European corporate treasuries and cash management providers, which focused on providing liquidity, flexibility in documentation and quick rollout of digital solutions in the immediate aftermath of the COVID-19 crisis, are now collaborating on more structural and digital solutions to adapt to the new normal.

The goal is to provide actionable insights through data analytics for real-time treasury and enhance business resilience, according to corporate treasury leaders at a virtual panel discussion on European Corporate Cash Management: Impact of COVID-19.

The webinar, held on December 10, 2020, was hosted by CRISIL Coalition Greenwich and moderated by Dr. Tobias Miarka, Co-Head of Banking. The panelists included Cara Savas, European Head of Corporate Sales, HSBC and Steven Lenaerts, Head of Product Management Global Channels, BNP Paribas.

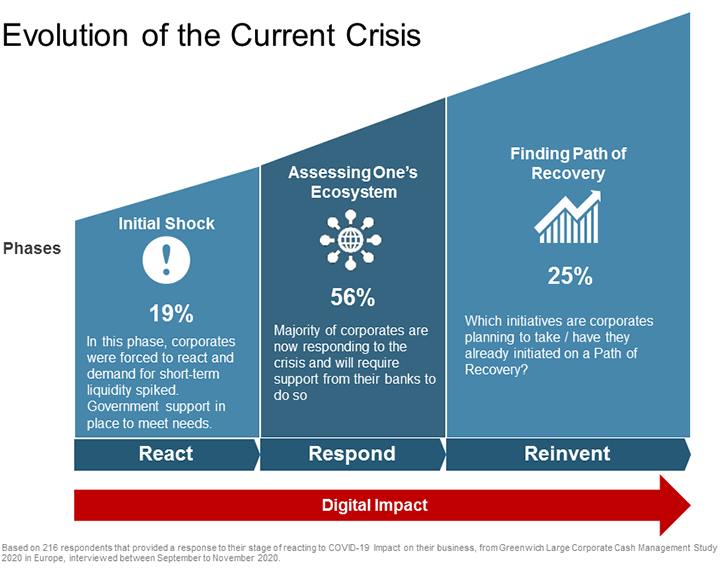

While the rollout of COVID-19 vaccines has raised hopes of recovery, businesses are still not out of the woods yet. As many as 19% of large corporates surveyed across western Europe in the Greenwich Associates 2020 Global Large Corporate Cash Management Study reported that they are still in the initial shock, or “react,” phase of the crisis, where they need short-term liquidity and government support. Greenwich Associates has classified the evolution of the current crisis into the “react,” “respond” and “reinvent” phases.

However, the study showed sentiment has improved over the past two quarters, with 59% of respondents being negatively to highly negatively impacted in Q4 2020 compared with 74% in Q2 2020. Twenty-nine percent of the respondents also reported a neutral impact on their business in Q4 compared with 23% in Q2, which was helped by a recovery in sectors such as consumer discretionary, staples and energy.

As Liquidity Improves, Focus Shifts to Path to Recovery

Moreover, liquidity has improved with funding lines made available by banks and governments. Banks have also supported business continuity by providing flexibility in documentation, especially on KYC protocols, digital solutions and real-time payment tracking.

This has helped 56% of companies in the study to move to the respond phase, where they are trying to orient themselves to the new ecosystem. About 25% entered the reinvent phase, where they are taking a fundamental relook at the actions required on the path to recovery. All three phases are underpinned by the ongoing digital transformation.

According to HSBC’s Cara Savas, corporate treasuries in the second and third phase are recalibrating their liquidity structures and solutions with an eye toward enabling agile, real-time reporting and decision-making. They are equipping their teams with tools to enhance visibility on cash management and provide actionable insights through data and analytics. Steven Lenaerts of BNP Paribas said renewed interest in cash forecasting has led to a better understanding of liquidity dynamics and is driving working capital optimization.

Digital Capabilities and Solution

An equal focus is on enhancing business resilience. Undoubtedly, digitalization will play a key role here, especially as the pandemic has highlighted the benefits of the ongoing digital transformation.

In the shock phase, banks had focused on accelerating the deployment of their existing digital capabilities and solutions—such as electronic signatures, digital KYC and contactless payments. Now, in the second and third phases, they’re increasing the scale and pace of the rollout to cover multiple geographies, while keeping in mind regulatory requirements, pointed out Steven Lenaerts.

One key focus area is client onboarding—or the nirvana that corporate treasuries and banks are trying to achieve, as Cara Savas called it. The digitalization of the KYC process, which is crucial to trigger onboarding, has helped hugely here. Next could be an industrywide KYC platform to derive greater value, panelists felt.

Corporates and banks are also leveraging digital solutions for tracking real-time transactions, especially for liquidity management and cash-flow forecasting, which has become critical, given supply-chain disruptions, said Cara Savas. Steven Lenaerts believes that would include gaining visibility on order-to-cash receivables.

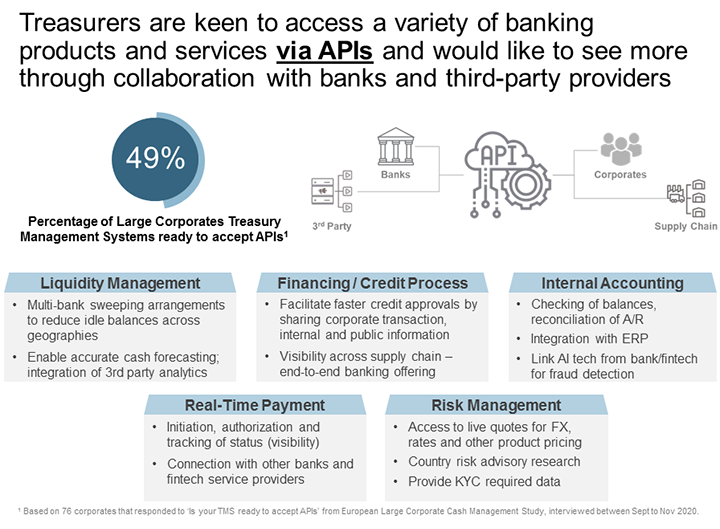

Application programming interfaces (APIs) could help here, although only about half of respondents said their treasury management systems are ready for them. However, this number is expected to increase rapidly with the growing understanding of the benefits of APIs.

The pandemic, meanwhile, has also highlighted the need for banks and corporates to manage their evolving international cash management needs. When it comes to cross-border transactions, corporates need to strike a balance between centralized, fully electronic treasury operations and boots-on-the-ground operations that are close to the supply chain.

This became clear during the pandemic, as companies needed to stay abreast of localized lockdown regulations and restrictions to ensure the sustainability of their business.

Risks and Opportunities on the Path Ahead

Going forward, what are the risks and opportunities for corporate cash management?

Steven Lenaerts warned of increased credit exposure once the financial stimulus wears off. Hence, corporates can benefit from an increased focus on accounts receivables positions—keeping them as low as possible—and controlling the collection process.

Meanwhile, growing digital payment innovations, such as instant payments and request-to-pay, offer an opportunity to further streamline cash management operations and thereby obtain visibility on liquidity positions, he said.

Cara Savas hoped that the industry will continue to take advantage of the agility and technological changes triggered by the pandemic, and that it will use the opportunity to build better adherence with environmental, social and corporate governance (ESG) principles.