Table of Contents

I was touring Ireland before the internet was widely available and chose to stay at a place called the Creek View Inn, or something to that effect. I was, therefore, expecting to see a creek (you can probably see where this is headed). When I got there, there was not a creek, brook or lake in sight. Some rain puddles, sure, but not a significant body of water to speak of.

What got me thinking about that? In May, the SEC approved a proposal to expand the Proposed Names Rule to ESG funds. In addition, the SEC proposed rules “to promote consistent, comparable, and reliable information for investors concerning funds’ and advisers’ incorporation of environmental, social, and governance (ESG) factors.”

One goal of these moves is to improve disclosures (as the SEC is wont to do) and investors’ ability to scrutinize ESG practices—if you state that the fund is an ESG fund, it has to actually be an ESG fund and you have to disclose details and ensure the fund follows your ESG guidelines. Using the above anecdote, if you call it the Creek View Inn you have to disclose what creek you can view.

The Current State of ESG

ESG receives a lot of press and investor attention. There are illuminating anecdotes and issues; for example, how ESG is defined. Tesla was recently removed from an ESG index that Exxon is still a part of. This action triggered some debate—and snark—about that seeming contradiction. The decision was not arbitrary, and it was necessary to understand the methodology of the index to see that. Information helps make informed decisions and informed takes.

That ambiguity can be somewhat offset by new disclosures; but as not all funds are the same, the level of ESG disclosure the SEC wants will vary. According to the proposal, “Integration Funds” would have more limited disclosures relative to ESG-Focused Funds. One example of a disclosure for certain ESG-Focused Funds is that such funds “would be required to disclose the carbon footprint and the weighted average carbon intensity (WACI)” of their portfolio. WACI is a measurement that provides investors with an improved ability to compare carbon usage across various funds, regardless of fund size. This is another example of both increasing transparency and standardization in ESG and the resulting data and reporting needs.

Of course, carbon intensity is just one potential component of “E”—greenhouse gas emissions, water consumption and hazardous waste are others. Quantifying all this requires data, and for ESG fund managers, ESG data is now as fundamental and necessary as security master or pricing data. And once “S” and “G” are added, data acquisition, validation, analysis, and dissemination become increasingly important.

Why is the SEC going down this path? The issue they are trying to resolve is “that funds and advisers marketing such [ESG] strategies may exaggerate their ESG practices or the extent to which their investment products or services take into account ESG factors.” Certain investors place a high value on ESG, and the SEC wants to ensure investment dollars meant for ESG-friendly investments go to ESG-friendly funds. In addition, there are other important aspects of the proposals, ranging from how data is disseminated to compliance policies, all of which enhances the U.S. ESG regulatory structure.

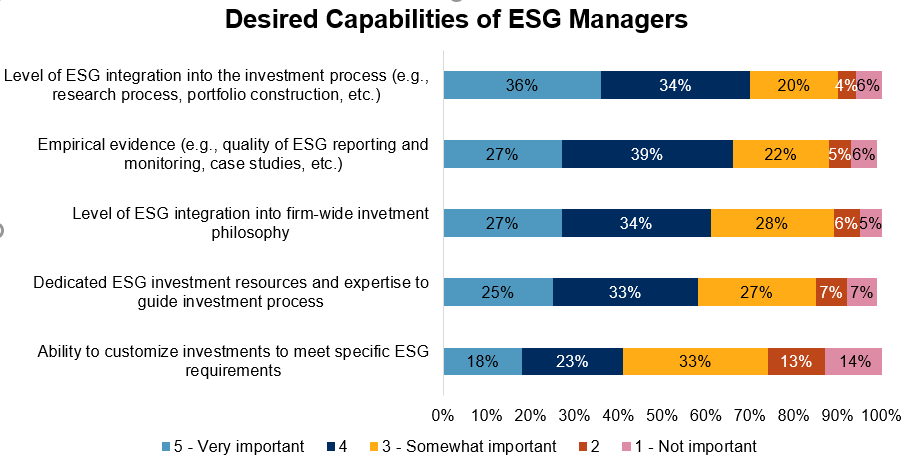

Institutional investors would seem to be in agreement with the goals of the proposals. In Coalition Greenwich discussions with investors, investors are focused on multiple ESG enhancements.

The primary focus of end investors and regulators is the integration of ESG into investment decision-making, as 70% cite that as being important to them. An additional area of focus is reporting—investors want assurances that ESG is, in fact, an integral part of the investment process, then see the evidence confirming that. In other words, investors want what the regulators want—to know that if they are allocating their capital to an ESG fund, that the fund is truly an ESG fund. Of course, there are many ways to define “ESG,” and “integration,” which means that not all ambiguity will be eliminated.

There is great demand for ESG funds from end investors, and asset managers are responding by launching more ESG strategies. Supply is strong as well; the Climate Bond Initiative estimated that in 2021, there was $509 billion of Green Bond issuances, for example.

So What?

For asset managers and investors, this is a global issue. Regulators and industry groups are all trying to help ensure investor assets are placed into strategies with relevant holdings. Organizations such as the International Capital Markets Association (ICMA) have created a taxonomy of sustainable funds. But more is required.

The data management ecosystem has been maturing along with the needs of the asset management community as they focus on future-proofing their ESG data management strategies. It’s not just ratings and indexes that are available—companies such as Bloomberg, ICE, MSCI, S&P, and Refinitiv also include other relevant ESG data so that portfolio managers can make better decisions and improve their stakeholder reporting.

But the industry also recognizes that the data ecosystem is not where it needs to be; therefore, multiple initiatives to help coordinate progress, such as from the Enterprise Data Management Council, are in process to help mitigate data challenges and improve compliance.

ESG funds are attracting both capital and attention, and the SEC’s proposals show that they will be looking more closely at how well these vehicles comply with their stated ESG principles. Even without these rules, the SEC has levied fines for ESG misstatements, and that is a trend likely to continue. Therefore, as regulatory risk increases with these rules, the industry will not only need to focus on data access and data quality, but also on measuring, validating and reporting on their compliance, perhaps increasingly via third parties. Given that the SEC is getting more active, no asset manager will want to be the Creek View Inn of the fund world.