Table of Contents

Asset managers looking to win retail investment assets must become more nimble and responsive to shifts in global markets, according to banks, financial advisors, insurers, and other companies that distribute retail investment funds.

Every year, Greenwich Associates interviews intermediary investment fund distributors around the world for our Intermediary Distribution Studies. These distributors had a clear message for asset managers in 2018: You will not be successful if you keep pushing the same suite of products year after year. To win assets on retail platforms, asset managers must adapt their offerings to changes in investment demand, while also providing the high-quality service and relationship management needed to help distributors and their retail clients navigate today’s rapidly changing markets.

The 2018 Greenwich Quality Leaders℠ in Intermediary Distribution in Asia and Europe demonstrate all of these qualities, complementing consistent investment performance with the product innovation, service quality, relationship management, and cost structure that fund distributors now demand.

Greenwich Quality Leaders

Based on evaluations from fund distributors, Allianz Global Investors, AXA Investment Managers and Robeco claim the title of 2018 Quality Leader in Europe, and in Asia, AllianzGI is joined by co-leader Alliance Bernstein. In both markets, AllianzGI successfully leverages the breadth of its platform and top-quality service to identify the needs of distributors and fill gaps in their platforms. Asian fund distributors say Alliance Bernstein delivers many of the same characteristics through a relationship management function that is second-to-none.

The Greenwich Quality Leaders and other asset managers that differentiate themselves in areas beyond pure investment performance are at a significant advantage to competitors when it comes to capturing assets on retail platforms. The reason: In Asia, for example, retail fund distributors include an average 28 asset managers on their platforms but actively market only 15. Across both regions, between 55% and 60% of distributors say the funds they actively market are hand-picked gatekeepers.

The need for asset managers to develop strong ties with gatekeepers and other decision-makers at distribution platforms is therefore undisputed. The best approach is through product innovation that shows distributors the asset manager is attuned to the needs of the investors on their platforms, and through service and relationship management capabilities that minimize pain points and add value for distributors.

Distributors Project Retail Fund Flows

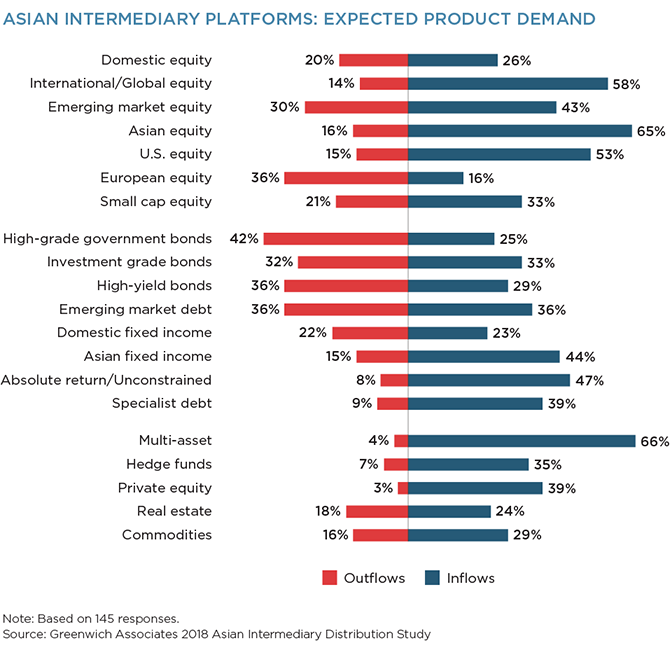

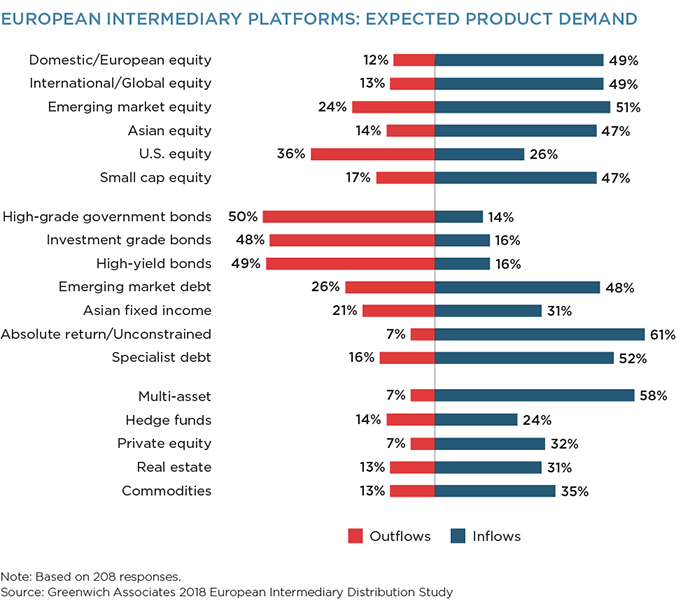

Retail investors in Asia and Europe are making opposing bets when it comes to U.S. equities, according to banks, financial advisors, insurers, and other companies that distribute investment funds. Meanwhile, distributors expect investors in both regions to move in lockstep in the next year by pouring money into multi-asset funds and specialty fixed-income products.

Every year, Greenwich Associates asks the platform gatekeepers and decision-makers participating in our Intermediary Distribution Studies where they expect their retail investors to be channeling their assets in the coming year.

Based on the results of that research, Asian retail investors that have been stung by recent losses in emerging market equities appear to be seeking out the relative strength of the U.S. stock market. Many European investors have come to a much different conclusion and are betting that current high valuations for U.S. equities signal weaker relative performance ahead.

Fifty-three percent of Asian fund distributors interviewed in 2018 expect to see retail inflows into U.S. equities in the next 12 months, with only 15% projecting outflows. In Europe, fund distributors on net are expecting outflows to U.S. equities, with 36% projecting reductions versus 26% anticipating increases.

Any inflows into U.S. equities by Asian investors would be part of a dramatic year-to-year shift in fund flows. That shift is driven by an ongoing search for sources of attractive investment returns that fund distributors expect to continue in the next year. By wide margins, Asian distributors anticipate inflows into higher-alpha products including private equity and hedge funds. Distributors expect this influx to be fueled by assets flowing mainly out of European equities and high-grade government bonds, and, to a slightly lesser extent, emerging market debt.

Meanwhile, European fund distributors expect retail investors on their platforms to stick closer to their current investment patterns. Assets are expected to continue flowing into equities, albeit at a slightly slower pace than that seen over the past year, with continued outflows in high-grade government bonds, investment-grade bonds and emerging market debt.

Fund distributors in both markets expect strong fund flows into multi-asset products, absolute return/unconstrained fixed-income strategies and specialty fixed income. Two-thirds of European distributors and 58% of Asian distributors expect inflows into multi-asset, with only relatively small shares expecting outflows. The story is the same for absolute return/unconstrained fixed income, where 48% of Asian fund platforms and 61% of European distributors expect inflows in the next year, and in specialist debt, where distributors on net are expecting inflows from retail investors in both Asia and Europe.

Managing Director Markus Ohlig and Principal Parijat Banerjee advise investment management clients in Europe and Asia.

MethodologyBetween May and July 2018, Greenwich Associates conducted 145 interviews with some of the largest fund distributors in Asia and 208 with fund distributors in Europe.

Senior gatekeepers were asked to provide detailed information on their business priorities, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business. Countries and regions where interviews were conducted in Asia include Hong Kong, Singapore, South Korea, Taiwan, Malaysia, Thailand, and China. In Europe, interviews were conducted in Austria, Benelux, France, Germany, Greece, Iberia, Ireland, Italy, Monaco, Nordics, Switzerland, and the United Kingdom.