Table of Contents

After weathering the chaos of the financial crisis and the subsequent restructuring of the European banking industry, Europe’s largest companies are enjoying a welcome phase of stability in their banking relationships. Credit is abundant (at least for big companies with good credit ratings), service is good and getting better, and banks are getting easier to work with.

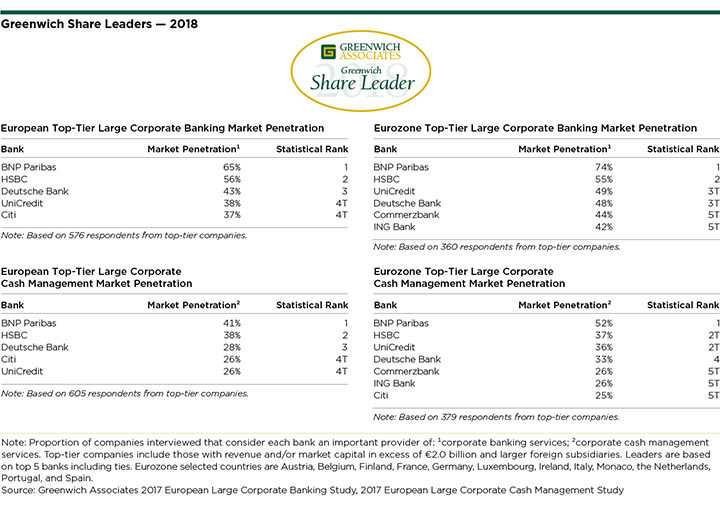

Aside from European corporates, the primary beneficiaries of this new stability are the big banks that already count many of Europe’s largest companies as clients. At the top of that list sits BNP Paribas, which is used for corporate banking by 65% of Europe’s largest companies. HSBC is next at 56%, followed by Deutsche Bank at 43%, UniCredit at 38% and Citi at 37%. These banks are the 2018 Greenwich Share Leaders℠ in European Top-Tier Large Corporate Banking.

