As credit investors diversify portfolios by adding increasing amounts of private debt, they are stepping up the search for better data, analytics and other technology to help assess and manage risks associated with these opaque investments.

Press Releases

Equity capital markets growth, led by the special purpose acquisition company (SPAC) boom, heightened M&A activity, and improved performance by equities and spread financing products, was one of the largest contributors to a surge in investment banking revenues in 2021.

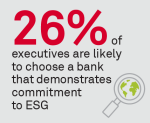

More than a quarter of U.S. small and mid-sized businesses say they are likely to choose a bank that demonstrates a commitment to ESG the next time they add or switch providers.

Budget increases for trading desks drove buy-side technology spending above $10 billion last year and is fueling fierce competition amongst an expanding host of innovative institutional fintech providers.

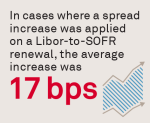

Commercial Lenders Try to Avoid Upsetting Borrowers With Spread Increases in Libor Transition

May 10, 2022

The commercial loan market is working through the messy details of how to reprice outstanding Libor-based loans into alternative base rates.

More than half of financial advisors in the U.S. will soon have the ability to offer private investment opportunities to their clients.

Institutional investors are putting their money—and their portfolios—where their mouth is, when it comes to climate change.

Amid continued disruptions from the COVID-19 crisis and concerns about mounting inflation, U.S. asset owners leaned more heavily on the advice of their investment consultants last year.

Although regulators started the move to cleared derivatives, recent growth in derivatives clearing has been driven not by mandates, but by the maturing market structure.

Coalition Greenwich Names Todd Glickson New Head of North American Investment Management

April 20, 2022

Coalition Greenwich, the leading global provider of data, analytics and insights to the financial services industry, is pleased to announce the hiring of Todd Glickson as Head of Investment Management, North America.

Pages

Media Contacts

Media Inquiry

Awards

- 2023 Greenwich Leaders: Asian Large Corporate Trade Finance

- Indian Corporates Turn to Big Banks to Fund Ambitious Growth

- Investment Consultants Support U.S. Asset Owners in Volatile Markets

- 2022 Greenwich Leaders: U.S. Institutional Investment Management

- 2022 Greenwich Leaders: U.K. Institutional Investment Management