Faced with persistent inflation and continuing market volatility, Canadian institutional asset owners are rebalancing their portfolios away from traditional equities and fixed income in favor of private markets, according to the Coalition Greenwich Voice of Client – 2022 Canadian Institutional Investors Study. The annual study covered senior investors from 163 of the largest tax-exempt funds between February and November of 2022.

Chief Challenges: Inflation Risk, Market Volatility and Asset Allocation

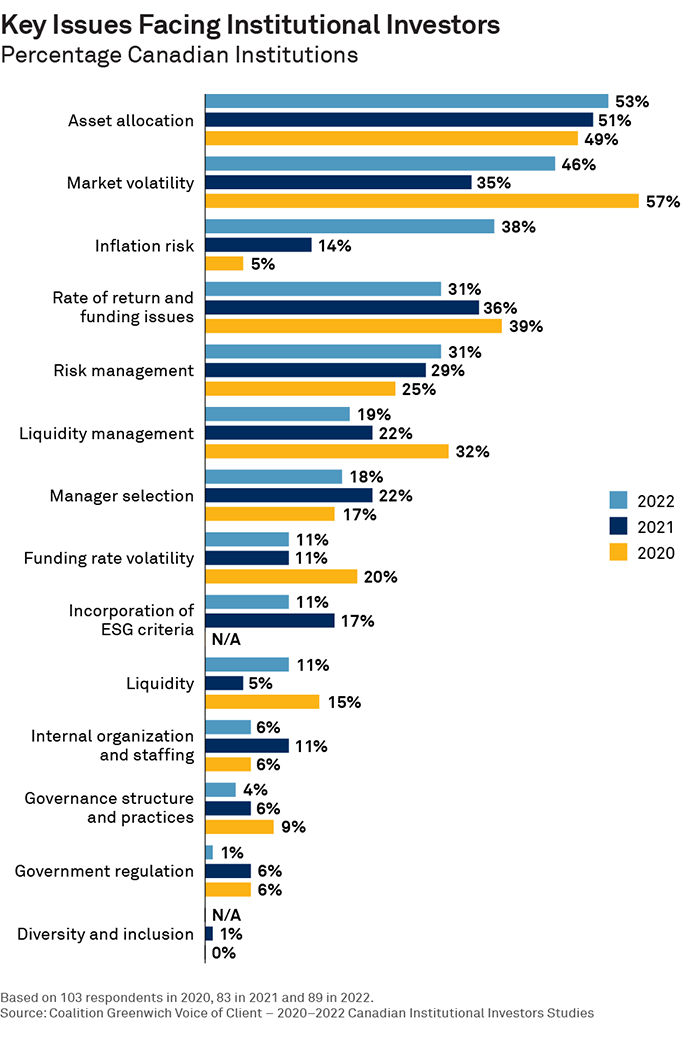

As markets shifted from a low-inflation, low-interest environment to one of turbulence and high inflation in 2022, institutional investors identified inflation risk, market volatility and asset allocation as their predominant challenges.

At the same time, concerns surrounding liability management and funding ratios abated as the increase in interest rates encouraged funding gap closures. Government regulation concerns also decreased significantly, owing in part to government efforts to combat inflation.

Sharp Increase in Pension Funding Levels

One positive impact of the multiple interest rate hikes during 2022 was the universal increase in pension plan funding levels, which were already high relative to the U.S. corporate plan funding levels. Public plan funding levels were also remarkably healthy.

Key Criteria for Investment Manager Selection

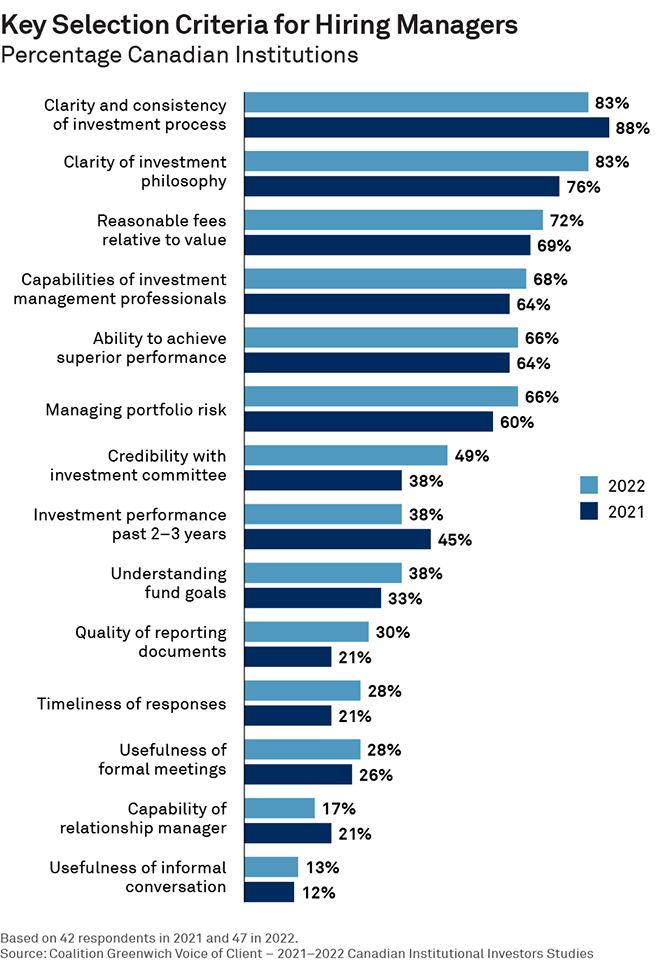

Clarity and consistency of the investment philosophy and process, value from a fee perspective, risk management, and performance remain the top key factors for selecting managers. However, as the surge in inflation propelled markets into bear territory, asset owners placed greater emphasis on managers understanding their goals and objectives. Manager credibility, reporting and responsiveness also gained a bigger spotlight in the selection process.

Across all channels, pricing remains pivotal in manager selection. Both corporate and public plans also consider managers’ willingness to accommodate customization as well as their brand strength.

Performance was the No. 1 factor in judging managers as best-in-class by brand.

Meanwhile, 78% of asset owners now consider environment, social and governance (ESG), and 55% consider diversity, equity and inclusion (DEI) as central factors for selecting an asset manager.

When it comes their relationship with existing and potential managers, asset owners place increasing importance on the quality of the relationship management team and the thought leadership provided by managers.

In Conclusion

A tumultuous year in the markets has reshaped investors' concerns and their expectations for future allocations. Funding levels are at an extremely high and healthy level, but investors are looking for more from their managers in terms of knowledge, thought leadership and partnership. The second half of this two-part blog will further explore how investors are adapting their hiring expectations, asset allocation, and OCIO and consultant usage to position themselves for success within the current market environment.