After months—arguably years—of little change in the competitive landscape for trading U.S. Treasurys (UST) electronically, the CME’s acquisition of NEX effectively dropped the yellow flag on the market. Now, like it or not, everyone will need...

While market sizes are often measured in the trillions of dollars, the number of firms that are responsible for the majority of transactions is measured in the hundreds if not the teens. Examples of this are numerous. According to...

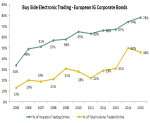

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

A few weeks back I had a great conversation with Liquidnet’s head of Fixed Income trading and the head of InteractiveData’s evaluated pricing service. Both firms provide tools to the market that hope to improve transparency and ultimately lubricate...

High costs can be a barrier to success for any swap execution facility (SEF), but there’s more to it than that. Based on our conversations with the buy side, simple fee models are preferable. Thankfully most major SEFs have taken a transparent...

I spent most of my summer digging through our 2014 North American fixed income data looking to see what's changed in the past year and what's the come. While the bulge bracket continues to dominate rates, mid-tier brokers are making some...

According to Liquidnet CEO Seth Merrin the corporate bond market is “a disaster waiting to happen”. A disaster? Maybe. But certainly it is a market waiting for better ways to match buyers and sellers. That is exactly what Liquidnet was thinking...

We've just released the results of our benchmark US equities study, based on almost 600 interviews with US equity investors. While Greenwich has been conducting this study for literally decades, this is my first market structure analysis...

Over the past decade or so, the growth of OMS and EMS platforms has paralleled the growth of electronic trading – but it would be a stretch to suggest a direct cause-and-effect relationship. These days, though, given the growing importance of...

Spot FX trading volumes in the first quarter of 2014 dropped 25-30% from the same period last year. From a macro-economic perspective, the reasons are relatively clear. In 2013, FX trading volumes were inflated by a surge of activity in the...

Pages

Need to Contact Us ?

We are always here to help you