Table of Contents

In a clear sign of the times, European institutional investors say they are twice as likely to hire a new asset manager in private equity as in public European equities in the coming year. This powerful shift in demand from liquid asset classes to alternatives is creating a polarized environment for asset managers that is working to the advantage of large firms like 2019 Greenwich Quality Leaders℠ Allianz Global Investors and PIMCO, which are capable of meeting institutions’ needs at both ends of the spectrum.

European institutional investors are increasing their exposure to alternative asset classes as a means of achieving the portfolio returns they need to fund liabilities at a time of historically low interest rates. The institutions participating in the Greenwich Associates 2019 Continental European Institutional Investors Study say the biggest challenge they face over the next 12 months will be achieving the correct asset allocation to address rate of return and funding issues while effectively managing risk. Increasingly, the solution to that challenge includes expanding allocations to real assets, including real estate. Along with private equity and private debt, demand is climbing for real asset classes like infrastructure and real estate, as institutional investors seek sources of badly needed yield.

“We have placed more focus on alternative investments, given the recent volatility in equity markets and the low yield in fixed-income markets,” says a study participant from a Swedish insurance company. “We are looking for higher returns by increasing allocations to real estate and private equity,” says a representative of a Dutch corporate pension fund. “We are actively hedging interest-rate risks in order to prevent funding ratios falling below critical levels.” A study participant from a German occupational pension fund says his institution’s focus is on infrastructure and real estate. “We minimize our risks, particularly in equity,” he adds.

Institutions participating in the study say changes in regulation are influencing these asset allocation decisions. After years of discussion and debate, national and EU regulations pertaining to institutional solvency requirements and risk budgets are now mostly in place, meaning that institutions have much more clarity when it comes to determining how much they can invest in real assets and other alternatives. “New governmental regulation enters into effect this year, giving more flexibility for state-owned funds to invest in illiquid assets,” explains the Swedish insurance company representative.

Targeting Alternatives

Institutions derive several important benefits from expanded allocations to alternative investments. In addition to the potential for possibly significant pickups in yield, these illiquid assets are not marked to market. As a result, changes in valuation take longer to play out in institutional portfolios, muting quarter-to-quarter volatility in portfolio valuations and funding ratios.

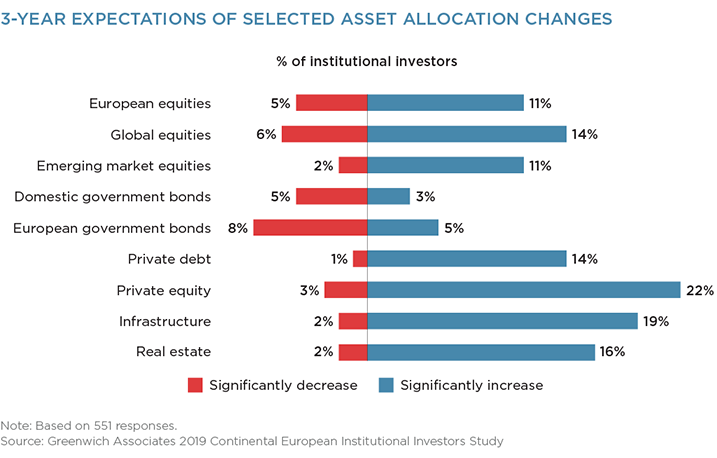

Growing investments in alternatives are being funded with assets previously allocated to domestic and European fixed income, primarily government bonds. These shifts are not yet apparent in institutional asset allocation profiles, however. The Q4 2018 equity market declines and de-risking by some large European institutions actually resulted in an increase in average fixed-income allocations from 2018 to 2019. But the longer-term trend is clear. Over the next three years, European institutions overall expect to significantly reduce allocations to domestic and European government bonds. Meanwhile, by margins rarely seen anywhere in our global research, European institutions are planning major increases in allocations to private equity, infrastructure, real estate and private debt. By smaller margins, institutions are also planning to increase allocations to equities, with a focus on areas with the greatest alpha potential, including emerging market and global equities.

