There has been plenty of talk amongst the industry about the MiFID II rules aimed at bringing more transparency to dark pool trading venues across Europe. Regulators claim the lack of transparency and details around transactions is dangerous...

US equity markets are always touted as the poster child for electronic trading, but our most recent electronic trading study results (see chart below) prove that view is somewhat misguided. Driven primarily by new rules requiring index CDS...

A few weeks back I had a great conversation with Liquidnet’s head of Fixed Income trading and the head of InteractiveData’s evaluated pricing service. Both firms provide tools to the market that hope to improve transparency and ultimately lubricate...

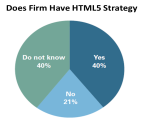

Growing uncertainty about the future of operating systems and devices used by financial services firms is forcing technologists to consider technology-agnostic application development. Our latest research suggests that companies developing...

Excel is the biggest killer app of all time. Yeah, web browsers are pretty useful and Instagram was sold for $1 billion, but when it comes to managing numbers nothing can touch Excel. This is why global financial markets continue to...

Social media has become ubiquitous and in large part defines how we interact in a busy digital age. But not every platform is created equal, especially not for business and investing. We recently interviewed 256 institutional investors—pensions,...

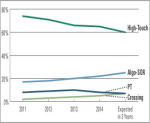

Institutions in Asia are executing a steadily increasing proportion of business on a low-touch basis (algorithms, DMA, crossing, portfolio trades) as opposed to traditional high-touch business executed through a broker sales trader. These same...

The European Commission, ESMA and the FCA appear to be including fixed income in new payment for research requirements in MiFID II and EMiR by not explicitly excluding fixed income research. The question is whether a service can be viewed as an...

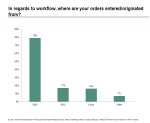

Market structure happenings have been fast and furious since 2009, and 2014 did not disappoint. Mandatory SEF trading finally began, fixed income electronic trading continued its steady incline, the current shape of the US equity market was...

Another year down. We're a year further from the Lehman bankruptcy, a year further from the signing of Dodd-Frank and a year closer to the full implementation of Basel III. But before we start looking ahead, let's look back at the year in market...

Pages

Need to Contact Us ?

We are always here to help you