Table of Contents

The continued pressure on plan sponsors to close funding gaps while simultaneously managing risk budgets is forcing U.S. institutional investors to take a hard look at their portfolio allocations. The 2017 Greenwich Quality Leaders in U.S. Investment Consulting are using this opportunity to cement their already strong client relationships by stepping up with advice on how to structure and implement new strategies and allocation models, while also providing new, unique and forward-looking perspectives about the future of the institutional asset management industry as a whole.

Based on our end-of-year research with institutional investors, Pavilion, Rocaton Investment Advisors and RVK are the 2017 Greenwich Quality Leaders℠ among large U.S. investment consultants. Among midsize consultants, Angeles Investment Advisors, Ellwood Associates and LCG Associates are the 2017 Greenwich Quality Leaders.

Institutions Cite Shifting Challenges

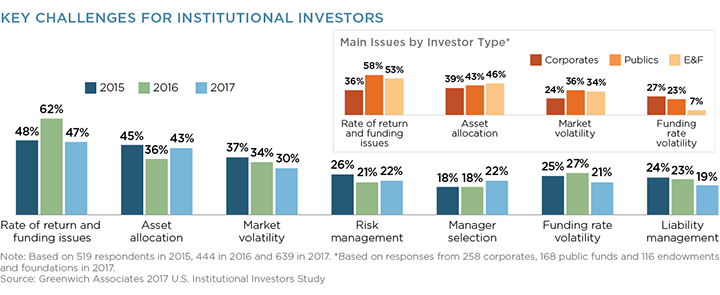

The chart below illustrates how the institutions participating in the Greenwich Associates 2017 U.S. Institutional Investors Study rank the challenges facing their funds. Although it remains the No. 1 concern, “rate of return and funding issues” saw a sharp drop in the share of institutions citing it as a primary challenge. The increase in the percentage of investors concerned with “asset allocation” is also a notable change.

For the past decade, the Fed’s stimulus policies and historically low interest rates have kept yields low and inflated the value of future pension liabilities, keeping institutional attention firmly on the issues of long-term rates of return and funding levels. In 2015–2016, the Fed started pushing interest rates higher, and in 2017, announced that it would start shrinking its balance sheet. This move from an extended period of accommodative interest-rate policy and quantitative easing to a new era of Fed tightening has forced virtually all institutions to reassess and adjust their allocation frameworks, only increasing reliance on external investment expertise provided by the investment consultant community.

Changing Role of Investment Consulting

The 2017 Greenwich Quality Leaders in U.S. Investment Consulting are playing a key role in that process. Over the past 10 years, the role of the investment consultant has changed profoundly. Firms that were once viewed almost exclusively as a resource for manager due diligence and selection are now routinely expected to provide advice and support to institutions on asset allocation, investment strategy and a host of other broad, portfolio-wide issues. Further complicating that mission for consultants is the fact that institutional investors are now increasingly looking to other external advisors—namely their asset managers—for similar support.

“Institutions’ need for ideas and solutions, and new competition for advisory relationships from sophisticated asset managers are forcing investment consultants to up their game,” says Greenwich Associates Managing Director Davis Walmsley.

The 2017 Greenwich Quality Leaders have done exactly that. Although, in some cases, the firms have varying specialties and/or target different segments of the institutional marketplace, all of these consultants have demonstrated the ability to gain a deep understanding of client needs and deliver high-quality, tailored advice that helps institutions achieve their investment goals.

Greenwich Associates consultants Andrew McCollum, Davis Walmsley, Rodger Smith, Sara Sikes, and Christopher Dunn advise on the investment management market in the United States.

Between July and October 2017, Greenwich Associates conducted interviews with 1,059 senior professionals at 884 of the largest tax-exempt funds in the United States, including corporate and union funds, public funds, endowments and foundations, insurance general accounts, and healthcare organizations, with either pension or investment pool assets greater than $150 million. Study participants were asked to provide quantitative and qualitative evaluations of their investment consulting providers.