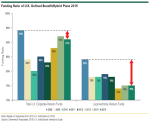

Bank relationship rationalization and the easing of concerns about counterparty risk in the U.S. are setting the stage for increased concentration of corporate banking business in the hands of the market’s biggest banks.

Press Releases

One in Four U.S. Small Businesses and Mid-Sized Companies Borrows From Non-Bank Lenders

October 15, 2015

One in four of U.S. small businesses and mid-sized companies are obtaining credit from non-bank providers, and—in a finding sure to catch the attention of bank executives—nearly all say the experience was so positive that they would borrow from non-bank lenders again.

BNP Paribas Leads Market Penetration in European Trade Finance

October 13, 2015

Large European companies are lowering costs and simplifying operations by consolidating trade finance business in the hands of large banks like BNP Paribas, Deutsche Bank and HSBC.

As U.S. Treasury Dealers Step Back From Market-Making, Alternative Liquidity Providers Emerge

October 13, 2015

More than 50% of top U.S. Treasury dealers have stopped actively making markets on interdealer platforms—a dramatic change to a market in which virtually all leading dealers once performed this function.

Big Banks Capitalize on U.S. Companies' Growing Demand for International Trade Finance

October 12, 2015

The market’s biggest banks are expanding their footprints in trade finance as large U.S. companies seek support for their expanding international businesses.

Baillie Gifford, Insight Investment and Majedie Asset Management Named 2015 Greenwich Leaders

October 7, 2015

U.K. pension funds are searching for answers to a mounting underfunding problem, and asset management firms are stepping up to help.

As FX users execute growing shares of their trading volume electronically, they continue to find significant value from real-life FX salespeople.

Emerging Market Brokers Brave Turbulent Markets

October 1, 2015

Equity brokers in the emerging markets are rewarded for consistency. Institutional investors like to trade with firms that provide high quality coverage of regional markets and sectors throughout the inevitable ups and downs.

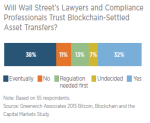

Big Questions About the Blockchain

September 30, 2015

The technology behind Bitcoin is coming to Wall Street, but few agree how it will arrive or what exactly it will achieve. A new report from Greenwich Associates examines four of the most pressing questions about the introduction of digital ledger technologies into the complex and highly regulated world of institutional capital markets.

Despite the recent wild gyrations in global stock markets, 2015 could represent the calm before the storm for European equity brokers, which are awaiting word from regulators on new “unbundling” rules that could upend the economics of their business.

Pages

Media Contact

Media Inquiry

Awards

- 2025 Coalition Greenwich Awards: Corporate Trade Finance in Europe

- 2025 Coalition Greenwich Awards: Asian Corporate Trade Finance

- 2025 Coalition Greenwich Awards: Corporate and Commercial Banking in India

- Investment consulting: A relationship business in a transactional world

- 2025 Coalition Greenwich Leaders: Middle Market Banking in the U.S.