More than half of European buy-side traders believe new CSDR rules scheduled for next year will reduce liquidity in fixed-income markets.

Press Releases

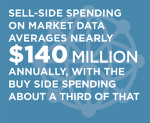

The onset of the COVID-19 crisis is highlighting the importance of market data infrastructure for both buy-side and sell-side firms.

Institutional investors are also looking to extend NLP technology to other core functions like surveillance and compliance and its ability to deliver accurate sentiment analysis.

U.S. banks are taking extraordinary steps to help companies survive the COVID-19 crisis and head off what could be the next major threat: a potential tidal wave of loan defaults.

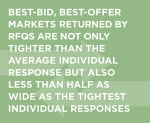

Greenwich Associates Study Finds Trading Convertibles on Electronic Platforms Can Cut Spreads in Half

May 14, 2020

Given the attractiveness of convertible bonds to companies with high borrowing costs and volatile stock prices, investors should expect a surge in convertibles issuance in the post COVID-19 world.

Asset managers are using analytics to create a competitive advantage in the sales process.

As problems with the application process for Paycheck Protection Program (PPP) loans have subsided, banks should start bracing for another massive wave of unintended consequences.

Surveillance Technology Helps Firms Manage Volatility, Work From Home But Also Produces Tidal Wave of “False Positives”

May 12, 2020

Among the myriad challenges facing trading desks during the COVID-19 crisis is managing the huge number of “false positive” warnings from trade surveillance systems, triggered by massive swings in financial markets.

Among the myriad ways the COVID-19 crisis will reshape the global economy, the pandemic could alter the trajectory of the European corporate banking market.

COVID-19 Crisis Adds New Variable To Debate Over Revisions To MIFID-II Equity Market Structure

April 30, 2020

Amid the unprecedented volatility sparked by the COVID-19 crisis, European regulators are watching the region’s financial market infrastructure closely to see how it performs under extreme stress.

Pages

Media Contacts

Media Inquiry

Awards

- 2023 Greenwich Leaders: Asian Large Corporate Trade Finance

- Indian Corporates Turn to Big Banks to Fund Ambitious Growth

- Investment Consultants Support U.S. Asset Owners in Volatile Markets

- 2022 Greenwich Leaders: U.S. Institutional Investment Management

- 2022 Greenwich Leaders: U.K. Institutional Investment Management