Table of Contents

Total notional volumes for retail structured products distributed by U.S. firms remain at over $54 billion annually. Products based on equity underlyings continue to account for the bulk of activity (61%), with the majority linked to an equity index. Looking forward, distributors expect the greatest demand to come from products with maturities of greater than a year.

When distributors select an issuer for structured products, pricing and creditworthiness remain the top two considerations. Not surprisingly given the search for yield in a continued low-rate environment, we are seeing demand for innovative new ideas increase, with 46% of distributors (up from 33%) noting that it is one of their key criteria for selecting an issuer. “As the market continues to mature, distributors are looking for issuers who provide them with fresh product ideas,” notes Greenwich Associates consultant David Stryker.

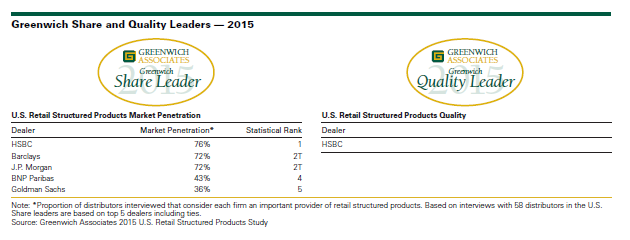

Greenwich Share and Quality Leaders

The U.S. retail structured product market is again dominated by three issuers—HSBC, J.P. Morgan and Barclays—with over 70% of distributors noting that they are one of their important issuers. BNP has held onto the impressive gains it made a year ago and ranks 4th with a 43% share. Goldman Sachs expanded its footprint in the U.S. retail structured products market and ranks 5th with 36%. HSBC is mentioned more frequently as a “Top 3” issuer than is any other firm.

Distributors in the U.S. continue to recognize the high quality of service that HSBC provides, and the bank ranks as the clear 2015 Greenwich Quality Leader in U.S. Retail Structured Products.

Consultants Andrew Awad and David Stryker advise on the retail structured products and fixed-income markets.

MethodologyBetween April and June 2015, Greenwich Associates conducted telephone interviews with 58 distributors of retail structured products in the United States to better understand product demand, distributor preferences and the competitive landscape.

Respondents were asked to name the firms they used for retail structured products and to rate those providers in a series of product and service quality categories.

Quality Leaders have distinguished themselves from their competitors by receiving service quality ratings that exceed those of competitors by a statistically significant margin.

16-4001

© 2016 Greenwich Associates, LLC. Javelin Research & Strategy is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.