Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away. Source:...

Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away. Source:...

Liquidity in the corporate bond market is tough. We've written about it time and time again. At a high level we see two solutions. One, inject new electronic trading tools and liquidity providers into the existing corporate bond...

Turned out the first week of mandatory SEF trading was a Big Bang, just in the wrong direction. Reported SEF volumes for interest rate swaps fell off a cliff for the week of February 17th, cliff signdropping 64% (revised down slightly as new data...

We all know that the massive reduction in dealer inventories and the cost of capital has had a huge negative impact on liquidity in the corporate bond market. While the primary market has helped soften the blow, that crutch isn’t going to be here...

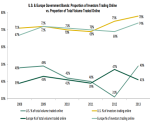

We spoke to just under 500 portfolio managers and traders globally to see what they’re doing with and what they think about OMSs, trading-system EMSs and TCA platforms for Equities, FX and Fixed Income. This is not a space of dramatic year on year...

The year 2013 will likely go down as the year of mandatory clearing. Once ignored by eager financial market Greenwich Associatesprofessionals as boring back-office stuff, collateral management, credit limits and all other things clearing stood front...

We are always here to help you