I spent most of my summer digging through our 2014 North American fixed income data looking to see what's changed in the past year and what's the come. While the bulge bracket continues to dominate rates, mid-tier brokers are making some...

I spent most of my summer digging through our 2014 North American fixed income data looking to see what's changed in the past year and what's the come. While the bulge bracket continues to dominate rates, mid-tier brokers are making some...

On October 2 market participants requesting price quotes for an order via a SEF will have to ask a minimum of three dealers to respond rather than the current minimum of two (although in neither case are those dealers required to respond to the...

According to Liquidnet CEO Seth Merrin the corporate bond market is “a disaster waiting to happen”. A disaster? Maybe. But certainly it is a market waiting for better ways to match buyers and sellers. That is exactly what Liquidnet was thinking...

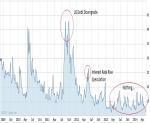

Its a little sad how excited I get about charts. Maybe its because they do such a good job telling a complex story, or maybe because looking at a chart is easier than reading - but I digress. Another great view of the fixed income world...

Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away. Source:...

I'm a little obsessed with volatility lately - well, the lack of it actually. The VIX has been hovering around 12 for months despite emerging markets turmoil, rigging scandals and regulatory environment that can only be described as volatile....

Liquidity in the corporate bond market is tough. We've written about it time and time again. At a high level we see two solutions. One, inject new electronic trading tools and liquidity providers into the existing corporate bond...

On Thursday May 1 the CFTC released an eagerly awaited clarifying document outlining when and how package trades would be required on SEF. Packaged transactions will be phased in by type from May 15th through November 15th, and to deal with...

Last week I did an interview with the guys at DerivAlert about where we've come and where we're going. The result was a pretty concise overview of our thoughts on SEFs, US Treasury's, corporate bonds and European regulatory reform, so we...

If you work in institutional finance you’ve heard talk of market structure. Not only are there entire conferences dedicated to the topic, but most of the participants at those conferences— banks, asset managers, researchers—send their heads of...

We are always here to help you