Table of Contents

With exchange-traded markets around the world already up and over the technology adoption curve, over-the-counter markets, including those for U.S. corporate bonds, securitized products and loans, have come into focus as markets that have only just begun their innovation journey.

OTC markets can still see huge improvements in efficiency, transparency and liquidity via new technology solutions. Collaboration technology, analytical tools, bots, and natural language processing (NLP) are all helping move these markets forward.

Rethinking Electronification

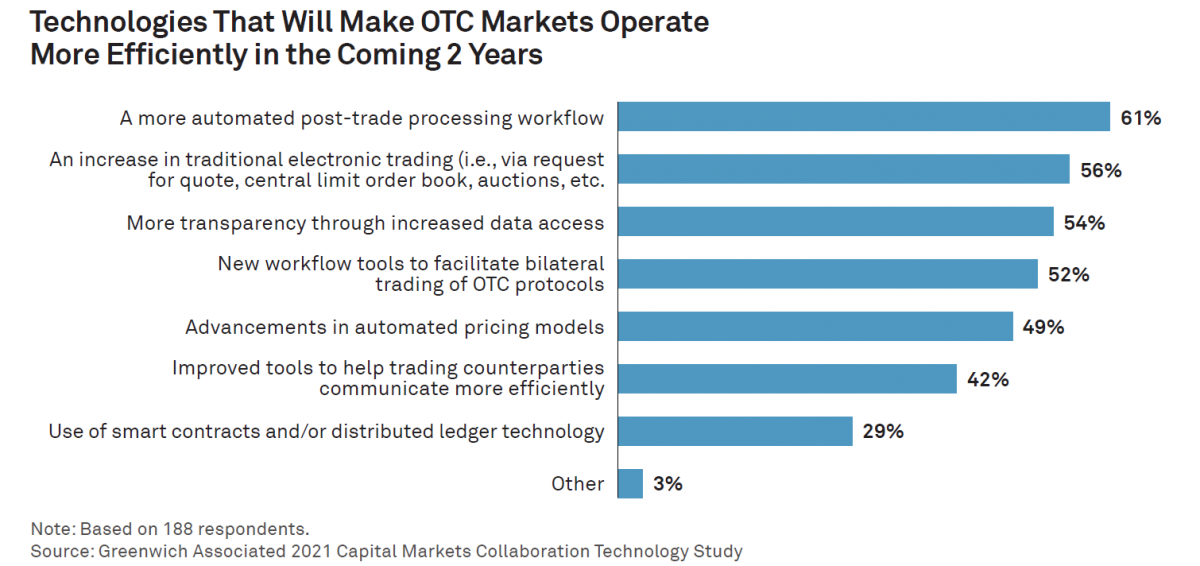

While electronic trading has been treated as the holy grail of progress, market electronification has become so much more. In fact, the most noted technology aid to OTC market efficiency has been post-trade workflow automation.

For more complex products, such as structured credit, loans or securitized assets, trading counterparties agreeing on the price is often the easiest part of the trade lifecycle. The processing of related documents, clearing, settlement, and managing periodic payments over the life of the contract create much more complexity and, as such, can benefit from new technology.

Even so, trading can still see benefits from new technology. As we have written many times in the past, for less liquid markets we must rethink what we consider electronification. There simply aren’t enough market participants nor enough liquidity in many bonds and bespoke derivatives to expect an order book or RFQ market to work optimally. To that point, technology has been developed to streamline bilateral negotiations, whether through NLP embedded into collaboration tools that turn plain chat text into a trade ticket or enhanced shared spreadsheets that let two counterparties collaborate over deal terms.

Efficiency Gains via Front-to-Back Technology

Interestingly, our study participants see corporate bonds as the market most ripe for big efficiency gains from the adoption of new front-to-back technology. This finding is interesting not because it is surprising, but because the corporate bond market has already seen tremendous growth via technology innovation over the past decade, with our data showing e-trading has grown from under 10% in 2010 to nearly one-third in 2020.

But given the market’s sheer size (especially following the issuances boom of 2020) and importance to global capital markets, there is clearly a lot more wood to chop related to market efficiency for market participants, trading venues and technology providers alike.

Loans, securitized and structured products are also high on the list for technology-led efficiency. The loan market was tagged years back as one that could see huge benefits from distributed ledger technology (aka blockchain), although attempts to improve loan markets via DLT have yet to bear noticeable fruit.

As for securitized and structured products, the credit crisis of 2008–2009 kicked off a push to improve data and transparency in these markets. However, progress on the execution and post-trade processing front has been slow. The limited progress is not due to technology limitations, but instead the market’s unwillingness to change. For some individuals and firms, it is better for things to stay as is, but bond markets have proven that efficiency will win out in the end.