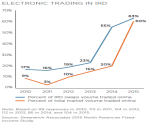

Electronic trading platforms are on pace to capture 20% of U.S. investment grade corporate bond trading volume in 2015—a 25% increase from 2014.

Press Releases

The country’s biggest banks have established themselves as the strongest brands among U.S. middle market companies—a segment that is growing in the form of increased demand for credit and other banking services.

Say Goodbye to Buy-Side Boom Times

November 18, 2015

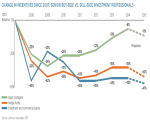

Pay levels in asset management in 2015 are projected to be slightly lower, according to a new report, Say Goodbye to Buy-Side Boom Times, from Greenwich Associates and Johnson Associates.

In Europe, New Regulations Drive Dealer Strategies, SAP Market Liquidity; Greenwich Leaders

November 12, 2015

The competitive positioning of Europe’s leading fixed-income dealers is increasingly defined by regulations and banks’ strategic responses to new rules that have altered the economics of the business.

Greenwich Associates today announced the 2015 Greenwich Share and Quality Leaders in Flow Equity Derivatives and Convertibles in Europe and North America.

RBC Capital Markets Leads Canadian Corporate Banking Industry

November 5, 2015

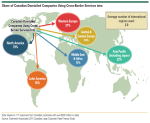

RBC Capital Markets continues as the clear leader in Canadian corporate banking this year by securing the top spot in investment banking, debt capital markets, equity capital markets, large corporate cash management, and trade finance.

Interest-Rate Derivative Trading Goes Electronic, But Investors Still Lean on Sell-side Salespeople

October 28, 2015

The business of trading interest-rate swaps is moving to electronic platforms at breakneck speed, largely driven by the implementation of Dodd-Frank.

Indian Corporate Banking: Domestic Banks on the Rise

October 28, 2015

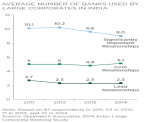

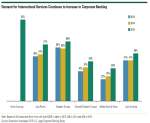

Domestic banks are expanding their footprints among India’s largest companies as foreign competitors reposition their business strategies in India and around the world.

Following the Successful Integration of Javelin, Greenwich Associates Announces New Management Team

October 19, 2015

Greenwich Associates today announced the appointment of a new management team for Javelin Strategy & Research. Chris McDonnell will be responsible for sales and business development.

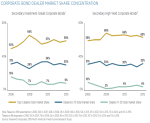

Bank relationship rationalization and the easing of concerns about counterparty risk in the U.S. are setting the stage for increased concentration of corporate banking business in the hands of the market’s biggest banks.

Pages

Media Contacts

Media Inquiry

Awards

- 2023 Greenwich Leaders: Asian Large Corporate Trade Finance

- Indian Corporates Turn to Big Banks to Fund Ambitious Growth

- Investment Consultants Support U.S. Asset Owners in Volatile Markets

- 2022 Greenwich Leaders: U.S. Institutional Investment Management

- 2022 Greenwich Leaders: U.K. Institutional Investment Management