European institutional investors have adopted ETFs into their portfolios for a surprisingly diverse range of uses. Institutions are using ETFs to obtain the long-term strategic exposures they need in their “core” portfolio allocations and as tools for achieving international portfolio diversification. They are also employing ETFs for a variety of shorter-term tasks, including making tactical adjustments to portfolios and rebalancing. Thanks largely to this flexibility, ETFs have become a mainstay in European institutional equity portfolios, and they are fast gaining traction in fixed income.

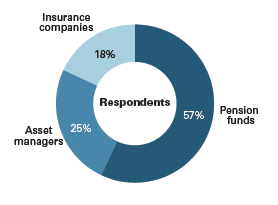

To better understand how and why institutions in Europe are integrating ETFs into their investment portfolios, Greenwich Associates conducted a study of 120 European insurance companies, asset managers and pension funds.

The results of this study suggest that ETFs will continue to grow in Europe in terms of both number of institutional users and size of institutional allocations. Institutions in the study say they are drawn to ETFs for three primary benefits: ease of use, efficient market access and liquidity. All three of these features will be important for European institutions as they move to diversify portfolios away from the traditional domestic and government bonds that have made up the bulk of their investments, and as the increasing complexity of their portfolios prompts institutions to outsource assets in search of external expertise and skill sets that are not in abundance in their internal management teams.

When making specific ETF investments, European institutions seek out high levels of liquidity, attractive expense ratios and benchmarks that fit their strategies. Because institutions rate BlackRock as best-in-class in these and other important areas, the firm has emerged as the ETF provider of choice for European institutions.

MethodologyGreenwich Associates interviewed a total of 120 European-based institutional investors, 83 of which were exchange-traded fund users and 37 were non-users, in an effort to track usage behaviors and examine perceptions associated with exchangetraded funds. The respondent base consisted of 68 pension funds (corporate and public funds, and other institutional investors), 30 asset managers (firms managing assets to specific investment strategies/guidelines) and 22 insurance companies.