Credit markets are a critical part of not only the capital markets but of the global economy. They allow money to flow smoothly from those that have it to those with new and interesting ways to put it to work.

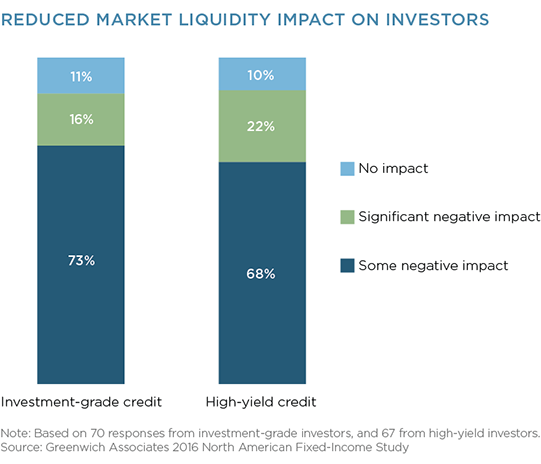

The ability of investors to express views on various credit instruments and hedge their exposures is a critical element to the market’s functioning. Yet access to the tools needed to do just that remains surprisingly limited.

This report examines investors’ and liquidity providers’ use of corporate bonds, credit default swaps, total return swaps, ETFs, and futures, and discusses the merits of each and the market’s likely path forward.

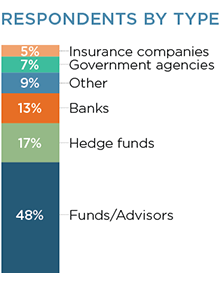

Between Februrary and April 2016, Greenwich Associates interviewed 998 U.S. institutional investors active in fixed income, including 200 credit investors.

Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.