Table of Contents

COVID-19 started in late December 2019 in Asia, but its effects on the global markets were truly felt two months later.

By late February, it was clear to investors all around the world that the pandemic would have a far-reaching impact on company earnings, credit profiles and, consequently, investor portfolios.

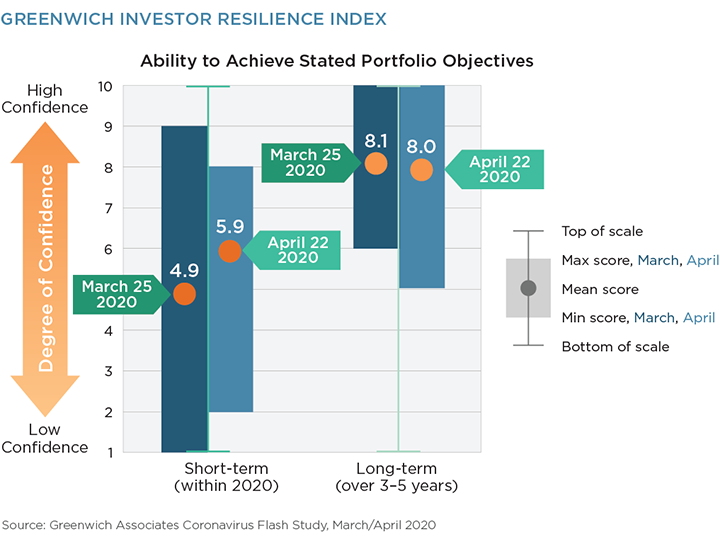

Investors globally have responded with varying strategies but generally believe that they will be able to meet their long-term portfolio objectives. The short-term view, however, is decidedly mixed.

To further learn about the impact COVID-19 has had on trading activity and outlook, and how dealers have responded, Greenwich Associates gathered feedback from 93 Asia-based buy-side fixed-income investors.

Most Investors Expect Volatility to Continue

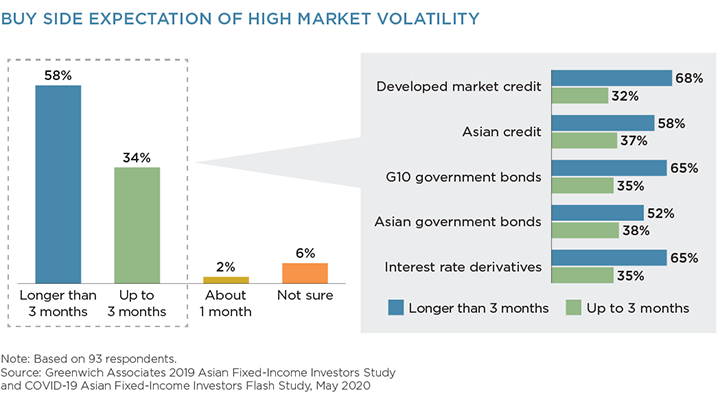

Most Asia-based investors believe that the current market conditions will result in continued volatility beyond the next three months, and nearly all the rest anticipate high volatility for up to three months.

While there isn’t much difference between the views of credit vs. rates investors, proportionally, more investors expect volatility to continue beyond three months in G10 products, as compared to Asian products. Some of this is an outcome of more favorable credit spreads seen in several developed market bonds, auguring opportunistic buying in Asia.

Anticipated Risks to Investors' Portfolios

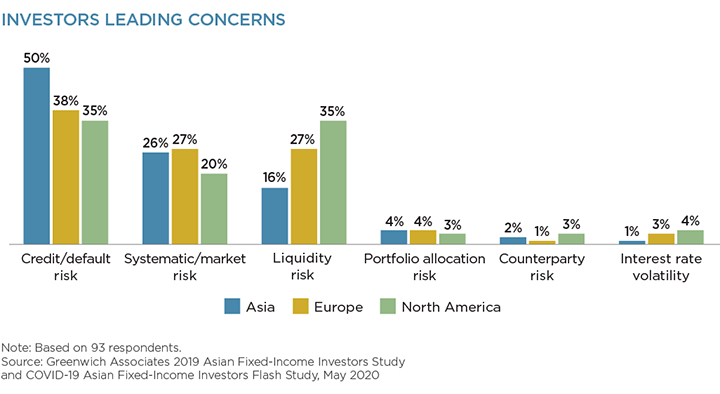

Not surprisingly, Asian investors find credit risk to be one of the most significant concerns they have. In similar studies we conducted in North America and Europe, investors echoed this concern.

