Table of Contents

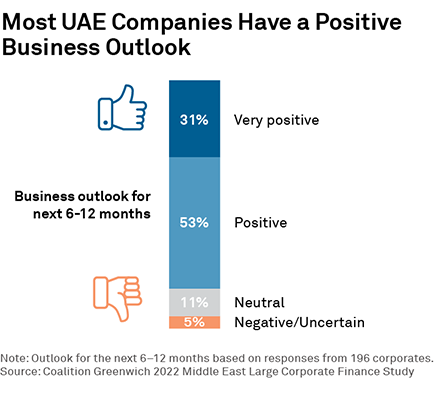

Approximately 85% of the nearly 200 companies in the UAE participating in the annual Coalition Greenwich Middle East Large Corporate Finance Study have a positive outlook for their businesses for the next six to 12 months.

That result suggests that businesses in Dubai/Abu Dhabi and other parts of the UAE are far more confident about the near-term economic environment than their counterparts in Europe and Asia. By far the biggest driver of that optimism is the reawakening of the national and global economy as COVID-19 subsides (hopefully permanently) in parts of the world.

However, corporate executives cite a range of additional positive factors, including increased government support for businesses, a boom in international business opportunities and a surge in tourism. “The airline industry is back in business and travel and tourism are booming,” says one corporate executive. “Due to Dubai Expo 2020 and surrounding events, we are seeing tourist volume coming back,” adds another.

The positive business outlook also reflects the impact of reforms by the UAE government intended to develop the economy and diversify away from energy. At the start of this year, the UAE officially shifted its national workweek from the Sunday-through-Thursday schedule traditional in most Middle East countries to a Monday-through-Friday model more in line with global economies.

In 2021, the UAE introduced one-year residency permits for remote workers. A relocation to the UAE is seen as attractive by some remote workers due to the favorable tax structure in the country, the vibrancy of life in Dubai, and the fact that, in terms of time zones, the UAE straddles Europe and Asia, allowing workers to more easily cover both regions.

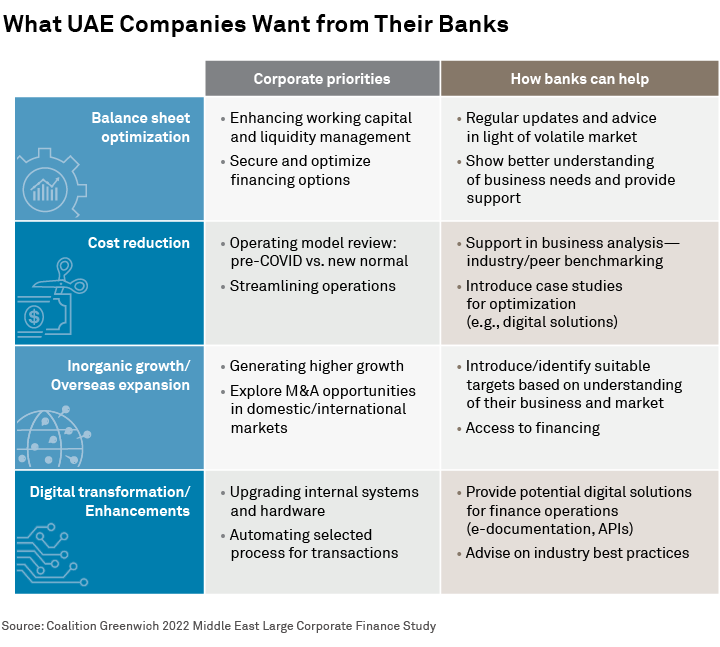

Despite possible headwinds in the form of geo-political and economic fallout from the war in Ukraine and the potential for new surges in the pandemic, corporate priorities for 2022 reflect the positive outlook. Like companies around the world, corporates in UAE are working to optimize balance sheets, enhancing working capital and liquidity management.

But in the current year they are also focused on securing financing for both their ongoing businesses and growth opportunities they see emerging within the UAE and internationally. A quarter of companies in the study rank inorganic growth and overseas expansion as a top priority for 2022. Most international growth strategies are targeted on Saudi Arabia and other Gulf Cooperation Council (GCC) countries, as well as Egypt.

Focus on Growth

This focus on growth, especially international growth, is creating a window of opportunity for banks hoping to win corporate business in the MENA region. Corporate executives made the following comments when asked how banks can help them achieve their goals for 2022:

- “Bring potential acquisitions deals and opportunities to us. Provide research and insights into the new geographies and market that we are entering into.”

- “Provide funding for overseas projects and growth. Our banking partners can support us with sufficient capital for acquisitions.”

- “They can help us via their banking networks in the areas that we are venturing into for M&A.”

- “Banks can help digitize cross-border payments, vendor management, credit facilities.”

Leading the Pack in Digital Transformation

The final comment in that list—“Banks can help digitize cross-border payments, vendor management, credit facilities”—reflects the other top priority companies have for 2022: digital transformation. The rapid digitization of the UAE’s corporate sector is being driven by several powerful trends. The first, of course, is COVID-19. Although UAE’s pandemic lockdowns were not as severe as those imposed in other cities and countries, COVID-19 disruptions nevertheless accelerated the switch to e-commerce and digital banking among both companies and consumers.

Second, over the past decade, the UAE has launched a series of initiatives it describes as designed to automate government services “as a part of the 4th industrial revolution, which depends on digitization and information technology.” This effort has pushed the country to the front of the pack in the MENA region in digital transformation, and it is carrying UAE companies along with it.

In some ways, companies in the UAE are skipping an entire generation of transitional treasury infrastructure, moving directly from paper-based manual processes to sophisticated digital systems. Nine out of 10 UAE companies now use online banking, and more than half use mobile banking. Three-quarters of study participants have plans to adopt mobile banking. Perhaps even more impressively, 70% of companies plan to adopt host-to-host banking channels, and 58% have plans to start using APIs.

How Banks Can Win Business and Help UAE Companies Achieve Their Goals

For banks competing for the business of MENA companies, digital capabilities are now a make-or-break feature. When picking cash management providers, companies rank electronic banking capabilities as their second most important criteria, just slightly behind pricing.

However, in a culture that values personal relationships, banks should not forgo real-life interaction. Face-to-face meetings and phone calls remain companies’ preferred method for engaging with banks. That said, companies are becoming more accustomed to email and more open to video calls (used by 57% of companies), webinars (used by 42%) and text/IM (used by 25%).

The following table, based on data from our study, shows the services and products MENA companies want most from their bankers in 2022 and beyond.