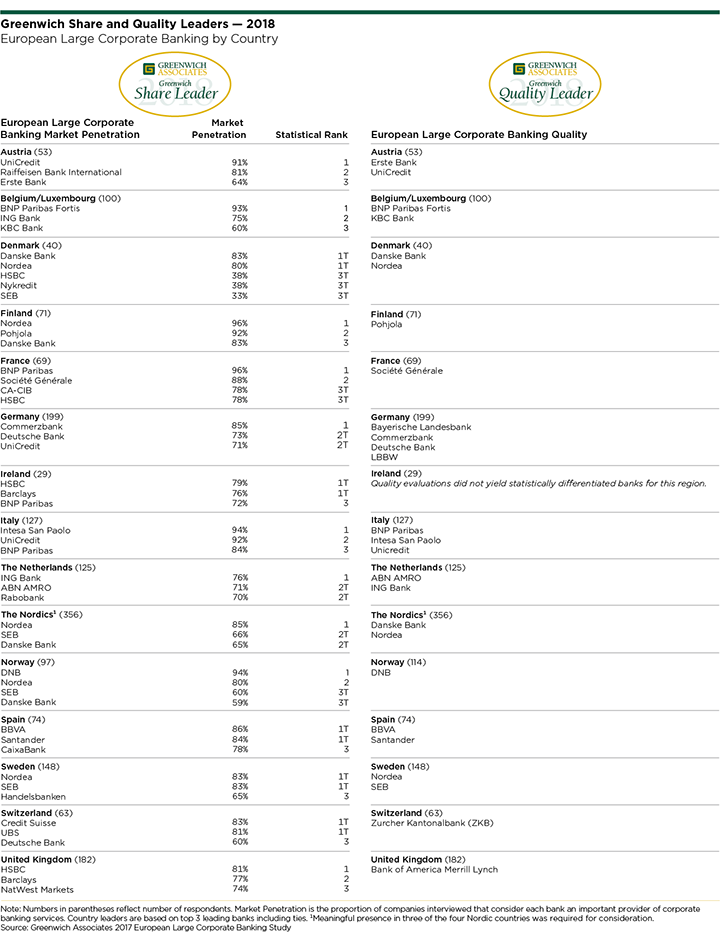

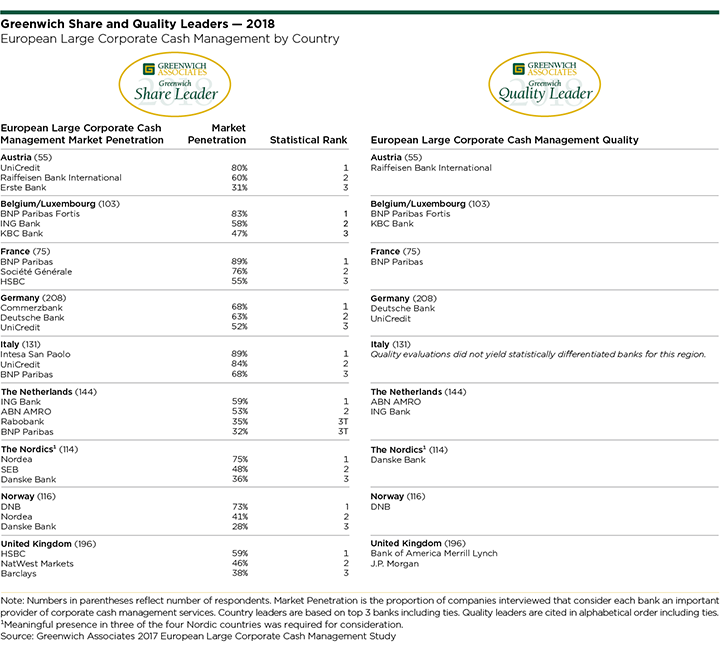

The 2018 Greenwich Share Leaders in Eurozone Top-Tier Large Corporate Banking are BNP Paribas, HSBC, UniCredit, and Deutsche Bank in the top spots, followed by a tie for fifth between Commerzbank and ING Bank. HSBC, Barclays and NatWest Markets are the top three for market penetration in the United Kingdom. The 2018 Greenwich Quality Leaders℠ in European Top-Tier Large Corporate Banking are BNP Paribas, Citi, J.P. Morgan, and UniCredit. Citi and UniCredit earn the title in Large Corporate Cash Management and in the Eurozone for both Banking and Cash Management.

Satisfied Companies Staying Put

Now that the banking industry has stabilized and most major European banks are back on their feet, it’s become harder than ever for these and other banks to differentiate themselves from rivals and win new business. At a time in which bank products are becoming increasingly commoditized, more banks are looking to compete for business on the basis of high-quality service paired with providing unparalleled advice.

Companies participating in the Greenwich Associates annual European Large Corporate Banking Study had been complaining for years that their banks were getting harder to work with. This trend was fueled in part by internal turmoil in some banks and by the fallout from some banks’ strategic decisions to narrow or shift the focus of their coverage. It was also driven by new regulations that increased the compliance burden on banks and clients, making many bank functions slower and more cumbersome.

Over the past 12 months, however, banks fighting to win and maintain clients have worked hard to address these problems. Although compliance remains a sticky issue, companies are finding that their banks have made great strides in the areas of “ease of use,” relationship manager coverage and overall quality. Amid increasing levels of satisfaction—and ample credit—companies have become much less eager to switch providers and much more likely to stick with their current banks.

