.