While credit risk is the most unanimous concern across regions, North American investors also consider liquidity risk a major issue, in contrast to their Asian counterparts.

Asian central bank’s proactive risk management stance and dovish policy measures may explain to some degree the reduced liquidity risk perception among Asian investors. On the other hand, the higher proportion of passively managed assets in North America may explain the higher liquidity risk concern there.

Most Asia-based investors found that e-trading was a benefit during the COVID-19 crisis, with 64% saying that e-trading helped their cause.

What We Expect the Buy Side to Change

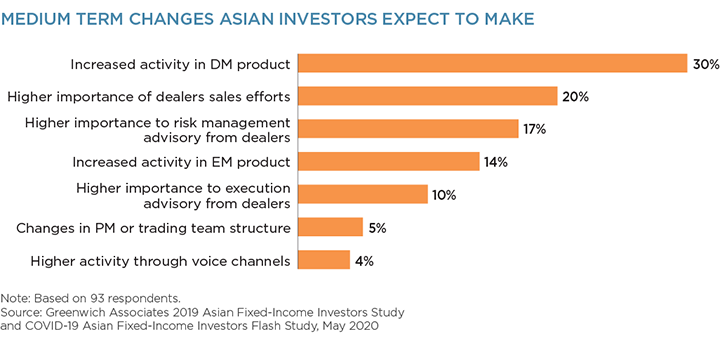

In the medium term, buy-side investors in Asia anticipate higher activity in developed market products compared to emerging markets. They also attach increased importance to sales advisory from their fixed-income dealers.

Fixed-income dealers who stand steadfast with their clients in the current environment will further cement the trust of their clients and may emerge from this crisis stronger than before. For this, buy-side investors tell us dealers should be ready to honor their bids and offers and to provide clients with increased sales and execution advisory, as well as specific analyses on the impact of COVID-19.

Dealers Turning Crisis into Opportunity

During this crisis, dealers have had to contend with providing advice and liquidity to clients in consistently choppy markets, while having their operating infrastructure transition to support remote working.

While years of preparation in BCP has ensured market infrastructure did not collapse, dealers’ sales personnel and traders have had to make the sudden and hard adjustment to working remotely, initially with less than ideal home infrastructure. Under these circumstances, we asked Asian fixed-income investors, “Which dealers have stood by you the best during the current turbulent market conditions?”

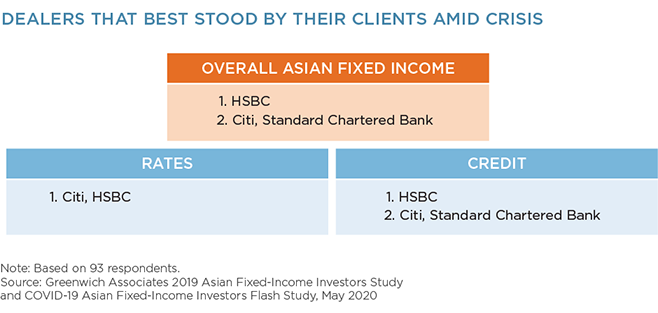

HSBC, Citi and Standard Chartered Bank are the most-mentioned dealers across Asian fixed income and are well ahead of all others.

While most investors had at least a couple of their counterparties step up for them during the crisis, 15% of respondents said that they felt no dealers stood by them during this period.

What’s Next for Dealers?

While the last few months have been manic, most sell-side banks have had a reasonable if not excellent Q1, driven by heightened volatility. In the short term, banks should expect volatility to continue to be in their favor.

In the medium to long run, dealers should anticipate a different set of client needs. Bank sales desks should be ready to provide higher levels of advisory than in the past, as clients navigate the rest of 2020 and beyond. In the context of a protracted economic recovery, banks should also prepare for more fundamental changes in client portfolios, such as a potentially different mix of DM versus EM activity and activity being concentrated in some sectors while reduced in others.

As with market and economic dislocations of the past, the banks which remain the most receptive to their clients evolving needs and take specific actions to address these, will come out of this one having turned the crisis into an opportunity.

Partnering with Clients in a Time of Market Turmoil

COVID-19 Impact on FICC Markets

COVID-19 Impact on Equity Markets

Uncharted Territory in European Fixed Income

European Fixed Income: Standout Dealers Amid Crisis

Recognizing Standout Equity Trading Brokers Amid Market Turmoil