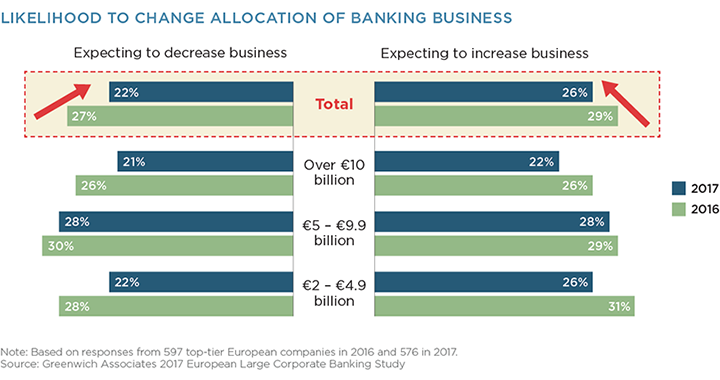

As recently as three years ago, upward of 40% of the largest European companies participating in Greenwich Associates annual research were shifting business among their banks. In 2017, 22% said they expected to decrease the amount of business they do with one or more banks in the next 6 to 12 months, and 26% said they expected to allocate more business to existing or new providers. Those shares were down from 27% and 29% in 2016, respectively. (The one outlier in this area is the United Kingdom, where strategic shifts on the part of major banks and the ongoing Brexit process are forcing companies to rethink and reshuffle their rosters of domestic and international banks.)

Cash Management: Demand for Seamless Service Puts Focus on Digital

In addition to overall service, banks looking for a way to stand out from the crowd are focusing on cash management—which Greenwich Associates research shows is as important as credit to a corporate banking relationship. “Banks know they won’t make a lot of money on this business directly, but cash management is the glue that holds a corporate banking relationship in place,” says Greenwich Associates consultant Melanie Casalis.

As in corporate banking overall, “ease of use” has become a critical criterion for companies in cash management. Two-thirds of large European corporates consider the simplicity of working with a bank a key factor in choosing a provider for cash/short-term investments—ranking that issue on par in importance with bank credit quality.

For corporates, ease of doing business means that providers should be able to customize offerings and be proactive and responsive. It also means removing some of the hassles associated with know your customer (KYC), new compliance and documentation demands—especially at a time in which corporate treasury departments are shrinking and remaining staff have limited time. At the very least, companies want banks to be honest and realistic about the timeframe and demands of the compliance process up front, and they want a system in place that alerts them to open action items and otherwise informs them of where they stand in the process.

That’s where digital technology comes into play. Banks are investing heavily in digital platforms. Although currently only a handful of banks such as Citi, J.P. Morgan and HSBC offer robust digital systems that go well beyond facilitating the mere transaction, in the not-too-distant future digital platforms that make cash management more seamless, efficient and truly integrated with other product offers will become minimum requirements for all banks. Going forward, companies will demand platforms that integrate all bank products and services and integrate with the internal treasury management system (TMS) and other internal systems.

Challenges Ahead for Second-Tier Banks

The increasing costs associated with building out digital banking and cash management systems will represent a major challenge for smaller banks attempting to compete for relationships with Europe’s large companies. So too will companies’ growing need for banking and cash management coverage in international markets that represent points of strength for the largest global banks.

“In the past it was possible for smaller and regional banks to cover gaps in capabilities by throwing manpower at their biggest corporate relationships,” says Greenwich Associates Managing Director Dr. Tobias Miarka. “When it comes to issues like the need to deploy sophisticated technology platforms and build out cash management capabilities in overseas markets, that approach just won’t work anymore. We expect many second-tier banks to shift their focus from Europe’s largest companies to second-tier companies with needs that are more aligned with their own capabilities.”

Consultants Dr. Tobias Miarka, Markus Ohlig and Melanie Casalis specialize in corporate and investment banking in Europe.

MethodologyGreenwich Associates conducted 2,453 interviews with financial officers (e.g., CFOs, finance directors and treasurers) at corporations and financial institutions with sales in excess of €500 million, including 576 with sales of at least €2 billion.

Interviews were conducted throughout Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. Interviews took place from August to November 2017. Subjects covered included bank credit capabilities, domestic and cross-border advisory capabilities and quality of institution and relationship management. Cash management and trade finance capabilities were examined in separate interviews with corporate treasurers.