Institutions are moving quickly to implement those allocation shifts. Almost 1 in 10 institutions in the study plans to hire a new manager in alternatives in the coming 12 months. That share is up sharply from approximately 6% last year. It also tops the roughly 7% of institutions planning to hire a new manager in equity or fixed income. About 5% of institutions plan to hire a new manager in private equity, roughly twice the share planning to hire a manager for public European equity.

Greenwich Quality Leaders

It’s a polarized environment for asset managers in Europe. For managers that possess the capabilities institutions are seeking, times are good. Meanwhile, managers offering strategies that have fallen out of favor are struggling. While this has always been the case in institutional asset management to some extent, recent shifts in institutional demand appear to be secular rather than cyclical reactions to market conditions.

In some ways, the competitive landscape has become more favorable to smaller or specialty investment managers. European institutions are expanding the total number of external managers they use, creating new opportunities for managers to win mandates. Institutions have also expanded the pool of managers they would consider for an open mandate—an indication that they are willing to look beyond familiar names and take a chance on lesser-known managers.

However, opportunities are not evenly distributed. On the contrary, managers that specialize in active equity and fixedincome strategies—especially European strategies—are facing downward pressure on fees and fierce competition for a limited number of mandates. Institutions have made fee reductions in liquid asset classes a top priority, and they are gravitating to passive strategies as a means of lowering costs. As a study participant from a Dutch pension fund explains, “Cost reduction and returns are still in focus, but policy in recent years—mainly moving to more passive investment—has already brought back costs significantly.”

On the other hand, even boutique managers specializing in infrastructure, real estate, private debt, and other alternative asset classes are more likely than ever to get a hearing with European institutions.

The 2019 Greenwich Quality Leaders in European Institutional Investment Management, AllianzGI and PIMCO, are succeeding in this tough market, due in part to the sheer breadth of their product offerings, which span both liquid and alternative strategies. These firms use these diverse capabilities to help European institutions shift their allocations across these categories as part of holistic solutions to the real challenges they face in the current market environment.

Regulations Hasten the Advance of ESG

The steady advance of environmental, social and governance (ESG) investing across the European institutional marketplace is getting an extra push from European regulators. In 2018, the European Commission released its action plan on financing sustainable growth. The plan has three main goals: 1) Reorient capital flows towards sustainable investment; 2) Manage financial risks stemming from climate change, environmental degradation and social issues, and 3) Foster transparency and long-termism in financial and economic activity. To achieve these goals, the action plan proposes new regulations that, among other things, would require institutional investors to disclose how they integrate ESG factors in their risk processes and investment decision-making processes.

Although these rules are still a work in progress, they are already having an effect. As a study participant from a German corporate pension fund explains, “In response to the general pressure on ESG reporting and governance, we have started our internal ESG program … to prevent having to hand in an empty reporting form.”

That single German study participant might speak for a sizable number of his countrymen. Over the past 12 months, the integration of ESG criteria into portfolio management has spread from the early adopters in the Nordics, Netherlands and France to the more hesitant institutions in Germany and Switzerland. In the Netherlands, close to 100% of institutional investors consider ESG criteria when hiring investment managers, as do more than three-quarters of institutions in the Nordics and 60% in France. The share of institutions taking ESG into account when hiring managers increased in Germany to 40% in 2019 from 29% in 2018 and in Switzerland to 36% from 24%.

German institutions have not embraced the increasingly common practice of tracking the carbon footprints of their portfolios. Nordic institutions are at the forefront of this movement; 43% are already tracking carbon exposure, and another 20% expect to start doing so in the next 24 months. Institutions in the Netherlands are not far behind, with one-third overall reporting plans to start tracking their portfolios’ carbon footprint in the next two years. In contrast, only 7% of German institutions have adopted this practice, with another 8% planning to do so within 24 months.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in continental Europe.

MethodologyDuring the first quarter of 2019, Greenwich Associates conducted in-depth interviews with 736 key decision-makers at the largest continental European institutional investors. Institutions included continental European corporate, public, and industry-wide defined-benefit, defined-contribution and hybrid pension funds, banks (including Sparkassen in Germany), foundations and churches, insurance and reinsurance companies, sovereign pension reserve funds, and other non-pension institutional investors including official institutions, central banks, monetary authorities, sovereign wealth funds, and supranationals.