Over the last few weeks many have speculated that low volatility must mean that investors are complacent. As I was writing this post, in fact, an email came through about a new volatility study from ConvergEx showing that half of their ...

Over the last few weeks many have speculated that low volatility must mean that investors are complacent. As I was writing this post, in fact, an email came through about a new volatility study from ConvergEx showing that half of their ...

On October 2 market participants requesting price quotes for an order via a SEF will have to ask a minimum of three dealers to respond rather than the current minimum of two (although in neither case are those dealers required to respond to the...

Sales trader relevance has been debated for more than a decade as buy-side driven execution algorithms and trading tools have made self-service trading ubiquitous. Despite the ability of institutional investors to trade via cheaper self-directed...

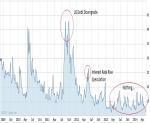

Its a little sad how excited I get about charts. Maybe its because they do such a good job telling a complex story, or maybe because looking at a chart is easier than reading - but I digress. Another great view of the fixed income world...

Greenwich Associates (and I) have for the most part stayed out of the recent high frequency trading debate. Thankfully the discussion has gone (somewhat) beyond whether HFT is good or bad and has moved towards a broader debate around the best market...

We've just released the results of our benchmark US equities study, based on almost 600 interviews with US equity investors. While Greenwich has been conducting this study for literally decades, this is my first market structure analysis...

Over the past decade or so, the growth of OMS and EMS platforms has paralleled the growth of electronic trading – but it would be a stretch to suggest a direct cause-and-effect relationship. These days, though, given the growing importance of...

Bloomberg TV ran a segment on cheaters - who cheats, why people cheat and how to get them to stop cheating. I was lucky enough to be part of that discussion, which included Dan Ariely, a behavioral economist from Duke who's been reaching this...

I'm a little obsessed with volatility lately - well, the lack of it actually. The VIX has been hovering around 12 for months despite emerging markets turmoil, rigging scandals and regulatory environment that can only be described as volatile....

Liquidity in the corporate bond market is tough. We've written about it time and time again. At a high level we see two solutions. One, inject new electronic trading tools and liquidity providers into the existing corporate bond...

We are always here to help you