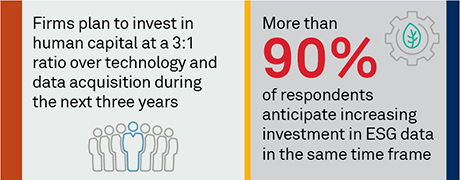

Global investment managers face myriad challenges in today’s market environment: continuing fee pressures, market gyrations, investment valuation challenges, as well as the ongoing need for innovative, alpha-generating ideas. Research, therefore, remains a top priority for frms, with investment in personnel, technology and data empowering the industry to fnd differentiated solutions to solve these complex problems. Firms are looking to invest in human capital at a 3:1 ratio over data acquisition and technology systems.

Driving these trends is the need to effciently tap into the information advantages generated by fundamental research. At the same time, such an edge often has a limited lifespan, so barriers to sharing that research create wasted potential. As more data is consumed, analysts create more research on that information, resulting in an ever-increasing need to effectively and effciently share insights and create actionable results.

The ability to create an integrated platform by weaving together the disparate threads across the human element, data streams and technology helps alleviate many of the current research pain points. Research management solutions (RMSs) attempt to bring these diverse pieces together, providing a primary means of identifying the ideas on which investment decisions can be based and where opportunities can be unleashed. Systems that can unlock the value of internal, proprietary data and intelligently integrate that with other frequently used data streams can help managers produce higher alpha and maximize returns on investment on human capital.

MethodologyIn Q1 2022, Coalition Greenwich interviewed 66 buy-side market participants in North America and Europe dealing with various aspects of the research process. In these discussions, we explored the institutions’ research organizations and priorities, capabilities across idea generation and investment, views on ESG research, and their use of research management solutions (RMSs).