I recently participated in a great panel discussion with James Jockle from Numerix and Kazu Yokokawa from the Nomura Research Institute. I look forward to getting an update from Kazu on the POCs they are working on!

I recently participated in a great panel discussion with James Jockle from Numerix and Kazu Yokokawa from the Nomura Research Institute. I look forward to getting an update from Kazu on the POCs they are working on!

Richard Johnson, Greenwich Associates vice president of market structure and technology, discusses the results of the firm's survey of 256 buy-side traders around the world. He speaks with Bloomberg's Alix Steel on Bloomberg Markets. Bloomberg...

An important, but little understood feature of US market structure is the operation of National Market System (NMS) Plans. NMS Plans came about through the 1975 Amendments to the Securities and Exchange Act, and essentially provide a mechanism for...

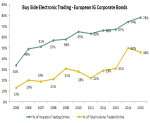

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

This was my first time chatting with Betty Liu at Bloomberg TV, which I really enjoyed. We discussed why the Fed shouldn't hyper focus on short term market volatility, how bond market liquidity has changed but a crisis isn't likely, and last but not...

The biggest FinTech story of last week was the announcement that not only had Digital Asset Holdings (DAH) raised $52mm in funding, but had also secured a strategic contract to develop distributed ledger (blockchain) settlement solutions for...

There has been plenty of talk amongst the industry about the MiFID II rules aimed at bringing more transparency to dark pool trading venues across Europe. Regulators claim the lack of transparency and details around transactions is dangerous...

Equity trading trails the technological progress made in other industries. Although today’s US equity market structure is more complex, nuanced, and competitive than any other asset class, one could argue that the electronic tools offered traders...

The anniversary of the Treasury "flash crash" and next week's market structure meeting at the NY Fed has brought with it a renewed focus on the functioning of the US Treasury trading. In an effort to provider further clarity into how this...

Despite the recent wild gyrations in global stock markets, 2015 could represent the calm before the storm for European equity brokers, which are awaiting word from regulators on new “unbundling” rules that could upend the economics of their business...

We are always here to help you